February 2026

The global fresh produce market size reached at USD 848.88 billion in 2025 and is anticipated to increase from USD 889.63 billion in 2026 to an estimated USD 1,356.62 billion by 2035, witnessing a CAGR of 4.8% during the forecast period from 2026 to 2035. The market is witnessing substantial expansion because of the growing uptake of healthier eating practices and a surge in demand for online sales of fresh products, such as fruits, vegetables, meat, and poultry.

The insights on fresh produce sellers and marketers were revealed by Fresh Trends 2025. According to Packer’s most sophisticated consumer report, Fresh Trends 2025, conducted deep research in 50 fresh produce commodities, to explore the shopping habits, preferences of five generations and multiple income levels. The report is based on 1.050 females 53% and males 47% consumers from across the U.S. (Source: Farm Journal)

| Study Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 4.8% |

| Market Size in 2026 | USD 889.63 Billion |

| Market Size in 2027 | USD 932.33 Billion |

| Market Size by 2035 | USD 1,356.62 Billion |

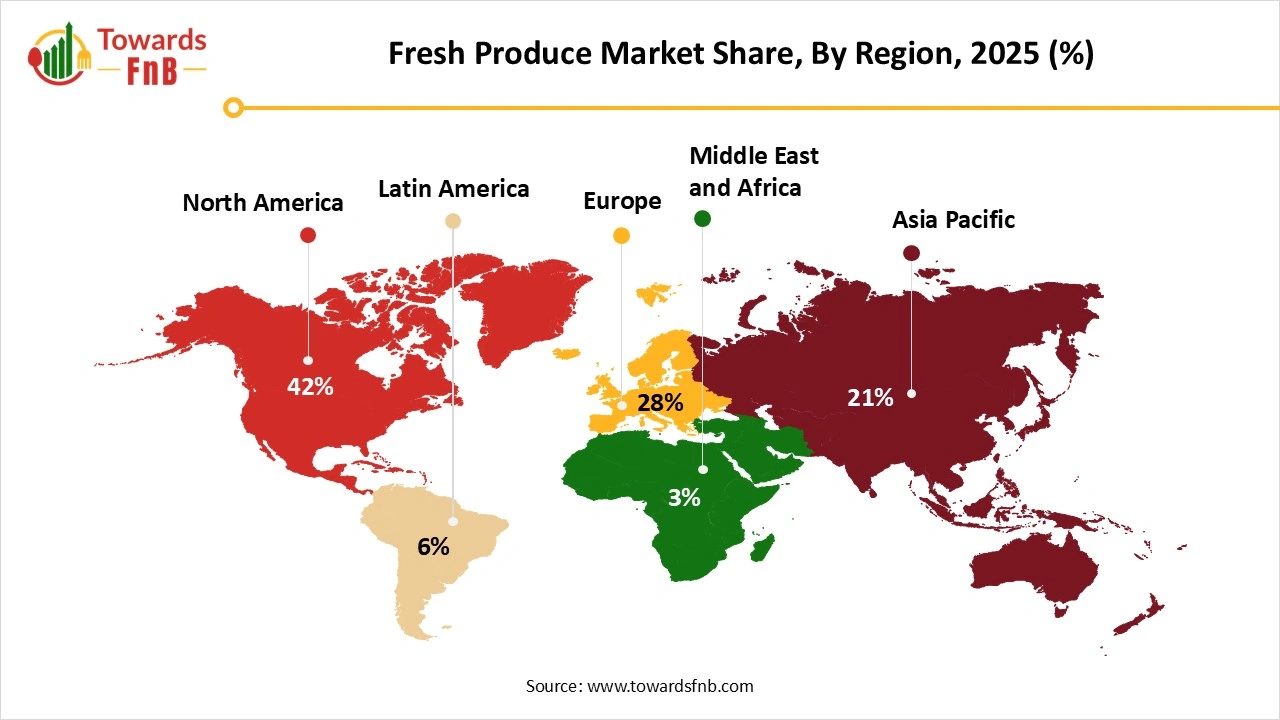

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fresh produce includes food items that are lightly processed and do not use preservation techniques like freezing, canning, or drying. These foods are generally eaten shortly after they are harvested or produced, preserving most of their natural flavors, nutrients, and texture. The worldwide enhancement of living standards and socioeconomic development has resulted in a significant change in individuals purchasing behaviors and requirements. The demands for food related to nutrition, safety, and health have also grown.

The rising number of health-aware consumers is propelling the demand for fresh produce as they look for minimally processed, nutrient-dense options. Fresh fruits and vegetables, which have low energy density and are rich in fiber, are essential parts of a nutritious diet and are related to a lower risk of chronic diseases and effective weight control and thus, expanding the market of fresh produce.

Promotion of local food system further drives the market of fresh produce and gaining more interest from the general public. In Canada, the government has recently launched the “Local Food Infrastructure Fund,” a five-year initiative with a budget of CAN$50 million set to conclude in 2024. Its goal is to assist “community-based organizations dedicated to decreasing food insecurity by developing and enhancing their local food systems”. Technological progress in e-commerce and supply chain management likewise promotes market expansion by enhancing distribution efficiency and accessibility.

Digital technologies like the Internet of Things, artificial intelligence, blockchain, and robotics are changing how food is produced, processed, and distributed. These technologies provide numerous advantages, such as enhanced efficiency, better product quality and safety, decreased waste, and ecological sustainability. Digital technologies allow for immediate tracking of essential factors like temperature, pH, and moisture, helping to avert spoilage, minimize food waste, and guarantee that safe, and high-quality food is delivered to consumers which contribute as the major growth opportunity in the fresh produce market.

Sustainability is becoming a more vital aspect of overseeing the supply chain for fresh and perishable foods. It is estimated that 35% of food products are wasted on average throughout the entire supply chain, starting from production to the retail shelf and the consumer's fridge. The speed of product degradation may increase based on the product's condition and surrounding environment, and it can also be significantly influenced by the design and planning of the supply chain, as this impacts how long products remain in each facility and transport vehicle and hamper the fresh produce market growth.

Production

Processing And Packaging

Distribution And Wholesaling

North America Dominated the Fresh Produce Market in 2025

The growth of the market is propelled by an increasing consumer demand for organic and locally sourced foods, bolstered by solid agricultural infrastructure. The availability of the economically developed countries in the region and the awareness regarding health and healthy food consumption accelerate the growth of the fresh produce market.

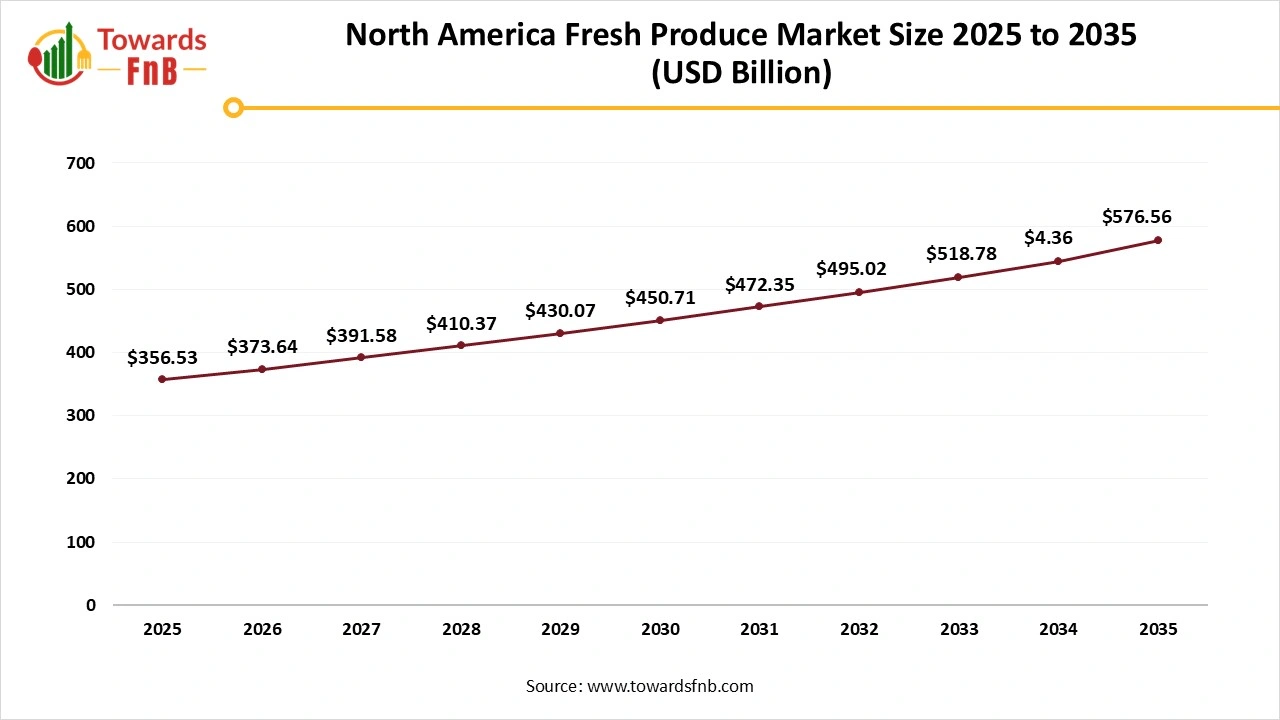

North America Fresh Produce Market in 2025 to 2035

The North America fresh produce market size estimated at USD 356.53 billion in 2025 and is predicted to increase from USD 373.64 billion in 2026 to nearly reaching USD 576.56 billion by 2035, growing at a CAGR of 4.92% during the forecast period from 2026 to 2035.

The United States led the market, as consumers prioritize freshness and nutritional value, creating a vibrant market for farm-to-table choices. Changes in consumer demand, advancements in production and marketing technology, and the consolidation of retail have transformed the conventional market dynamics among producers, wholesalers, and retailers. Shoppers are consuming increased amounts of fresh fruits and vegetables, buying a greater assortment throughout the year, and seeking more convenience, such as pre-packaged salads. Information technology has brought efficiencies across the supply chain, lowering production and marketing expenses.

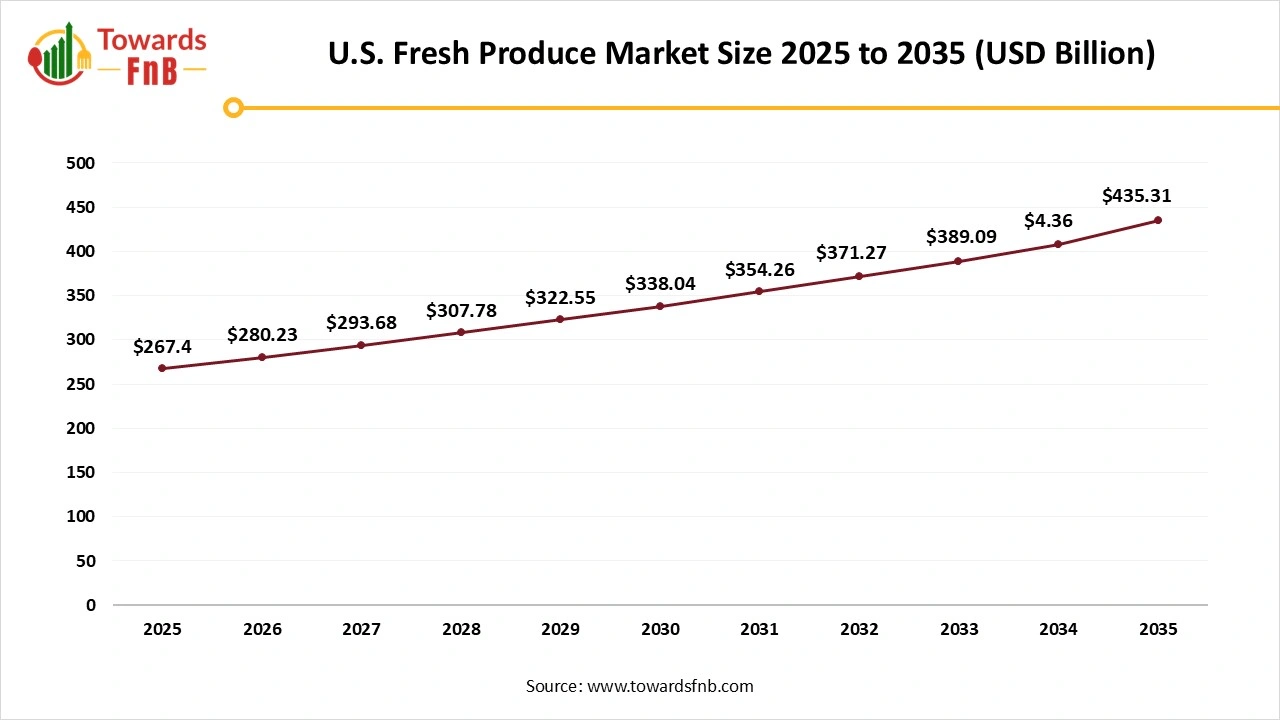

How Big is the U.S. Fresh Produce Market?

The U.S. fresh produce market size was calculated at USD 267.4 billion in 2025 with projections indicating a rise from USD 280.23 billion in 2026 to approximately USD 435.31 billion by 2035, expanding at a CAGR of 4.99% throughout the forecast period from 2026 to 2035.

Asia Pacific Expects a Significant Growth in the Fresh Produce Market During the Forecast Period

Growth of the market is mainly propelled by its vast agricultural endeavors and significant rural populations involved in farming. The area enjoys a range of climates that are perfect for cultivating various fresh foods, such as fruits, vegetables, and meats. A dense population creates significant local demand. Furthermore, cultural inclinations for fresh foods rather than processed ones increase consumption levels even more. According to Fruit Logistica's 2018 Trends Report over half of the global sales of fresh produce by 2030 will occur primarily in the Asia-Pacific market.

India is the second biggest producer of fruits and vegetables globally, following China. The nation features varied landscapes and climates, guaranteeing the presence of fruits and vegetables throughout the year. In 2023-24, India exported fresh fruits and vegetables worth 1814.58 million USD.

Europe Fresh Produce Market: A Notable Growing Region

The European fresh produce market is a large and mature sector characterized by strong demand for both fruits and vegetables. It sees significant international imports, particularly of tropical fruits, and is experiencing a growing impact from online sales. Consumer preferences are influenced by health, flavor, and convenience, leading to increased demand for products such as avocados, blueberries, and sweet potatoes. Europe is home to seven of the ten largest importing countries in the world, making it a diverse market for fresh fruit and vegetables (FFV).

Germany has a large, highly competitive, and import-oriented fresh produce market. It is marked by strong consumer demand for high-quality, value-focused, and health-conscious options. The market is dominated by major retail chains and discount stores. As the largest consumer of fresh fruit and vegetables in Europe, Germany is also the leading importer of fresh produce.

Expanding Fresh Produce Market of MEA

The fresh produce market in the Middle East and Africa (MEA) is large and rapidly growing. This growth is driven by increasing health consciousness and a rising demand for organic and convenient options, such as frozen fruits. Government initiatives focused on food security further support this growth. Countries like the UAE and Saudi Arabia are significant players, making substantial investments in agricultural technology and modern retail formats. The adoption of technology such as freeze-drying and vertical farming will be crucial for enhancing production efficiency and quality.

The UAE's fresh produce market is poised for growth, driven by increasing demand for healthy food, food security initiatives, and technological advancements like controlled-environment agriculture. Fresh produce in the UAE is sourced from major wholesale markets like the Al Aweer Central Fruit & Vegetable Market in Dubai and the Al Mina Fruit and Vegetable Souk in Abu Dhabi. Imported produce is a significant part of the market, but local and organic options are expanding.

Latin America Fresh Produce Market Growth

The need for fresh fruits and vegetables in Latin America is strong and expanding, fueled by significant domestic consumption and rising global export possibilities, especially to the U.S. and China. Farmers in Latin America sell a greater volume to local supermarkets than they export globally. Brazil is the biggest market and anticipated to show the highest CAGR in the area. Consumers in the area are progressively moving towards plant-based diets and are attracted to fresh, natural, and nutritious choices.

Brazil's market for fresh produce is seeing considerable and rising demand, mainly fueled by heightened health awareness among consumers, urban growth, and a burgeoning food service sector. The growing urban population and higher disposable income lead consumers to be more likely to buy fresh produce, especially in large cities like São Paulo and Rio de Janeiro, which feature strong distribution systems.

The Dairy Segment Held the Dominating the Fresh Produce Market in 2025.

The expanding population and a rising demand for fresh dairy items are key factors driving market growth. Knowledge of the health advantages of dairy, along with its abundant nutritional qualities, continues to draw in consumers worldwide. Organic dairy is projected to expand swiftly, supported by consumer interest in clean-label and high-quality products. Health-aware selections and worries about antibiotic traces in traditional dairy are driving interest in organic alternatives.

The Fruits and Vegetable Segment are Seen to Grow at a Notable Rate in the Fresh Produce Market During the Predicted Timeframe.

The growing recognition of the health advantages linked to eating fresh fruits and vegetables is boosting demand, as an increasing number of individuals from different demographics emphasize nutrition and healthier living. Advancements such as vertical farming and hydroponics are enhancing agricultural efficiency and guaranteeing the availability of fresh produce throughout the year, fostering a more sustainable and effective food supply.

The program like the 'Eat Right Fruit and Vegetable Market' spearheaded by FSSAI seeks to enhance the safety and quality of unregulated fruits and vegetables retail markets to match that of regular and structured fruits and vegetables retail shops. The aim is to enhance the current state of fresh fruit and vegetables market nationwide and ensure safe, hygienic products for consumers.

The Supermarkets and Hypermarkets Segment Led the Fresh Produce Market in 2025.

Since supermarkets allocate the most shelf space for fresh fruits and vegetables in comparison to other types of retail outlets, it is believed that buying at a supermarket presents the best chance for acquiring and consuming fresh produce. The broad accessibility of numerous products from various brands and farms offers people several options, driving the growth of the sector. Additionally, shoppers can examine and choose vegetables directly, enabling them to evaluate their quality, ripeness, and freshness. In addition, physical stores can address unique local tastes and preferences by providing region-specific options that might not be accessible through online retailers.

The Online Segment Expecting the Significant Growth in the Fresh Produce Market During the Forecast Period.

These platforms enable consumers to buy fresh vegetables from home and provide round-the-clock access, removing the necessity to go to physical stores. Furthermore, the increasing accessibility of fresh vegetables, encompassing organic, exotic, and specialty goods, through online retailers will enhance the expansion of segment. The growth of e-commerce has encouraged the conversion of traditional agricultural product brokers and numerous agricultural product producers into local e-commerce operators.

By Product Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026