April 2025

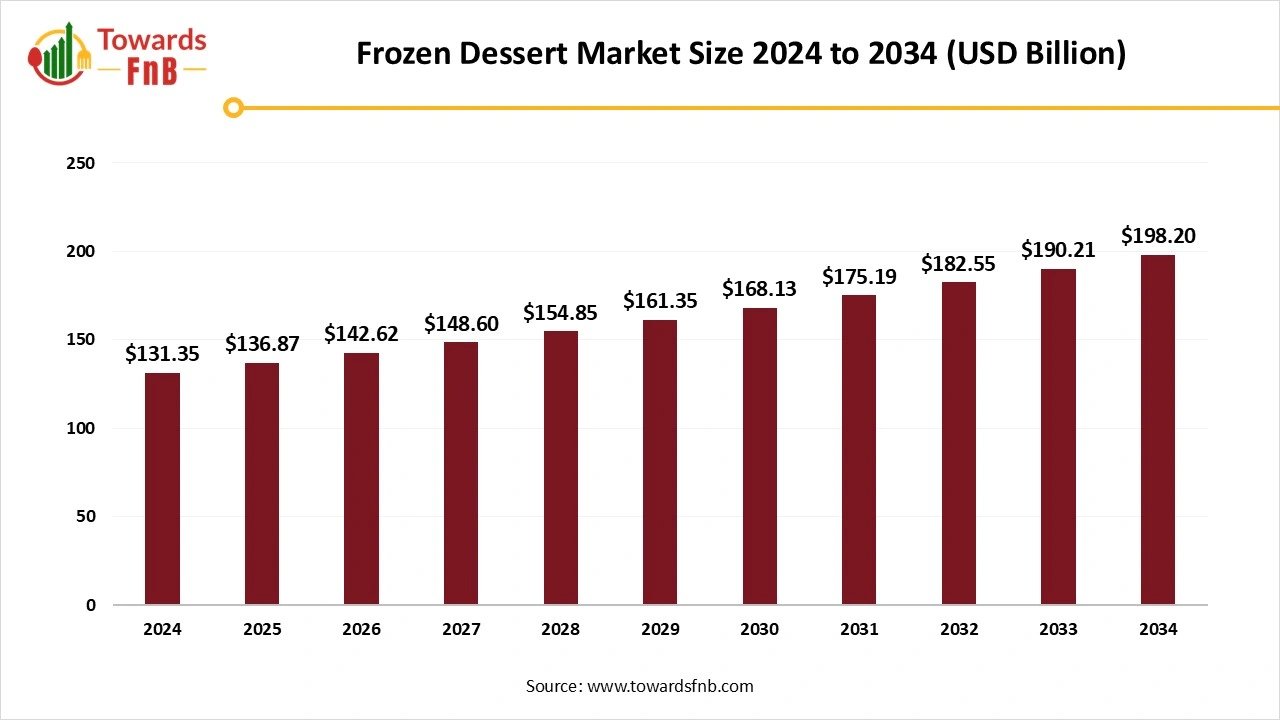

The frozen dessert market size grew from USD 131.35 billion in 2024 to USD 198.2 billion by 2034, with an expected CAGR of 4.20% from 2025 to 2034. Health-aware consumers are progressively looking for low-fat, low-sugar, and dairy-free choices, while producers explore innovative flavors and high-quality ingredients that contribute in the growth of the market.

Frozen desserts are formulated by freezing liquids, semi-liquids, or solids and then incorporating flavored waters, added colors, custards, milk and other ingredients that improve the color and flavor of these desserts. The growth of the market is due to the increasing consumer demand for premium ice creams, the heightened popularity of international flavors, and the recent innovations in products by manufacturers. Major developments in areas like mechanical refrigeration, chilling and freezing methods, sanitation and cleaning, packaging along with ingredient performance have influenced the industry and boost the frozen dessert market.

Numerous rival brands of frozen treats are consistently showcased to buyers in supermarkets and hypermarkets, presenting a range of flavors, ingredients, and options in various sizes and formats further driving the market. Following a meal, consumers tend to choose frozen dessert products to help improve digestion. The market is growing due to changing consumer choices and tastes, income variations, climate changes, and the launch of various flavor products. Micro-formats are becoming more popular, particularly with Gen Z.

Their preference for exciting formats and novel flavors has led to the rise of tapas-style dishes, shareable plates, and adjustable portion sizes as food trends in both retail and dining establishments. The ice cream sector is also included, as one-third of ice cream buyers in the UK are keen to sample bite-sized servings. A third of ice cream eaters in the UK are keen on sampling bite-sized servings. Shoppers who purchase bite-sized ice creams in addition to traditional types typically spend 76% more on ice cream overall.

As the frozen dessert industry grew, rapid freezing methods like blast freezing were developed. This advancement enables producers to maintain the flavor and quality of ice cream while lengthening its shelf life. High-Pressure Processing HPP has become a transformative force in the ice cream sector. HPP entails applying elevated hydrostatic pressure to packaged ice cream, successfully removing detrimental bacteria and prolonging shelf life without relying on preservatives. Improvements in automation and robotics have revolutionized ice cream manufacturing processes. Contemporary factories employ automated machinery to perform tasks such as mixing ingredients, adding flavors, and packaging, resulting in enhanced efficiency and uniformity in production.

The variable costs of raw materials, especially sugar and dairy, represent one of the primary challenges as they can affect pricing and profit margins. Disruptions in the supply chain also impact production timelines and availability, particularly with regard to sourcing ingredients and packaging materials. Inconsistent revenue flows result from sales typically surging during summertime and falling in colder periods. Seasonal demand also affects the market.

North America dominated the frozen dessert market in 2024.

There is a growing demand for high-quality and artisanal frozen desserts that feature distinctive flavors and superior ingredients. Buyers are progressively seeking frozen desserts that are more nutritious, made with natural components, and devoid of synthetic additives. These factors fueling the growth of the market. Industrial merging, acquisitions and collaborations further expanding the market.

Frozen desert market of Canada showed significant potential, attributed by changing consumer preferences and growing retail facilities. The market is defined by a growing consumer preference for snacking outside the home and trying new food options.

Asia Pacific expects a significant growth in the frozen dessert market during the forecast period.

The increasing popularity of frozen desserts has resulted in considerable expansion in the overall quantity of ice cream and frozen dessert retail outlets throughout the Asia-Pacific area. In addition, the frozen dessert is set to succeed in the Chinese market, since the rising demand for low-fat healthy options is expected to motivate consumers to invest more in these items. The growing consumer income, significant advancements in manufacturing capabilities, the trend towards premiumization in the country, and the rising adoption of premium products by consumers are expected to meet the rising demand for frozen desserts in China.

The ice cream segment dominated the frozen dessert market in 2024.

The view of ice cream as a more nutritious, locally produced treat is a major factor propelling the market. Nations such as the U.S., Germany, and France are experiencing a transition towards high-quality, artisanal ice creams crafted with organic components and creative tastes. The sector is experiencing substantial expansion worldwide with an increasing focus on clean-label components and sustainability.

The frozen yoghurt segment expected to grow with highest CAGR in the frozen dessert market during projection period. The rising trend of low-fat frozen yogurt and the launch of healthy product variations in multiple flavors are expected to offer consumers seeking a nutritious substitute for frozen treats a wide array of choices. Additionally, hectic lifestyles, along with health and wellness issues, are prompting consumers to opt for frozen yogurt as alternatives to meals.

The hypermarkets and supermarkets segment accounted for the largest share in the frozen dessert market in 2024.

Customers show a tendency to choose supermarkets and hypermarkets for frozen dessert purchase, availability of various brands and easy accessibility, improved and attractive packaging boosting the market. The café and bakery shops segment expected grow in the forecast period from 2025 to 2034. A variety of cafes and bakeries offering frozen treats have emerged due to the increasing trend of purchasing items from specialty shops. Due to current trends, they are including nutritious desserts in their menus, enhancing their product offerings.

By Product

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025