April 2025

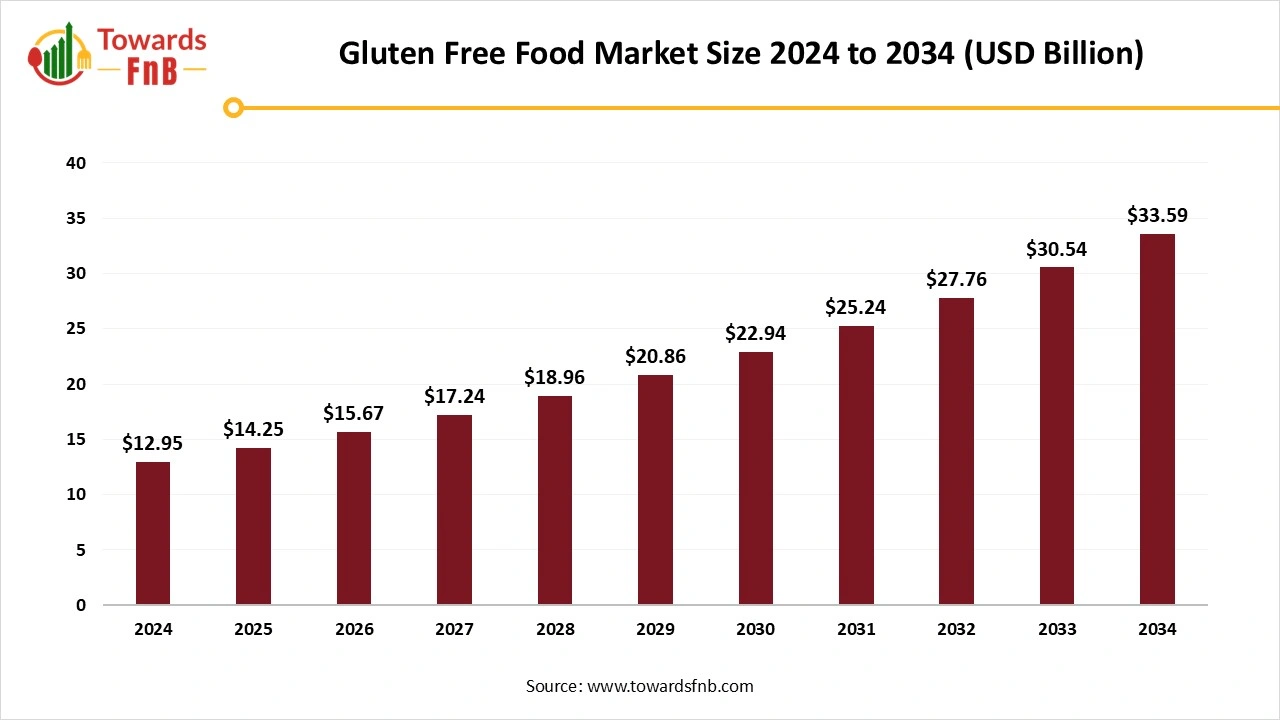

The global gluten free food market size accounted for USD 12.95 billion in 2024 and is projected to be worth USD 33.59 billion by 2034, registering a CAGR of 10% from 2025 to 2034. Increasing prevalence of celiac disease, awareness regarding celiac disease and healthy diet habits are driving the market of gluten free food.

The global prevalence of celiac disease ranges between 0.7% and 2.9% in the general population. This increasing burden of celiac disease and food allergies demanding for the gluten free food and thus fostering the market. Moreover, the expansion is driven by broadening the product line beyond traditional baked goods to also encompass snacks, ready-to-eat foods, and beverages, highlighting the demand for convenience.

The increase in the proportion of retail trade and online sales has escalated overall market expansion, as gluten-free items are now readily available in supermarkets and online platforms. Furthermore, the incorporation of clean labels and organic trends in product development redirects focus of manufacturers towards natural, protein-packed, and alternative flours like almond, coconut, and quinoa, which has boosted the market.

Micro-encapsulation technology is utilized to enhance the shelf-life and texture of gluten-free baked goods. This technology aids in boosting moisture retention and addressing texture issues. The quality of gluten-free products is maintained through the controlled release of constituents by micro-encapsulation. Methods for microencapsulating substances and their utilization in the food sector is a highly encouraging field that will further expand as the potential growth opportunity in the market.

Producers grapple difficulties in producing gluten-free items since gluten is essential for providing texture, structure, and elasticity in goods. Substituting gluten with alternative ingredients such as xanthan gum, guar gum or psyllium husk is challenging. The problem of cross-contamination also needs mandated controls in manufacturing plants. These factors contribute to the increased difficulty and cost of producing gluten-free products, which restricts the selection and attractiveness of gluten-free choices available in the market.

North America dominated the gluten free food market in 2024.

The growth of the market is attributed to the rising awareness regarding the health and increasing adoption of heathy millets, and other gluten free diets in their daily routine is driving the growth of the market. Additionally, the increasing prevalence of the celiac disease in the United States population and increasing number of allergic conditions due to the gluten-based foods and easy accessibility of gluten free products are collectively accelerate the growth of the market.

Asia Pacific is projected to grow in the market during forecast period.

The growth of the market is attributed to the growing population and the rising awareness regarding the health and dietary supplements which boosts the demand for the healthy food that boosts the demand for the gluten free food. The rising presence of the people with the celiac disease that boosts the demand for the alternative food options which contributed to the expansion of the gluten free food market.

The bakery product segment led the gluten free food market in the gluten free food products. The rising consciousness regarding healthy diets, including natural, organic, and gluten-free products, is expected to propel the expansion of this segment. Whereas gluten-free snacks and ready-to-eat foods segment is projected to grow throughout the forecast period. Different innovative, smart and attractive foods by industries are launched and demand is increasing due to busy lifestyle and requirement of healthy nutrition rising the market.

The hypermarkets and supermarkets segment dominated the gluten free food market in 2024.

This segment offers convenient access to various items in one place, making it simple for shoppers to select products from numerous choices. Seasonal displays, featuring gluten-free items, contribute to the introduction of new products and ultimately enhance segment growth. Furthermore, online segment is anticipated to grow with highest CAGR in forecast period. The online platform offers several advantages that are especially attractive to millennials and younger individuals, including the ease of shopping from home, home delivery, complimentary shipping, and special discounts.

By Product

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025