April 2025

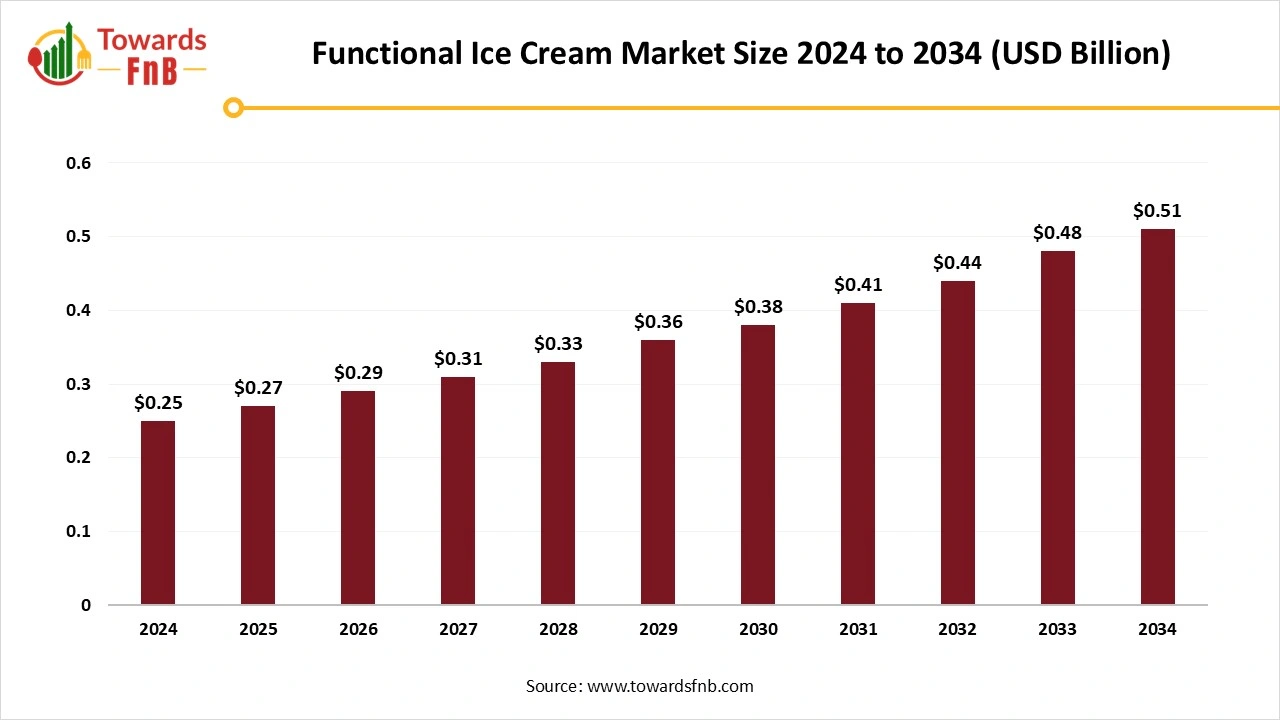

The functional ice cream market size is valued at USD 0.25 billion in 2024 is forecast to grow from USD 0.27 billion in 2025 to USD 0.51 billion by 2034, with a CAGR of 7.40% during the period from 2025 to 2034. The functional ice cream market is experiencing strong growth fueled by rising demand for creative flavors and varieties, along with increased health awareness among consumers in developing regions.

The growing fascination with foods that enhance human health, and nutrition has increased a demand for the food industry to focus on developing innovative and functional ice cream. Ice cream is an extremely well-liked food item globally and is consumed both after and during meals. The heightened awareness of the connection between food and health has prompted consumers to seek an ice cream that aligns with their physical and mental wellness requirements.

Ice cream has a relatively high content of fat and sugar, leading to an increased consumption of these nutrients and subsequently raising the risk of obesity, which includes childhood obesity and associated health issues. These issues have resulted in a spurred demand for low-calorie and high-fiber foods, thus creating the necessity to formulate functional ice cream as well. Indeed, the factors driving the development of functional ice cream are the rising health concerns of consumers and their interest in novel foods that align with a healthy lifestyle.

Single-serve ice cream items, like handheld treats, ice cream bars, and single servings, are becoming popular with busy consumers seeking convenient snack solutions. additionally, the ice cream sector is being shaped by evolving consumer demographics and cultural factors. With increasing net incomes in emerging markets and rapid urbanization worldwide, the demand for ice cream is on the surge as an accessible luxury and a representation of the Western way of life.

The expanding vegan community and rising interest in plant-based options offer considerable opportunities for the functional ice cream market. Moreover, buyers are progressively backing brands that focus on sustainability. Businesses embracing eco-friendly methods, like utilizing biodegradable packaging and sourcing organic materials, are gaining a competitive advantage. Fortification of ice creams is an intelligent approach since children would receive most of the benefits from these fortified ice creams. Merging bio-active compounds with ice creams is an intriguing method to create a beloved treat that carries the label of being healthy and nutrient-rich. Recent advancements in ice cream are showcasing notable enhancements in the textural, rheological, and sensory characteristics of the final product.

Frequent intake of high-fat, high-sugar foods such as ice cream can lead to the onset of chronic conditions like metabolic syndrome, obesity, and non-alcoholic fatty liver disease. These circumstances may lead to lasting effects on general health and life quality. The increasing recognition of these problems has led numerous consumers to look for healthier options hampers the functional ice cream market expansion.

North American Dominated the Functional Ice Cream Market in 2024.

Market is boosted by changing consumer tastes for high-quality, artisanal flavors and the swift increase in demand for plant-based and low-sugar options. an increasing preference for distinctive and seasonal tastes has further stimulated growth. Leading ice cream brands are improving their products, appealing to health-aware customers with options that are lower in sugar, dairy-free, and high in protein, backed by the strong cold chain network of the region. Common flavors like chocolate, cookies and cream, vanilla, and strawberry are greatly enjoyed by North Americans. The market is additionally shaped by marketing tactics that emphasize sustainability, as brands prioritize eco-conscious packaging and responsibly sourced ingredients.

United States functional ice cream market is expanding as consumers are looking for more healthier options as well as innovative flavors. Another crucial factor is the rising prevalence of dietary limitations and allergies. Numerous functional ice creams are formulated to be free of allergens, considering those with lactose intolerance, gluten sensitivity, or various dietary limitations. Functional ice creams that are low in sugar, high in protein, and enriched with additional vitamins or minerals align perfectly with the dietary routines of fitness enthusiasts.

Asia Pacific Expected to Grow at the Fastest Rate in the Functional Ice Cream Market During the Forecast Period.

The Asia-Pacific market is growing as consumers possess greater net income and favor buying premium ice cream products. This expansion is driven by the rising demand for food products such as ice cream and frozen treats in the area, with net income mainly directed towards food acquisition. The growth of functional ice cream manufacturing is bolstered by the increasing dairy sector in the Asia Pacific area. The growing trend of health-aware consumers looking for ice creams with functional and health advantages is increasing the demand for premium functional ice creams.

The Vanilla Segment Dominated and Held the Largest Share of Functional Ice Cream Market in 2024.

Vanilla acts as a foundational flavor for numerous other ice cream varieties and confections. It enhances an array of ingredients and can be readily added to various dishes and thus, increase the demand. However, despite the emergence of nearly endless unique and new flavors, vanilla still stands as the most flavored ice cream type. As stated by the International Ice Cream Association, 29% of consumers favor vanilla ice cream. Increasing consumer demand for premium products is urging both established companies and new entrants to elevate their standards and perfect their vanilla ice creams.

The chocolate segment is observed to grow at the fastest rate during the forecast period. The chocolate ice cream industry is witnessing substantial expansion, fueled by evolving consumer tastes for luxurious desserts and the rising demand for chocolate-flavored items. Moreover, the increasing impact of social media and culinary trends motivates brands to create and present distinct flavors, which aids in drawing a larger audience. Distinct flavor combinations, like chocolate with unusual spices or regional ingredients, are becoming popular among daring food enthusiasts.

The Lactose-Free Segment Held the Dominating Share of the Functional Ice Cream Market in 2024.

This market growth is fueled by several reasons such as, the increase in lactose intolerance, the popularity of vegan and flexitarian diets, and a general movement towards healthier, sustainable food options. Food and beverage producers are consistently developing new flavors, textures, and nutritional profiles, making lactose-free ice cream an attractive choice for health-conscious buyers and eco-friendly shoppers.

The vegan ice cream segment is observed to grow at the fastest rate during the forecast period. A change in consumer purchasing habits towards healthier food options has driven developers to concentrate on creating low-sugar alternatives, such as vegan ice cream and vegan ice cream bars. Consumers are acknowledging their dietary restrictions or opting for dairy-free diets for health purposes, leading to a rise in demand for alternatives like vegan ice cream. Consumer tastes are changing, and the demand for plant-based options is spurring, leading to an increasing focus on innovation in the sector. This entails developing new tastes, consistencies, and recipes that closely resemble conventional dairy ice cream yet are devoid of animal-derived ingredients.

The Store-Based Segment Held the Largest Share of the Functional Ice Cream Market in 2024.

This significant portion is linked to the growing consumer desire for luxurious and high-quality functional ice cream options. Supermarkets and hypermarkets are the leading distribution channel because they provide a vast selection of ice cream brands and flavors to customers. These retail outlets like supermarket and hypermarkets provide a wide range of protein bars featuring various packaging sizes, brands, and price ranges to meet the diverse tastes of consumers.

The non-store-based segment is expected to grow at the fastest rate in the functional ice cream market during the forecast period due to increased adoption of digital and e-commerce. E-commerce vendors and shipping providers present convenient delivery solutions, such as timed deliveries, expedited shipping, and home delivery services. This removes the necessity for customers to go to brick-and-mortar shops, conserving time and energy.

By Flavor Type

By Claim

By Distribution Channel

By Region

April 2025

March 2025