April 2025

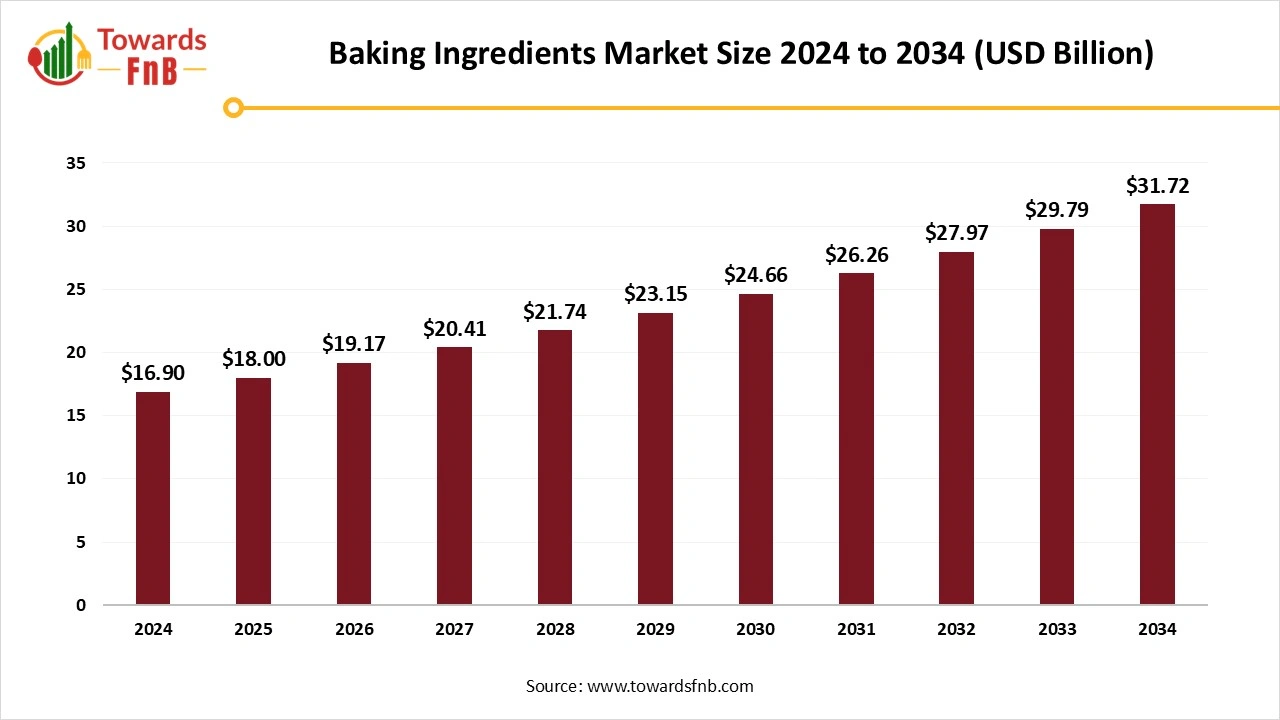

The baking ingredients market size was projected at USD 16.90 billion in 2024 is expected to reach USD 31.72 billion by 2034, growing at a CAGR of 6.5% over the forecast period from 2025 to 2034. The growing interest in multi-cuisine bakery items, along with the rising need for baking components that shorten time of fermentation, is anticipated to propel market growth. This trend is especially noticeable in developing nations, where urban populations are growing quickly resulting in a higher demand for accessible and low-cost baked products.

The primary driving force behind the market is, the rapidly growing commercial bakery sector. Furthermore, the appetite for high-quality bakery items like artisan loaves, pastries, and even fusion desserts is increasing due to the growth in net income in emerging regions. The need for items like bread and biscuits is rising rapidly and is expected to offer profitable growth prospects for the expansion of the baking ingredients market throughout the forecast period.

In the established baking ingredients markets of North America and Europe, there is a significant rise in demand for bakery ingredients that offer health advantages and contain fewer or minimal artificial components, thereby boosting the market.

Numerous producers have created inventive techniques that preserve the product's freshness over a longer shelf life, as well as baked goods that merge freshness and taste using natural ingredients and enzymes with minimal sugar content. This trend is also influenced by the changing desire for clean labels and foods that are minimally processed. The launch of convenient baking mixes, providing simple and fast options for at-home baking, is strengthening the market.

With growing consumer awareness of dietary limitations and health-conscious food options, there is an increasing demand for gluten-free, dairy-free, and organic baked goods. This trend presents a chance for bakery ingredient producers to create unique products that address particular dietary requirements. Firms engaged in mergers and acquisitions are pursuing strategic alliances to improve their product offerings and grow their market.

Frozen baked goods, including bread, pastries, and cakes, offer a convenient option that enables consumers to savor fresh-baked items without the lengthy preparation time. This element of convenience significantly appeals to consumers, especially those looking for quick and easy meal options to fit their busy lifestyles. Increased market of frozen bakery creating various opportunities for the innovations in bakery ingredients. The bakers are adding functional components such as oats, enriched flour, millets, and prebiotics to meet the particular demands of health-aware customers.

Regulatory agencies frequently enforce stringent regulations on food components, necessitating that producers adhere to particular safety, labeling, and quality criteria. Adhering to these regulations can be expensive and labor-intensive, possibly decreasing the profitability of producers of bakery ingredients.

Additionally, various baked goods have been linked to foodborne illnesses caused by Salmonella spp., Listeria monocytogenes, and Bacillus cereus, whereas Clostridium botulinum poses a risk in high-moisture bakery items sealed in modified atmospheres. Producers need to allocate resources for strict quality control and food safety protocols, which can raise operational expenses and restrict the ability to explore new ingredients.

North America held the largest share and dominated the baking ingredients market in 2024.

The North American baking ingredients sector shows strong growth fueled by rising consumer interest in convenience foods and artisanal baked goods. Major trends involve a movement towards healthier components like whole grains and natural sweeteners, in addition to advancements in gluten-free and organic offerings.

Market leaders prioritize product variety, eco-friendliness, and strategic alliances to strengthen their market position. The growth of e-commerce platforms boosts market expansion by increasing accessibility for suppliers of baking ingredients.

Asia pacific is expected to rise with highest CAGR in the market throughout the projection period from 2025 to 2034.

The demand for gluten-free baked goods is boosting, which is driving up the need for gluten-free flour in the area. Businesses are making substantial investments in innovation-led initiatives to meet consumer needs, emphasizing functional bakery components such as high fiber, fat replacers or substitutes, fortified flour. As the frozen baked products sector expands, the demand for baking ingredients is expected to increase throughout the forecast period. Shoppers are progressively looking for baked items that offer a longer shelf life and great flavor. To address this need, producers are launching creative bakery options.

the baking powder and mixes dominated the baking ingredients market in 2024.

Baking powders and mixes are essential in numerous bakery products such as bread, tarts, pies, pastries, biscuits, and cakes. Premium baking powder is crucial for improving the flavor, color, and texture of baked items. The baking powder market demand has remained stable in recent years, despite a shift in consumer preferences towards healthier food choices. Whereas, emulsifier segment is projected to grow in the predictive timeframe. Recent statistics show that around 400 million pounds of emulsifiers were utilized by the food sector. The bakery sector represents 50% of the overall food emulsifier market, and it is projected that the demand for emulsifiers in the bakery sector will increase. To maintain quality and freshness, the processing, distribution, and storage of baked products necessitate the use of food additives. Consequently, emulsifiers offer significant benefits to the baking sector.

bread segment led the market and held the largest share in 2024.

The bread market has undergone significant changes influenced by technological progress, evolving consumer habits, and adjustments in global supply chains. Manufacturers are now more adaptable in reacting to changing dietary trends, such as the increase in health-focused options and the demand for artisanal quality. Consumers are progressively seeking bread items crafted from whole grains, offering greater fiber, vitamins, and minerals compared to refined flour bread.

Whereas, the cakes and pastries segment are anticipated to expand at the highest pace during the forecast period from 2025 to 2034. Cakes are specifically associated with celebratory events like birthdays, anniversaries, and weddings. A range of pastries can be found in the market, all baked with comparable ingredients in different amounts. The need for cakes and pastries is anticipated to rise due to urban development and a boost in net income of consumer.

By Product

By End use

By Region

April 2025

April 2025

March 2025

March 2025