April 2025

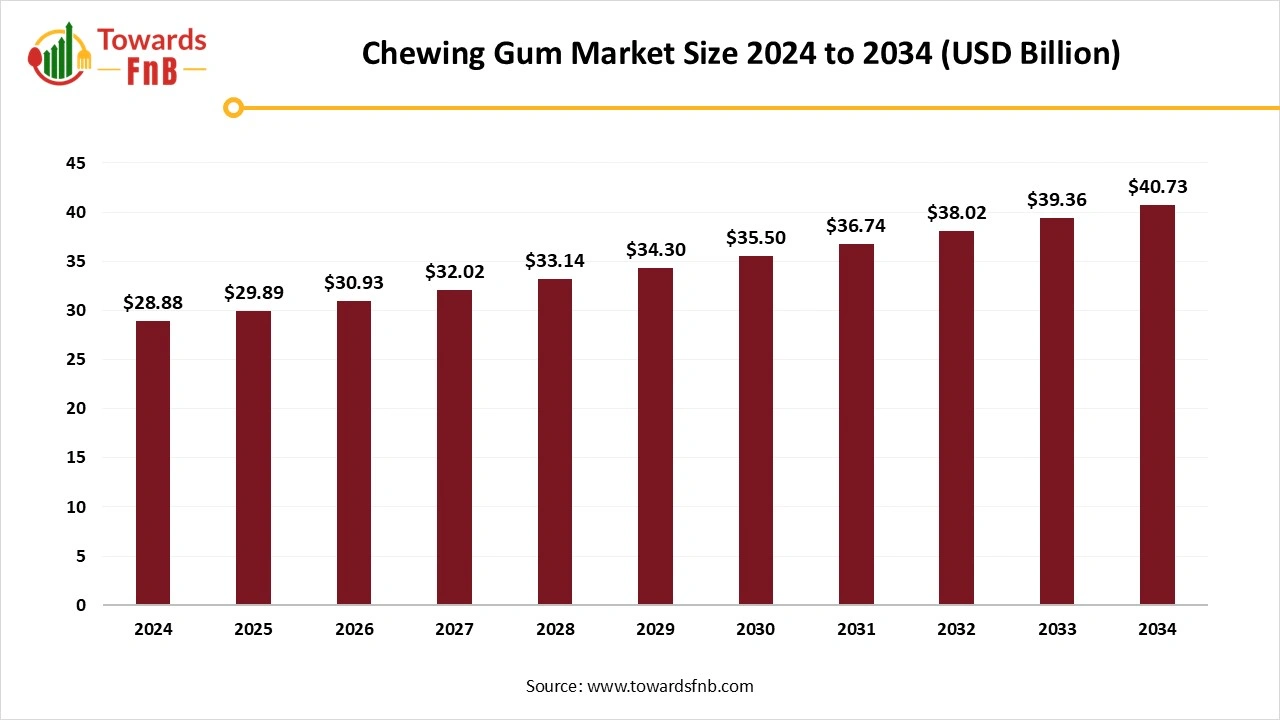

The chewing gum market size was estimated at USD 28.88 billion in 2024 and is predicted to increase from USD 29.89 billion in 2025 to approximately USD 40.73 billion by 2034, expanding at a CAGR of 3.50% from 2025 to 2034. As awareness of the health advantages of chewing gum increases, such as dental benefits and stress relief, it is gaining popularity among individuals of all ages and boosting the market.

Chewing gums are a globally enjoyed candy product that can be chewed for enjoyment without being ingested. The European Food Safety Authority (EFSA) has formally incorporated chewing gum into its guidelines for a healthy diet. The use of chewing gum has been mainly propelled by numerous individuals for health-related concerns such as preventing dental caries, regulating appetite, and managing stress and mood fluctuations. Data on consumer trends indicated that the primary reasons for use of chewing gum are to freshen breath, simply to enjoy the flavor, and for oral health. The chewing gum is projected to draw significant interest from both the industry and the scientific community for various reasons, such as its high consumption rates, the significance of the chewing gum market within the confectionery sector, and its possible health advantages by providing bioactive compounds.

Additionally, an increase in efforts by producers to invest in sustainable practices is anticipated to enhance the sales of confectionery items at higher price points. Most environmentally aware consumers link their health to ecological concerns, which greatly affects their buying decisions. In addition, the availability of nicotine gums in the market, which are also extensively used by individuals attempting to stop smoking, has aided its sales performance. In 2023, the Tobacco Control Division of the Health Ministry suggested that all 2 mg nicotine gum should require prescriptions, limiting its availability without a prescription.

The market for microbial gums like xanthan, gellan, dextran, and curdlan is consistently growing, fueled by their rising use across different sectors including petroleum, pharmaceuticals, cosmetics, and food, which makes up around 50% of worldwide consumption. The growth of e-commerce platforms is strengthening the market by providing consumers an easy and fast method to purchase their preferred gum products. This factor has expanded the market's scope beyond geographic boundaries, enabling individuals globally to effortlessly access and buy chewing gum. Digital platforms provide comprehensive product details, customer feedback, and suggestions, enhancing consumer choices.

Stress has driven consumers to engage in careless snacking, while their awareness has provided opportunities for food producers. Consumers are growing more interested in experimenting with unique and different flavors of chewing gum. This encompasses unique fruit flavors, seasonings, and even savory choices. Enhanced retention and regulated release of various flavors, colors, sugars, and nutritional components in chewing gum base can be assured through microencapsulation or nanoencapsulation techniques.

Encapsulation can reduce the levels of included volatiles or bioactive substances in the chewing gum matrix, thereby helping to avoid certain off-flavors. Enhanced chewing enjoyment utilizing advanced gum base technologies, producers can develop chewing gums with better texture, flavor distribution, and prolonged chew duration. Improvements in the formulation of gum base have enabled the development of gums that dissolve at a slower rate, offering a more enduring chewing sensation. This subsequently boosts customer satisfaction and improves the general attractiveness of chewing gum as a product.

Changing consumer preferences for healthier alternatives and sensitivity to pricing could significantly affect the growth of the chewing gum market. Moreover, economic downturns have changed consumer spending behaviours, which is expected to hinder the worldwide industry growth. The increasing prevalence of diabetes in younger people could negatively affect the chewing gum industry moving forward.

Europe Dominated the Chewing Gum Market and Held Largest Share in 2024.

Recent studies indicated that a large majority of European consumers chew gum, irrespective of their nationality, age, or gender. Intakes are comparable around the world, averaging 1.87 grams daily. This equates to roughly 0.75 pieces daily for children and 0.98 pieces daily for adolescents and adults, respectively. The consumption of chewing gum has been promoted for years based on studies regarding health benefits like the reduction of dental cavities.

The chewing gum market in Europe is experiencing swift expansion due to a rising consumer demand for sugar-free and functional types of gum. Increasing awareness about the advantages of oral health and a surging demand for natural and plant-derived ingredients are transforming the industry. Sustainability has emerged as a major priority for chewing gum companies, with 40% more brands embracing biodegradable and plastic-free packaging. Traditional chewing gum includes artificial polymers, which has led to environmental issues. Consequently, brands are launching plant-derived gum bases and recyclable paper packaging to appeal to environmentally aware consumers.

North America Observed to Grow at the Fastest Rate in the Market During the Forecast Period.

The North American chewing gum market has consistently expanded due to a shifting consumer demographic and a diverse selection of products. The significance of gum as both a practical product and a light snack shapes this market. Sugar-free gum has become a widely embraced trend, attracting health-conscious individuals, particularly those aiming to manage their weight and dental health. The market in North America is influenced by shifting consumer preferences, including a trend towards organic and natural components. Businesses are reacting to these changes by introducing products that align with the growing clean-label and non-GMO food movements.

The Pellets/Pillows Segment Dominated the Chewing Gum Market with the Largest Share in 2024.

Pellet-style chewing gums offer a unique and convenient chewing experience, leading to their growing popularity among consumers. These small and portable gum forms are favored for quick refreshment, making them perfect for busy lifestyles and hectic routines. As the demand for easy and enjoyable snacking choices increases, the pellet segment of chewing gum products is expected to boost market growth. Its convenience, diversity, and sensory interaction make it ideally suited to fulfill contemporary consumer desires and preferences.

Sticks/tabs segment is seen to grow at a notable rate during the predicted timeframe. The growth of the segment is attributed due to change in consumer preference and lifestyle trends. Chewing gums in the form of sticks or tabs portable and easy to carry even in pockets. Marketing product innovation further fostering the demand of chewing gums.

The Sugar-Free Chewing Gum Segment Held the Dominating Share of the Chewing Gum Market in 2024.

Sugar free chewing gums consumption can differ among various age categories and the trend of urbanization. Various research indicate that adolescents and young adults are significant users of sugar free chewing gums. They could possess open and autonomous consumption attitudes, leaning towards ideas of individualism and style in their consumption. Additionally, they frequently show a readiness to experiment with new things. They purchase and chew sugar-free gum not solely to avoid dental cavities, but primarily to enhance their breath freshness. Functional features of sugar-free chewing gums and ongoing product enhancements through the introduction of new flavors are contributing to a stronger market growth.

The invigorating flavor of these sugar-free chewing gums boosts their appeal among health-minded individuals. Furthermore, the increasing desire for convenient and portable healthy snacks enhances the demand for sugar-free chewing gum. The sugared chewing gum segment is seen to grow at a notable rate during the predicted timeframe. Innovations in gum manufacturing have resulted in novel flavors and textures, ensuring the market remains vibrant and appealing. New developments in formulations maintain market excitement and interest, drawing in consumers looking for unique sensory experiences increasing the demand for sugared chewing gum.

The Supermarkets/Hypermarkets Segment Dominated the Market with the Largest Share in 2024.

Supermarkets generally offer a wider variety of products compared to a conventional grocery store. The products are organized and arranged in aisles for customers to stroll through and select what they desire. Alongside this, hypermarkets and supermarkets are also gaining popularity as they provide various bundling options and discounts on product prices that are anticipated to boost the market.

The convenience stores segment is expected to grow at fastest rate during forecast period. Impulse purchases greatly influence the chewing gum market, with items being deliberately positioned near checkout areas in convenience shops and service stations. This strategic placement takes advantage of consumers' tendencies for last-minute purchases, prompting them to pick up a pack as they stand in line. Convenience shop as a retail establishment that offers the community an easy spot to swiftly acquire a diverse range of consumable goods and services.

EXCEL® Gum

Centerfruit

By Form

By Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025