April 2025

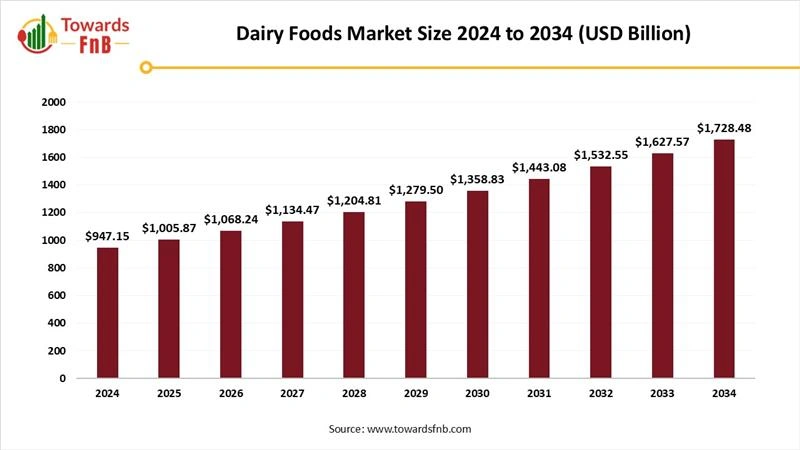

The global dairy food market size was valued at USD 947.15 billion in 2024 and is expected to grow steadily from USD 1,005.87 billion in 2025 to reach nearly USD 1,728.48 billion by 2034, with a CAGR of 6.20% during the forecast period from 2025 to 2034. Demand for milk and milk-based products as meat alternative option for fulfil nutritional demand significantly driving the market.

Dairy foods are loaded with nutrients that are beneficial for good bone health, including calcium, protein, vitamin D, phosphorus and potassium. In low and lower-middle-income nations where access to animal-based foods is restricted, dairy foods play important role in completing the community’s nutritional demands. More than 6 billion consumers globally consume milk and milk-based items and most of these consumers live in developing regions.

Demand for milk and milk products in developing nations is rising with increasing incomes, rising population, urbanization and changes in dietary habits. The fostering demand for milk and dairy foods give a good chance for producers and members involved in supply chain in strong-potential, outer-urban areas to improve their livelihoods through boosted production of dairy foods and leads to the growth of dairy food market .

Flavor innovation and diversification in dairy foods providing the opportunities for the new product development with exotic flavors to attract consumers. By acquiring complete knowledge of flavor trends and using advanced flavor development technology, producers are developing the newer products. Rising demand for ethnic and authentic flavors further boosting the dairy food market. Flavor improvement of fermented dairy foods using microorganisms is encouraging as a method that permits an internal approach to create target aroma compounds.

Increasing cost of feed, fuel, processing and labor rising the ultimate cost of the dairy foods. Surging costs can affect profit margins and demand for effective cost management strategies. Supply chain incapabilities, majorly in the unorganized segment, can lead to high wastage and low product quality. In last few years, the worldwide dairy food market has faced unparalleled supply chain breakdowns, compelled by a combination of geopolitical tensions, pandemics, and natural calamities.

Asia Pacific Dairy Food Market Dominated the Market with the Largest Share in 2024.

Almost around half of people in the region prioritize their diet, looking for products that complete their nutritional and personal needs. One out of three consumers in Asia Pacific have bone health as their primary concern therefore there is increase in demand for milk and dairy foods. Government initiatives for milk promotion, with the help of school milk program, also act as an accelerator the expansion of demand. Worldwide competitiveness is also fostering new uses for milk-based food products, increasing demand for cheese variety, rise in niche items markets and prolonged shelf life of the product.

China’s Evolving Dairy food market

Dairy food market of China held the prominent position in the market. China's dairy industry has transformed into a significant player in production, consumption, and trade, utilizing years of growth to gain a competitive advantage. Chinese dairy firms are becoming more embedded in the international market. As living standards improve, dairy products have become essential in the Chinese diet, transforming from basic breakfast milk to a variety of dairy items such as cheese and milk tea, indicating a wider consumption pattern. In the first half of 2024, New Zealand continues to be the top exporter of dairy products to China, holding a 51% market share. Almost fifty percent of the import volume from New Zealand consists of powders, with milk and cream following. As living standards improve, dairy food products are now essential to the Chinese diet, transitioning from basic breakfast milk to a variety of dairy foods such as cheese and milk tea, showcasing a more complex consumption pattern and boosting dairy food market .

North America Expected to Grow at the Fastest Rate in the Market During the Forecast Period.

Rising consumption of dairy foods in North America is mainly driven by emerging awareness of health benefits related with dairy consumption. Increase in the demand of food products such as milk, cheese, butter and skimmed milk powder boosting the market. The rising acceptance of the dairy foods due to the nutritional benefits and the heavy consumption of cheese in daily diet accelerate the market expansion.

Emerging Dairy Food Market of United States

Dairy food market of United States expanding significantly in recent years. Increasing demand for the healthy and nutritious food, innovation in technology and increasing e-commerce platform fostering the market in United States. From milk and cheese to ice cream, yogurt, and other dairy-based ingredients, U.S. dairy firms are striving to provide their nutritious, safe, and cost-effective products to consumers globally, while also generating employment opportunities. The U.S. dairy sector is set to create a new "golden age" for U.S. dairy exports, with anticipated sales hitting $8.2 billion in 2024, marking the second-highest export value on record and a $223 million rise from the previous year, based on recent figures from the U.S. Department of Agriculture (USDA).

The Cattle Segment Held the Largest share of the Dairy Food Market in 2023.

Milk and dairy-based foods are majorly produced by urban dairy farmers and dairying is the side the side business for the farmers. Although urbanization often drives dairying to outskirts and rural regions, there remains a strong consumer demand for fresh milk from farms. In comparison to other dairy animals, cattle offer numerous benefits regarding milking convenience, udder dimensions, capacity for milk storage, and milk production. Indeed, cow's milk makes up the biggest portion of the global milk production. The leading producers of cow milk include India, the United States, and China.

The Sheep Segment is Seen to Grow at a Notable Rate During the Predicted Timeframe.

Sheep milk serves as a superb source of high-quality protein, calcium, phosphorus, magnesium, zinc, and various vitamins. The significance of sheep's milk in terms of nutrition stems from its makeup. Even though sheep's milk contains more nutrients than cow's milk, it is seldom consumed as a beverage. Typically, it is utilized for cheesemaking, but in specific nations, some is produced into yogurt or other fermented dairy products and expanding the market. The production of sheep milk occurs primarily in Asia and Africa, followed by Europe, with a total global output of 10.61 million tons. The largest producers of sheep milk are China, followed by Turkey and Greece. Sheep milk is primarily produced in the Mediterranean area, where the key dairy sheep breeds are also located.

The Lactose Segment Led the Dairy Food Market in 2024.

Lactose, the primary carbohydrate found in milk, is a distinctive sugar synthesized in the mammary glands of mammals. It is recognized for its ability to improve the absorption and retention of calcium, magnesium, and manganese and therefore increased demand for the lactose milk. Following the process of cheesemaking, over 90% of the lactose is found in whey. Several studies have indicated that whey is a valuable source of high-nutrition compounds that can enhance the efficiency of the dairy industry.

The Lactose-Free Segment is Expected to Grow at the Fastest Rate in the Market During the Forecast Period.

About 70% of the global population faces a high risk of developing lactose intolerance, and its prevalence has risen over the past ten years, which accounts for the growing significance of lactose-free products in the market. Furthermore, increasing demand for the natural, organic and clean label product also driving the market.

The Milk Segment held the Largest Share of the Dairy Food Market in 2024.

Increasing net income, rising population and increasing health consciousness significantly increasing the demand for the milk. Milk gives comparatively fast returns for small-scale producers and is a vital source of cash income. On an average 150 million households around the world are involved in milk production.

The Cheese Segment is Observed to Grow at the Fastest Rate During the Forecast Period.

Increasing demand for western food menu like burger, pizzas and pastas loaded with cheese, growing outlets of fast-food chains like dominos McDonalds, pizza hut, Subway etc. fueling the demand for the cheese and increase the cheese production. Cheese has substantial power with areas such as the US and SE Asia projected to rise imports. In 2024, that increased capacity and the fostered growth in milk production was anticipated to drive a 2% rise in cheese production of 6.5 million tons.

Supermarkets and Hypermarkets Dominated the Market With the Largest Share in 2024.

Supermarkets offer the probable convenience by providing a one-stop shopping experience. Supermarkets can buy items in large amounts, which reduces their costs. These savings are further passed on to consumers in the form of reduced costs. Hypermarkets provide extensive types of fresh dairy food products. Therefore, consumers majorly prefer supermarkets or hypermarkets for buying dairy foods.

The Convenience Stores Segment is Seen to Grow at a Notable Rate During the Predicted Timeframe.

Convenience stores are typically small, local stores that provide consumers a different range of dairy food products. The products present in a convenience store are with reduced costs than those available in larger retail stores. Anyone in hurry can easily approach the convenience store for buying goods without wasting much time.

Mother Dairy

Straus Family Creamery

Danone and Microsoft

By Source

By Type

By Product Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025