April 2025

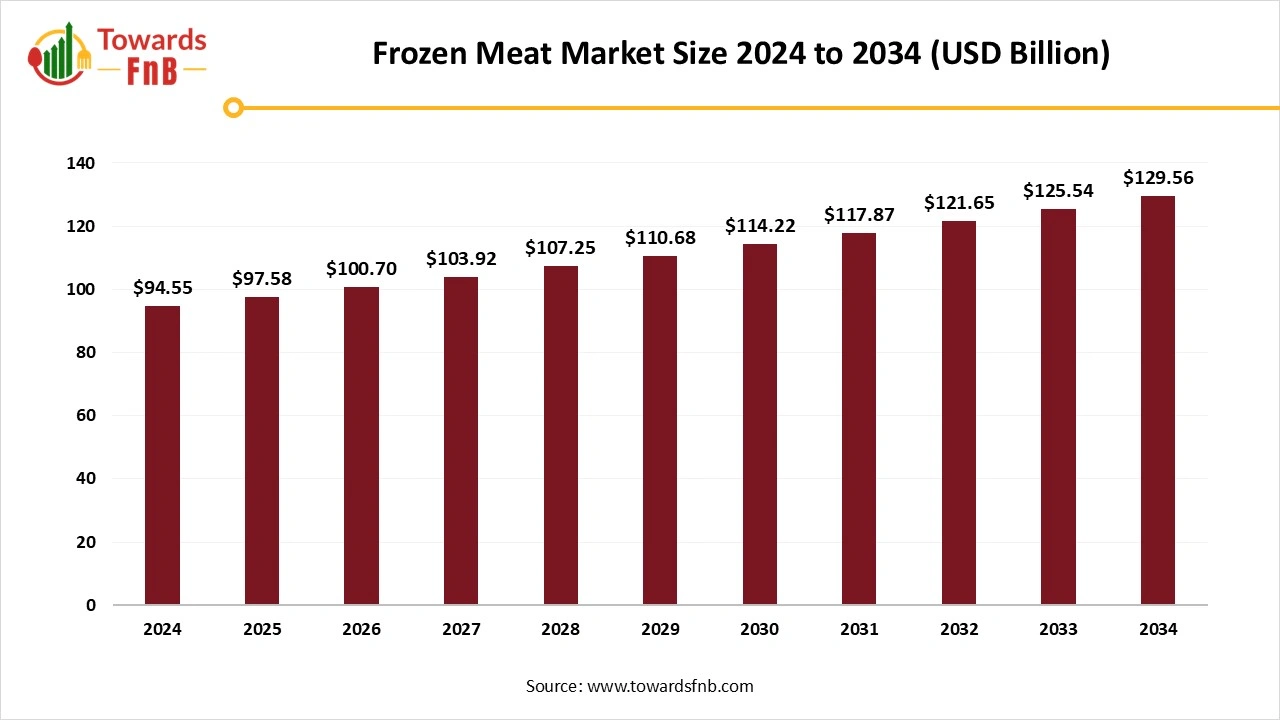

The global frozen meat market size was estimated at USD 94.55 billion in 2024 and is expected to rise from USD 97.58 billion in 2025 to nearly reaching USD 129.56 billion by 2034, growing at a CAGR of 3.20% from 2025 to 2034. Increasing net income in developing nations is enabling consumers to spend more on food items, such as frozen meat, which is driving their demand in the market.

Frozen meat lasts longer than fresh meat and decreases the chances of foodborne illness. Moreover, it is frequently reduced in fat and calories in comparison to fresh meat, which is sought after by a substantial consumer market. Rising demand for various types of meats with the yearning of the culinary experiences increasing the frozen meat market.

Moreover, the rising appeal of fast food and quick-service eateries has also played a role in the expansion of the frozen meat industry. Frozen meat products serve as an essential component in numerous fast-food dishes and are consequently sought after by the fast-food sector. Increasing demand for organic frozen meat expanding the frozen meat market as the consumers are becoming more health conscious and looking for organic, clean label and natural without preservatives food.

At present, the primary technologies employed in developing alternative meats are either plant-based or cell-based. The offerings from the two leading companies, Impossible Foods and Beyond Meat, are plant-based yet distinct, as Impossible Foods utilizes soy protein, whereas Beyond Meat merges pea proteins with various bean sources. Cell-based research is still in its early stages, and presently, there is no widely available commercial product in any market except Singapore and create opportunity for meat production.

Cell-based production occurs in laboratories and involves cultivating stem cells extracted from specific animals. Although cell-based meat products do not completely replace meat, they avoid the conventional farm or ranch to slaughterhouse method, thereby alleviating some environmental and animal welfare issues for certain consumers.

The substantial expenses related to purchasing freezing equipment could represent a serious challenge to the expansion of the global frozen meat market. In addition, frozen foods include different kinds of preservatives that can impact the human body, which is another significant factor anticipated to hinder the growth of the global frozen meat market in the forecast period. Also, various issues have been highlighted concerning the improper use of preservatives in meat products, manifesting in different ways, such as incorporating levels exceeding the maximum limit set by regulatory bodies or introducing ineffective concentrations. So far, the inappropriate use of preservatives is a global concern due to their effects on public health and the stability of the environmental microbiome, hampering market growth.

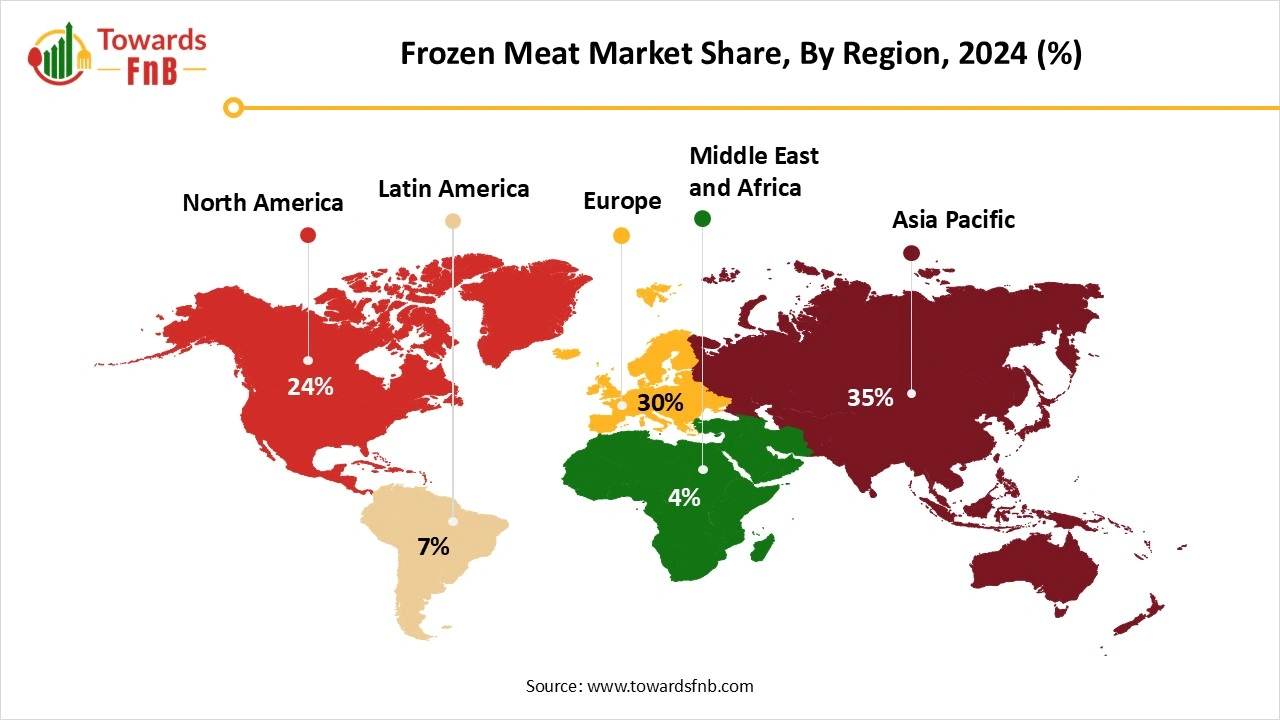

Asia Pacific dominated the frozen meat market in 2024.

As the worldwide meat consumption continues to grow due to factors such as population growth, urban development, and rising incomes, particularly in developing nations. As income increases, consumers can buy a wider variety of meat products, including frozen options. An increasing middle class in China, India, and Brazil is boosting the demand for frozen meat even more. The shift towards premium products in the food sector is impacting the frozen meat market as well. Shoppers are prepared to spend extra on premium, specialty meat items like grass-fed, free-range, or organic frozen meats. The appetite for gourmet meat items, like aged beef, artisanal sausages, or unique meats, is rising as consumers look for distinctive, premium choices for their meals.

China has the biggest meat consumption frozen meat market in the world. Chinese consumers also indicate that they are spending more on meat in restaurants, unlike consumers in the surveyed peer countries, who allocate more for meat to prepare at home. Chinese eateries generally utilize frozen meat; thus, the expansion of the restaurant and catering sector with 8 percent annually from 2018 to 2023 is expected to boost frozen meat usage. Similarly, as convenience-focused customers dine out more frequently, international companies have a chance to satisfy the rising need for frozen meat.

North America expects significant growth in the frozen meat market during the forecast period.

Multiple factors are fueling the expansion of the frozen meat market in North America. The growing demand for high-protein diets, shifting consumer tastes, and rising disposable incomes are all factors contributing to the market's expansion. Moreover, advancements in food processing technology and enhancements in supply chain efficiencies are allowing manufacturers to satisfy the increasing consumer demand for meat products. The market is seeing improvements in plant-based meat substitutes, which are becoming more acknowledged as a segment of the larger protein consumption trend.

In the United States, the increasing need for convenient ready-to-eat food driven by fast-paced work routines and bustling lifestyles is boosting the market for frozen meat. In addition, the increasing consumer preference for processed meat items, like bacon, sausages, hot dogs, canned meat, and so on, is fueling market expansion. Moreover, the extensive availability of fast-food establishments, food trucks, cafes which heavily rely on processed and ready-to-cook meat options for quicker and more convenient customer service is further boosting the frozen meat demand in the nation.

Europe expects the notable growth in the market during the forecast period.

The increasing consumer interest in protein-heavy diets is a major factor influencing the market, with meat serving as a key protein source in European homes. The rising trend of health-focused diets has resulted in a higher intake of leaner meat choices, like poultry, as individuals aim to harmonize nutrition with flavor. European shoppers are progressively emphasizing sustainability and ethical factors in their buying choices. The need for organic, free-range, and sustainably sourced frozen meat keeps increasing, fueled by worries regarding environmental effects and animal welfare. These preferences have driven the growth of cultivated and plant-based meat substitutes, broadening the industry's range to cater to various consumer values.

Beef segment held the dominating share of the frozen meat market in 2024.

Frozen beef guarantees that high-quality meat cuts are accessible throughout the year, irrespective of local farming circumstances. Transporting frozen beef is also more economical than fresh meat, as it enables larger amounts to be delivered over greater distances without risk of spoilage, increasing the demand for frozen beef. The demand for beef is increasing because of higher public welfare, growing population, land alterations, dietary changes, urban development, and democratization.

The chicken segment is seen to grow at a notable rate during the predicted timeframe. The primary factors driving the expansion of the frozen chicken market are the increasing consumer preference for convenient food options, heightened awareness of frozen chicken as a nutritious and affordable protein source, and swift urban development resulting in more working professionals who have little time for meal preparation. The frozen chicken industry provides an extensive selection of products, featuring pre-cooked choices, nuggets, strips, and numerous flavored types. This variety meets various consumer tastes and enables flexible meal preparation.

Supermarkets and hypermarkets segment held the dominating share of the frozen meat market in 2024.

Shoppers choose to purchase frozen meat items from these stores because of the diverse selection offered and the ease of buying all grocery items in a single location. Supermarkets provide shoppers with a greater variety of choices based on their preferred type of meat. Additionally, numerous supermarkets provide pre-marinated meats, meals that are ready to cook, and various other items.

Online segment expects a significant growth in the frozen meat market during the forecast period. Businesses have acknowledged the significance of e-commerce, and various entities are currently collaborating with external retailers to provide products directly to consumers' doorsteps. During the pandemic, online meat sellers such as Tyson Fresh Meats joined the meat E-Commerce trend. They noted that 23% of their clientele were expected to keep purchasing online following the lockdowns. Thus, they took steps to facilitate online meat sales.

By Product

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025