April 2025

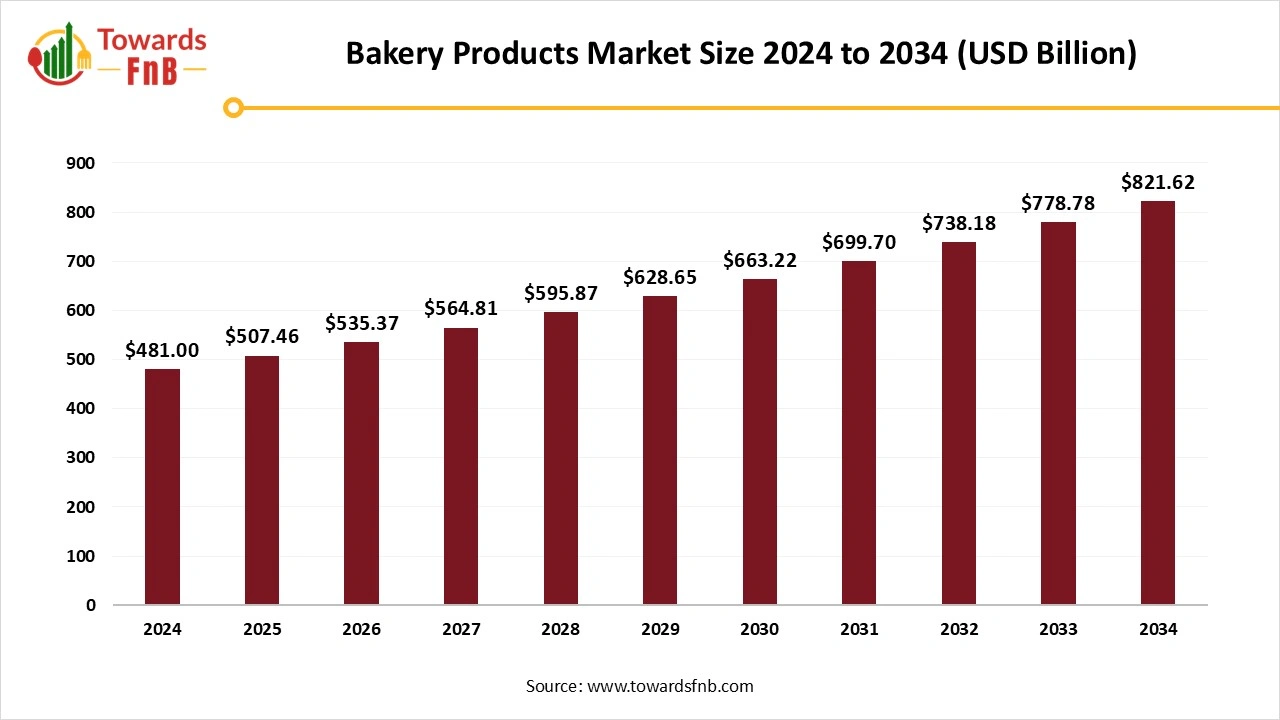

The global bakery product market size was accounted for USD 481 billion in 2024 and is projected to be worth USD 821.62 billion by 2034, with an expected CAGR of 5.50% from 2025 to 2034. The market is shifting towards healthier and more diverse offerings as consumers are preferring health and wellness, growing demand for gluten-free and no-sugar products over traditional products helps grow this market.

The bakery product market has seen steady growth in the market, driven by innovation, health-conscious consumers, and an increase in demand for convenient food products due to urbanisation and a busy lifestyle. Bakery items include breads, cakes, pastries, and cookies, which are made by using whole grain, plant-based ingredients, and functional additives such as probiotics and fibers. The increasing demand for plant-based and whole grain products has increased the production of healthier baked options due to a shift towards healthy and clean lifestyle choices of consumers. The demand for ready-to-eat and convenient food has helped grow this market.

Packed food such as cakes, breads, muffins, and snacks are being made for the convenience and ready-to-eat and on-the-go purpose, keeping in mind the taste and nutritional value, and quality of the product. Innovation in packaging that stores the baked product for a longer duration by increasing the shelf life of the product attracts the consumers and increases the demand for the product. The shift towards sustainable and eco-friendly packaging also has a positive impact on the environment, reducing waste generation and lowering environmental tension. These factors drive the market to grow at a significant rate in the forecasted period.

The growing demand for functional and healthy food like protein bars, keto-friendly, and plant-based bakery products has gained popularity and attracted consumers due to changing lifestyles and a change in diet towards healthy additions to food. Rising popularity of the package and frozen baked food like frozen croissants, doughnuts, and baked bread has increased the demand according to consumer preferences for convenient food, which also preserves them for a longer duration, increasing the shelf life of the product. The change in food preferences due to the increasing healthy diet of the consumers grows demand for nutritious and fiber-rich products, which drives the market and creates opportunity for bakery product market expansion in the region.

The bakery item requires wheat and sugar for its production, and as a raw material, the changing and fluctuating prices of wheat, sugar, and dairy affect the production cost of the bakery products which limits the consumption of bakery products. And the rising health awareness and diet culture is further hampering the growth of the bakery product market.

Europe dominated the bakery product market in 2024.

Europe is the largest consumer of bread, cake, pastries, and other bakery products, as it is the staple food of the region, which results in higher demand and higher consumption of the bakery products. Europe is home to traditional bakery giants, and the market is also focusing on premium and organic products. They also trend in modern and traditional baking practices, which offer consumers innovative and a variety of products. The region is considered the world's largest bakery product manufacturer. Germany, France UK, Italy, and Spain account for the largest bakery consumption market in the region.

Germany accounts have the largest manufacture and consumer of the products. The growth of frozen food and packaged bakery products is gaining popularity among the population due to their increasing shelf life and convenience. Major supermarkets and food chains are expanding their frozen bakery food section in the region like Carrefour and Tesco. Spain and France have led the frozen bakery product with companies like Europastry, which supply the products to the shops and cafes across Europe as well as North America. Sustainable and ethical sourcing is followed under EU regulation, which creates an environmental impact, which helps develop the market space within the region.

Asia Pacific expects a significant growth in the bakery product market during the forecast period.

The growth is driven by several factors like urbanization, rising disposable income, a shift towards western culture, and changing consumer preferences. Fast food chains like McDonald's, KFC, Starbucks, and other food chains are expanding their business in the region, which demands bread and other bakery products like pastry, cake, and muffins. The demand from consumers for bakery products from such joints is resulting in a rise in the bakery options in the food chain. Increasing demand for gluten-free and functional bakery products by the health-conscious individual increases the demand for organic and healthy bakery products.

India and China are growing economic regions with an increasing middle-class population which resulting in rising disposable income, and the changing consumer preferences for convenient and healthy bakery items are driving the demand for the market. Growth of packages of ready-to-eat bakery products like pre-packed sandwich bread, cookies, and cakes is seen in the region due to the changing and busy lifestyles of the consumers. India and China are experiencing strong demand for biscuits and snacks, which increases the e-commerce expansion, fuelling online bakery product sales, which also brings in a variety of products to the consumers under one platform. These factors increase the demand and lead to the expansion of the market in the region.

The bread segment of the dominated the bakery product market in 2024.

Bread holds the largest share in the market as it is a staple food in most regions. The rising demand for healthy and fortified bread, which is enriched with high fiber, protein, and made of multigrain and whole wheat to make it more nutritious and healthier. The easy availability of bread makes it easily accessible to consumers and thus dominates the market.

The biscuit and cookies segment is anticipated to grow significantly in the bakery product market during the forecasted period. The rising demand for packaged and convenience snacks with a longer shelf life has a strong demand for the biscuit and cookies segment. The growth of sweet biscuits, gluten free biscuits, Savory crackers, and digestive biscuits has seen growth with time due to the growth in e-commerce and supermarket private label. Health-conscious consumers demand sugar-free and whole-grain high-protein biscuits which gain the attention of the larger population.

The supermarket and hypermarket segment dominated the bakery product market in 2024.

The availability of a wide range and variety of products in such stores attracts consumers as they are offered with wide product selection, convenience, and value. The big brands like Walmart, Tesco, Big Bazar, offer the consumers fresh as well as frozen products and offer great discounts at affordable prices, which attracts the middle-class population to the supermarket more for bulk buying.

The convenience stores segment expects a significant growth in the bakery product market during the forecast period. These stores are easily accessible to the audience, with high sales of packaged bread, biscuits, and pastries in grab and grab-and-go format. Growth in private label bakery products has shown exponential growth due to their fresh product availability and quality.

The conventional segment dominated the bakery product market in 2024.

The easy availability and wide range of products in the conventional segment drives the attention of consumers, and the price range of these products is also affordable for the middle-class population. With the rising disposable income in the economic regions, this segment is seen as the dominant one and will see growth.

The specialty segment expects a significant growth in the market during the forecast period. With the rising health-conscious individuals and health awareness the consumers are adopting gluten-free and organic food over traditional food due to its health benefits. The rising chronic disease cases have increased the demand for a healthy range of biscuits and breads, which drives this market to grow.

The fresh segment dominated the bakery product market in 2024.

Few bakery products are staple foods in the western region, which increases the demand for fresh products due to large and bulk use, and daily consumption and inclination towards healthy food consumption have increased the demand for freshly baked products.

The frozen segment expects a significant growth in the market during the forecast period. The rising demand for ready-to-eat and frozen products has increased with busy lifestyle changes and the demand for frozen food because of the increase in shelf life of the product and use for longer duration drives the growth of the market.

By Product Type

By Distribution Channel

By Product Range

By Form

By Region

April 2025

April 2025

April 2025

April 2025