March 2026

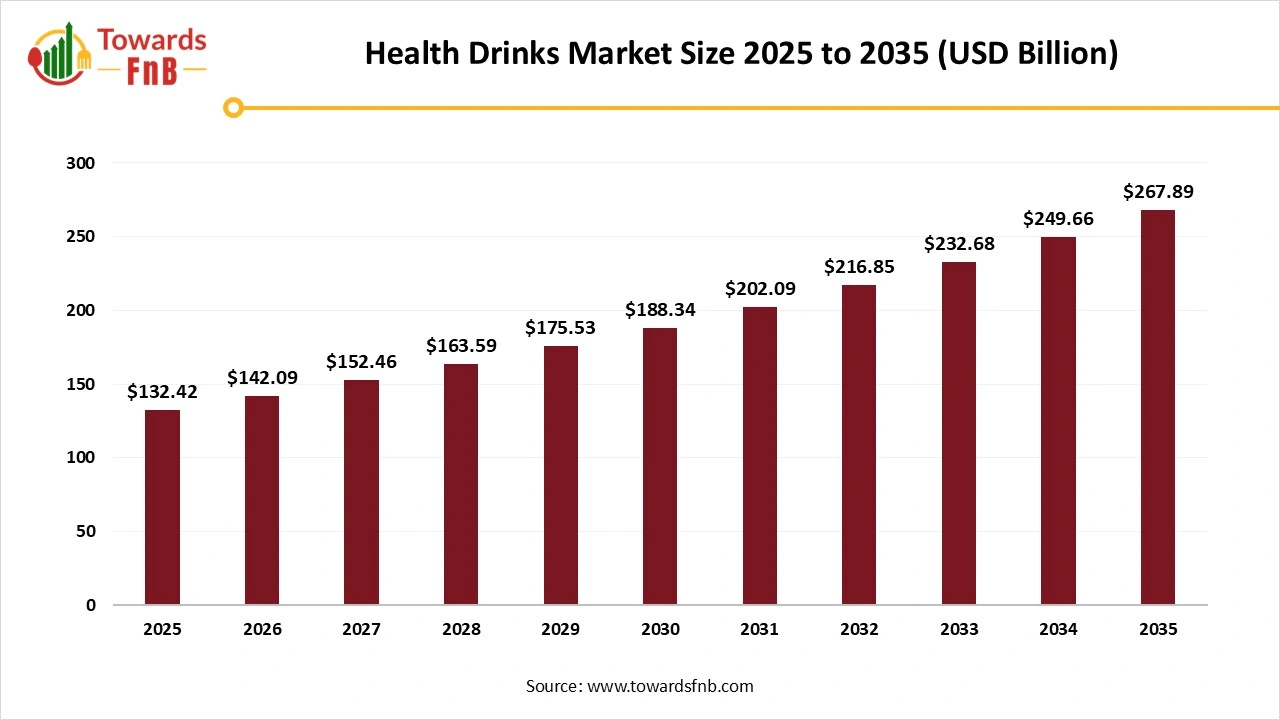

The global health drinks market size was estimated at USD 132.42 billion in 2025 and is predicted to increase from USD 142.09 billion in 2026 to approximately USD 267.89 billion by 2035, expanding at a CAGR of 7.3% from 2026 to 2035. The overall expansion of new technology, shift towards new flavors and ingredients, health and wellness, sustainability & convenience are promising growth factors for this sector.

| Study Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.3% |

| Market Size in 2026 | USD 142.09 Billion |

| Market Size in 2027 | USD 152.46 Billion |

| Market Size by 2035 | USD 267.89 Billion |

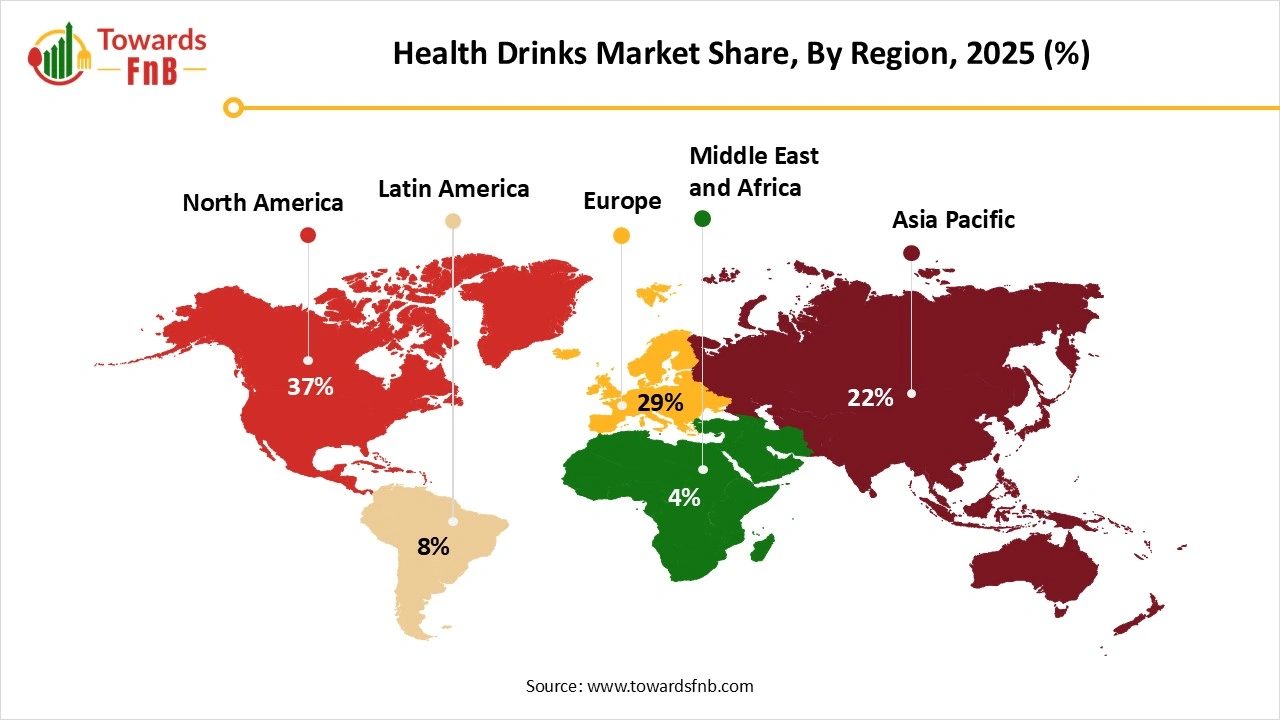

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health drinks are kinds of healthy beverages filled with vitamins and nutrients, and which are promoted as products that can enhance mental alertness and physical performance. The market driver revolves around consumers who are increasingly navigating towards healthy beverages made with natural, plant-based ingredients such as fruits, vegetables, and herbs. Beverage brands that can convey the nutritional and functional benefits of their products are gaining attention in the industry. The growing demand for convenient, health-focused drinks is energizing growth in pea proteins, prebiotic fiber, and botanical extracts which further expands the health drinks market growth.

The health drink industry is commanding a revolution determined by increasing consumer demand for health as they are conscious about their consumption. They are accepting plant-based diets as the demand for plant-based and dairy free beverages has been boosted. Oat milk, Almond milk, soy water, and coconut water are some of the examples of these. The alcohol alternatives are another opportunity emerging in health drinks as brands are coming with non-alcoholic spirits which have similar complexities and taste as regular alcoholic drinks and immune-boosting beverages are another contingency as herbal tea such as turmeric, ginger, and echinacea are being promoted for their potential to increase immunity and support overall health.

Health drink brands face major market challenges. Despite being marketed as nutritious, many contain excessive sugar, synthetic additives, and caffeine, raising health concerns. Consumers are becoming more aware of these issues, leading to skepticism and demand for transparency. Strict regulations and evolving food safety norms also pressure brands to reformulate products.

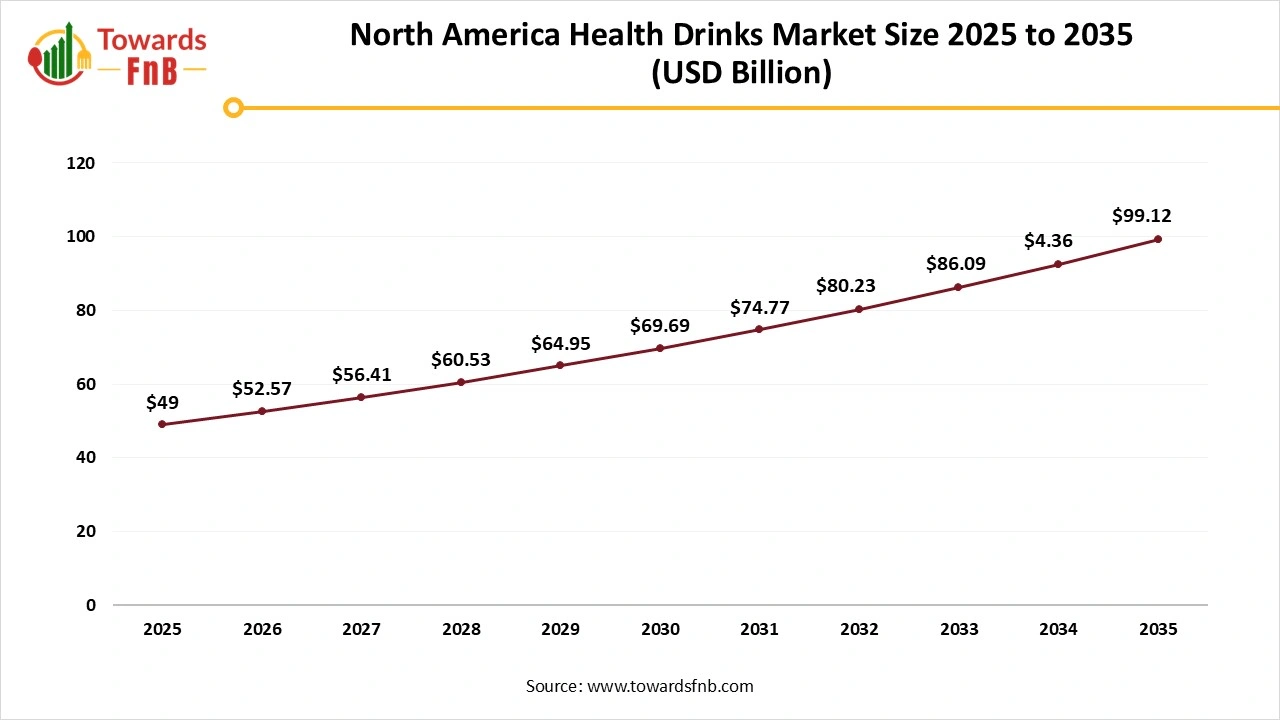

North America Dominated the Health Drinks Market in 2025

There is a shift towards natural energy sources in beverages. Consumers want goods that deliver lasting energy without the jitters associated with synthetic caffeine. Green tea, guarana, and medicinal mushrooms (e.g., reishi, lion's mane) are being used in drinks to improve focus and stamina. Plant-based beverages are becoming increasingly popular, with customers choosing dairy alternatives including almond, oat, and coconut milk. The rising inclination toward sustainability and health-conscious consumption drives the growth of the market.

North America Health Drinks Market Size 2025 to 2035

The North America health drinks market size was calculated at USD 49 billion in 2025 with projections indicating a rise from USD 52.57 billion in 2026 to approximately USD 99.12 billion by 2035, expanding at a CAGR of 7.3% throughout the forecast period from 2026 to 2035.

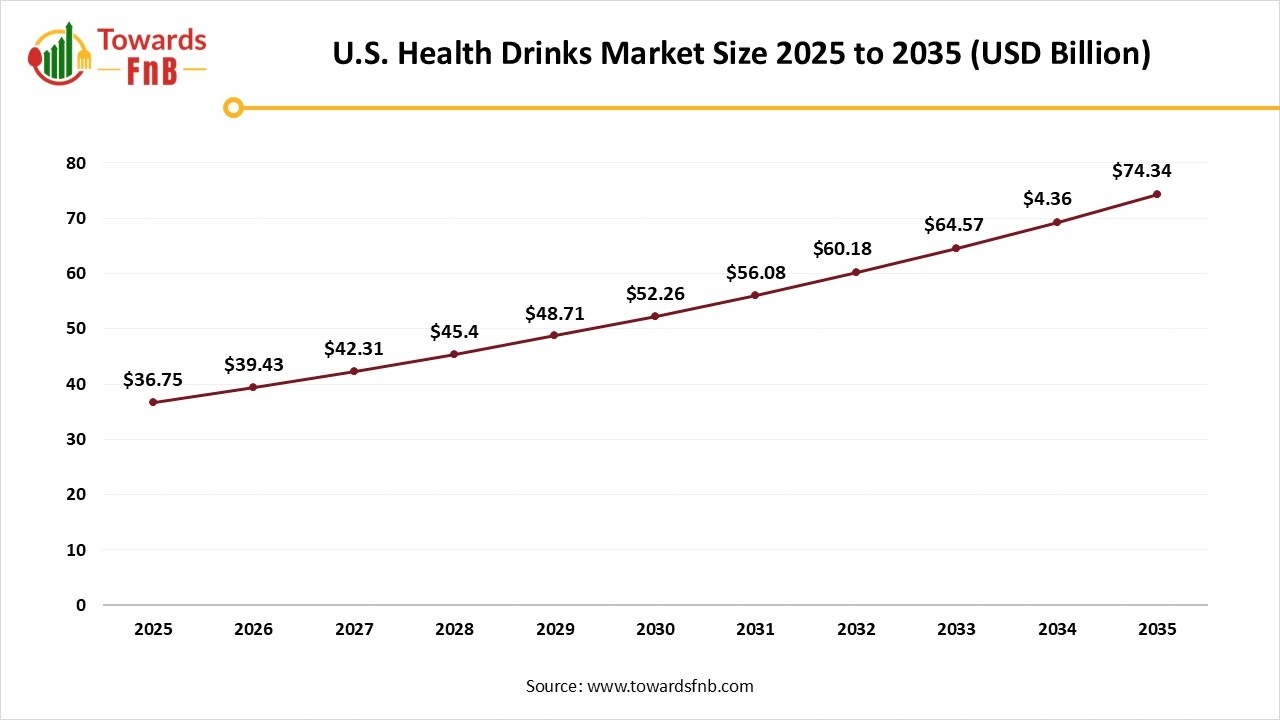

The U.S. is a major player in the regional market, contributing to growth due to a large consumer base for healthier drinks in the U.S. The growing demand for functional and health-conscious beverages is driving innovative approaches in the health drink industry. The demand for convenient and nutritious beverages has increased in the country. Additionally, the plant-based and functional drinks are gaining traction. The protein, prebiotics, and probiotics functional beverages are the key segment dominating the U.S. health drinks market.

How Big is the U.S. Health Drinks Market?

The U.S. health drinks market size reached at USD 36.75 billion in 2025 and is anticipated to increase from USD 39.43 billion in 2026 to an estimated USD 74.34 billion by 2035, witnessing a CAGR of 7.3% during the forecast period from 2026 to 2035.

Asia Pacific Expects Significant Growth in the Health Drinks Market During the Forecast Period

Protein-based health drink is the most important ingredient found in the Asia Pacific region as 42 % of consumers prefer protein drinks, especially among Gen Z and Millennials. This trend opens new gates for market. The rising health awareness in the regional population and inclination towards the sports nutrition drinks for fulfilling the protein requirement of body. Additionally, the rising demand from consumers for the new flavours further boosts the growth of the health drinks market.

China is a major player in the regional market, growth driven by rising consumer awareness about health and wellness. China has a large population, making it the ultimate country with a large average consumer base. The growing health consciousness and increasing disposable income are enabling consumers to spend on premium beverage products, including plant-based, functional, and nutrition-rich drinks. Additionally, China's increasing emphasis on sports and fitness is contributing to the rising demand for health drinks.

India is the second-largest country, leading the regional market, due to rapid digitalization and an increasing health-conscious consumer base. The demand for plant-based and organic drinks has increased in the country. The low-sugar and sugar-free segments are leading the market growth. With expanding soft drink industry and growing health consciousness are fostering the market growth. Strong and supportive regulations for food safety and beverages are contributing to innovative approaches in health drinks.

Europe Expects a Notable Growth in the Health Drinks Market During the Forecast Period.

Refreshing health drinks offer various functions in terms of cognitive health, immunity support, protein fortification, and constantly increasing energy and hydration offerings, which all lead to innovation. Great-tasting flavors are making new ways for the European market, and choosing bold flavors is trending. Approximately 49% of global consumers have accepted that new flavors are launching as permanent lines or limited-time seasonal offerings. Subjective fruit blends and more complicated flavor options are driving invention and differentiation as brands commonly leave consumers guessing for an exact taste of flavors.

The UK is leading the European health drink market due to increased health consciousness, advanced beverage fortification technologies, and increasing consumer demands for convenient nutrition. The UK has experienced significant growth in consumer shift toward healthier beverage options such as juices and fortified water.

Fresh Packaged Fruit Juices Held the Dominating Share of the Health Drinks Market in 2024.

This growth is due to factors such as the healthy point of view of these juices with options free of preservatives, artificial additives, and sweeteners and with a blend of functional ingredients like extracts, vitamins, and prebiotics. These input goals are to meet consumers' health and well-being needs. New Flavors fascinates and makes fruit juice perfect for different consumption scenarios, but when it comes to production, providers of high-quality inputs such as Alimentos SAS. And thirdly, groundbreaking inventions in the industry have led to more environmentally friendly packaging that has sustainability features.

The Functional Drink Segment is Expected to Experience Significant Health Drinks Market Growth During the Predicted Period.

The increasing consumer demand for functional beverages due to the growing awareness regarding health and wellness and the desire for convenient and on-the-go solutions. This area is driven by discovery, as 258 new products were launched in functional drinks that offer health benefits and companies are constantly experimenting with cutting-edge ingredients such as probiotics, adaptogens, and collagen, which create formulations that address everything from stress relief to immune support. The rising focus on personalized health has led to growth in products tailored to concerns such as digestive problems, stress management, and post-workout recovery.

The Supermarket and Hypermarket Segment Dominated the Health Drinks Market in 2024.

Supermarkets and Hypermarkets offer an extensive range of products in the categories of groceries, electronics, and even drinks too which makes it easy for consumers to purchase from a single location. Another advantage associated with this channel is that all products are present under one roof which provides a great shopping experience with good quality and a wide variety of products.

The Online Retail Expects a Significant Growth in the Market During the Forecast Period.

The growth of digital marketing for different drink brands and E-commerce platforms serves innovative ways to communicate with consumers, which gather feedback and rearrange their products in actual time. This direct-to-consumer approach not only develops brand visibility but also allows for a tailored customer experience, which includes customized recommendations and subscription beverage services. Quick commerce, segmented by delivery times sometimes within minutes, aligns with consumers' growing demands for speed, convenience, and efficiency as consumers seek brands that satisfy their needs.

On 25 September 2024

On 17 September 2024

On 2 December 2024

On 6 March 2025

By Type

By Distribution Channel

By Region

March 2026

March 2026

March 2026

March 2026