April 2025

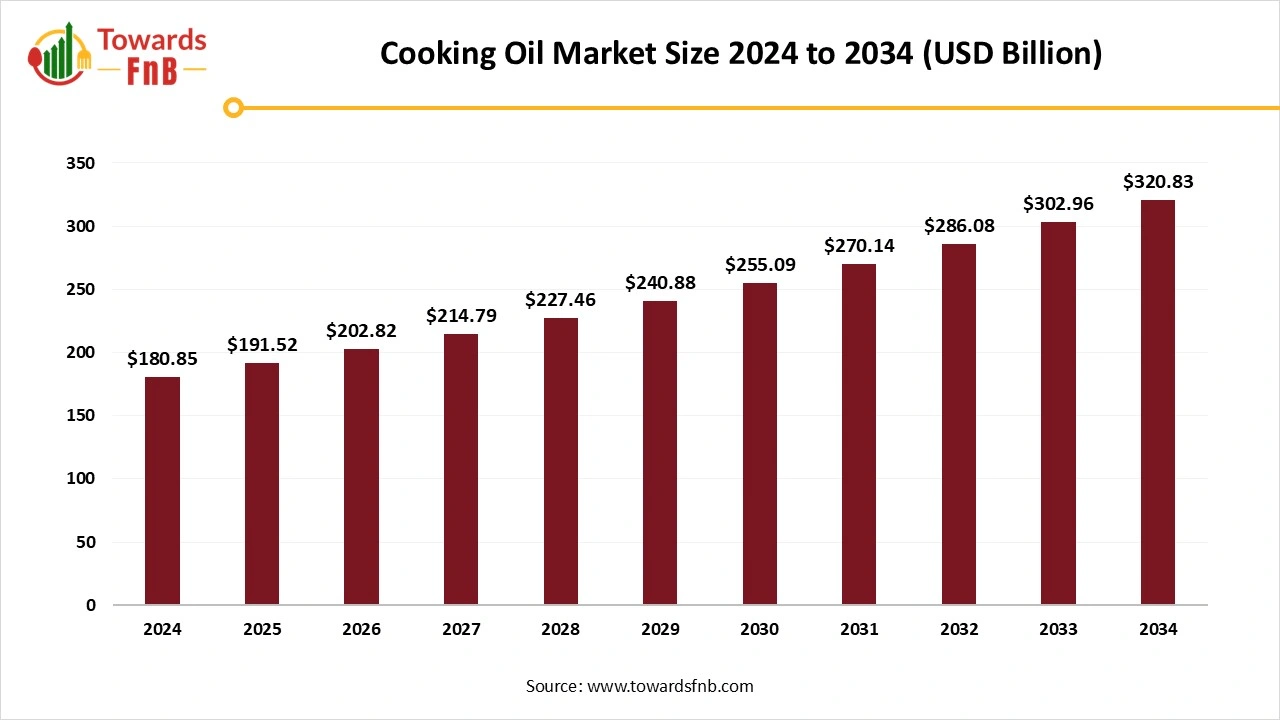

The cooking oil market size was valued at USD 180.85 billion in 2024 and is forecast to rise from USD 191.52 billion in 2025 to approximately USD 320.83 billion by 2034, with a CAGR of 5.90% from 2025 to 2034. The growing consumption of processed foods will play an important role in market expansion. Consumer choice for packaged and processed food will grow demand for these oils in food preparation by small food chains, households, and restaurants, which will drive the market.

Cooking oils are lipids that are typically liquid at room temperature, which makes them different from fats, which are solid at room temperature. The main components of cooking oil are triglycerides (which are the most prevalent lipids found in food), phospholipids, and sterols. There are so many types of cooking oil, but the healthiest ones are those that include heart-healthy poly and mono-unsaturated fats like nuts, seeds, avocado, olives, and vegetable oil which assist in reducing the levels of toxic cholesterol in low-density lipoprotein (LDL) in the blood.

The rising awareness of heart health, cholesterol control, and weight management is growing the demand for oils that are opulent in unsaturated oils like canola and sunflower oil. fortification with vitamin D, omega-3, and antioxidants which are gaining attention as consumers seek additional health advantages. So, consumers are leaning towards healthy oils like avocado oil, olive oil, and cold-pressed oil because of their nutritional benefits.

The demand for cooking oil is rising due to a growing shift towards processed foods, changing food habits, and its potential to be recycled and used in soaps, fuel, animal feed, and various industrial products. The new working culture and lifestyle are marketing the demand for packaged and ready-to-serve food is leaning towards the rising demand for cooking oils. On the other hand, growing incidences of cardiovascular diseases like heart attack and artery diseases worldwide have immediate requests to consumers to eat healthy cooking oil. Other future possibilities and opportunities in the cooking oil market are growing urbanization, rising income levels, and health-driven choices.

The increasing price of the cooking oil due to the factors such as geopolitical tensions, weather conditions, and alterations in demand, which makes it complex to predict price and strategy for long-term uses. Thus, the fluctuation of price point is limiting the growth of the market.

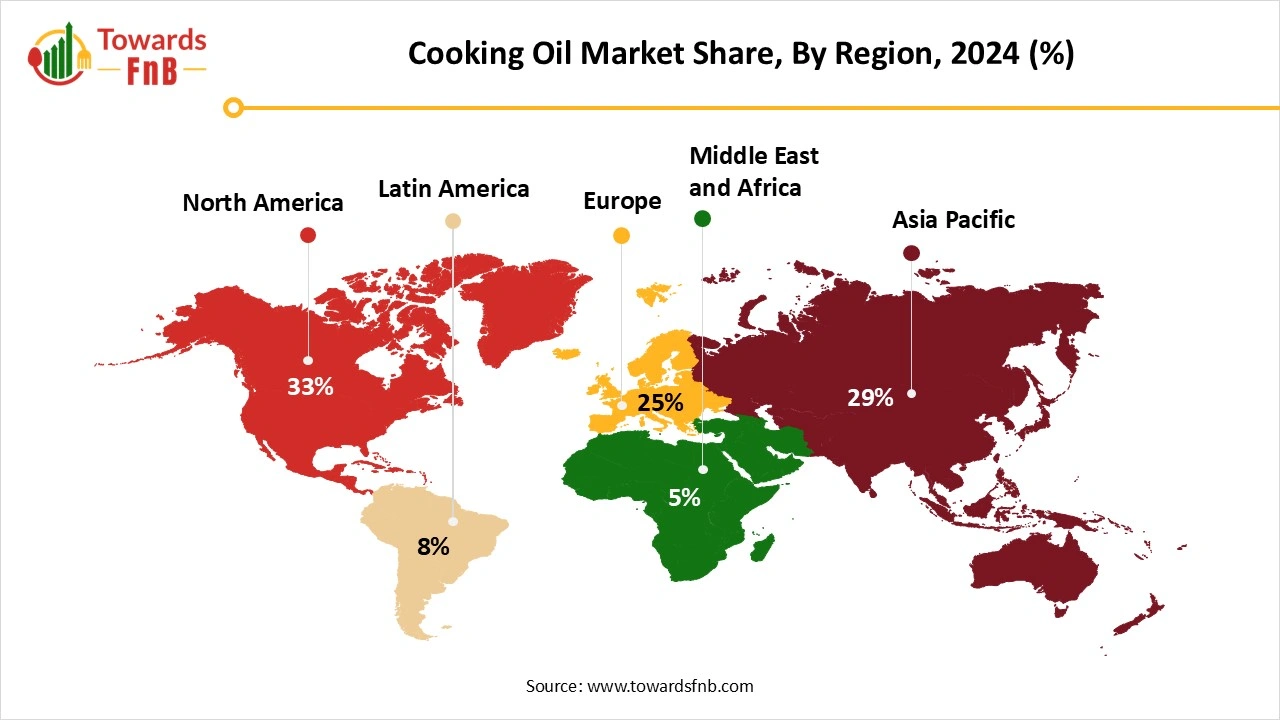

Asia Pacific Dominated the Cooking Oil Market in 2024.

The market demand is due to friendly and premium options like extra virgin ranges, herb, vegetable, and fruit-infused Australian olive oil, and regular versions and choices. Sustainability is which main reason for the rising importance of transparency and eco-friendly practices, which paved the way for grown oil product launches that include heart claims, specifically less reduced cholesterol and transfat free. Countries located on the Arabian Peninsula in the southwest zone of Asia have some World's biggest deposits of Oil, and the overall demand for oil specifically by countries like China, is the reason for conflict for Oil.

North America Expects Significant Growth in the Cooking Oil Market During the Forecast Period.

This demand is due to constant growth in the last few years as a trend for healthy cooking oil, the rising popularity of plant-based diets, and the expanding use of cooking oil in the food processing industry. Oil is the main element of North America's economy. Health-conscious cooking remains popular, with low-carb, keto, gluten-free, and whole-food diets influencing what individuals make at home. There is a greater emphasis on minimizing processed diets and incorporating fresh, natural components. The United States, Canada, and Mexico are among the world's leading oil producers.

The Palm Oil Segment Held the Dominating Share of the Cooking Oil Market in 2024.

Palm oil, which is an adaptable and universal vegetable oil derived from the fruit of the oil palm tree, has become a constant ingredient in the food industry. Its exceptional properties include its high stability, unique and rich flavor, and acceptability for kicking in widespread usage in a variety of food products. It is rich in antioxidants like vitamin E tocotrienols and tocopherol as it assists in protecting the body from oxidative stress and inflammation, which can affect our lungs and cause asthma or chronic obstructive pulmonary diseases. One can use palm oil in several food products ranging from baking to create moist and flavourful cakes, frying to gain that golden crisp to adding flavor to salad, it can take any dish to the next level.

The soy oil segment is expected to experience significant cooking oil market growth during the predicted period. Soybean oil is used in the making or production of the variety of products and is famous among harvesting options for many farmers. This oil is rising in popularity as a firm alternative fuel. One can derive biodiesel and renewable diesel from soybean oil, which allows us to seek many utilizations for this famous crop. It is a skillful ingredient in the kitchen due to its neutral flavor profile which has a mild taste that makes it easy to blend into any dish.

The Residential Segment Held the Dominating Share of the Cooking Oil Market in 2024.

Home chefs can use cooking oil for different purposes like salad dressings, marinades, and dip sauce making too. Apart from these, it can be used for grilling, stir-frying, baking, or roasting foods from low to high temperatures, but always coat pans with any oil before putting food in so it won't stick to the pan. But High-temperature cooking methods (like frying and deep frying) can break down oil and generate chemicals like peroxide and aldehydes, which are extremely harmful to health.

The food service segment is expected to experience significant cooking oil market growth during the predicted period. In the ever-increasing restaurant category, efficiency and sustainability are very crucial factors to consider. Choosing the right cooking oil is essential for kitchen purposes, as different oils have different smoke points. High smoke oils such as sunflower oil, peanut, and canola are perfect for making the deep-fried food products, while olive oil is well-suited for low-heat cooking. The second point is flavor profile, as the taste of oil can change your dish, so choose wisely as Neutral oils are versatile to us, and nutritional values matter, especially for health-conscious customers.

The Supermarkets and Hypermarkets Segment Held the Dominating Share of the Cooking Oil Market in 2024.

By offering variety, supermarkets and hypermarkets have great accessibility, which makes them the most convenient and perfect retail option for several consumers in urban areas. With large retail connections and the contiguity of both local and global brands, this kind of retail has a platform for widespread cooking oil and its several types, including in smaller towns and rural areas, where supermarkets and hypermarkets don't have the same level of penetration.

The online segment is expected to experience significant cooking oil market growth during the predicted period. Online shopping from different E-commerce websites gives convenience to consumers to browse and buy several types of cooking oil from the comfort of their home or on-the-go. This is perfectly suitable for consumers who are totally busy particulars and it's impossible for them to hit the stores physically. Additionally, online retailers serve more competitive prices and seasonal discounts.

In May 2024

In March 2025

In March 2025

By Product Type

By End User

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025