April 2025

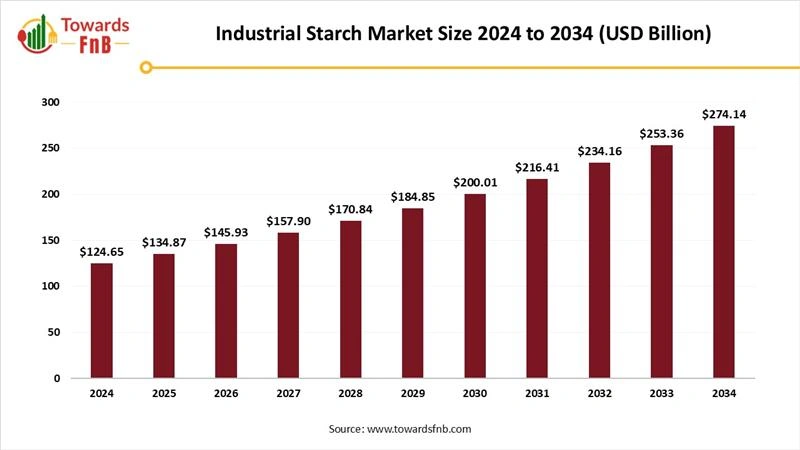

The global industrial starch market size was estimated at USD 124.65 billion in 2024 and is predicted to increase from USD 134.87 billion in 2025 to approximately USD 274.14 billion by 2034, expanding at a CAGR of 8.20% during the forecast period from 2025 to 2034. Expanding food and beverage sector and use of starch as gelling, thickening and stabilizing agent significantly fostering the market.

Starch is a complicated carbohydrate polymer created by plants, particularly by crops, in large quantities. Starch is crucial for both humans and animals as a source of nourishment and energy. Today, starch is frequently utilized in non-food industrial sectors for numerous applications. A key factor driving the industrial starch market is the growing consumer demand for processed and convenient foods. As the contemporary way of life accelerates, there is an increasing need for convenience meals and processed food items. Starch is essential in the food processing sector because it serves as a thickening agent, stabilizer, and texturizer. The market is experiencing considerable expansion fueled by rising demand in multiple sectors, such as food and drinks, paper products, textiles, and pharmaceuticals.

As interest in reducing environmental pollution and promoting sustainable healthcare increases, techniques for resistant starch preparation utilizing eco-friendly technologies have undergone significant research. Utilizing starch in 3D food printing provides numerous advantages, such as enhanced food presentation, the possibility of integrating flavors and ingredients into the printed dishes, biodegradability, and fostering increased creativity. With ongoing technological advancements, market of modified starch is boosting. The outlook for modified starch technology is expected to concentrate on precise alterations, allowing for the tailoring of starches to fulfill industrial needs. In addition, the merging of biotechnology and materials science presents significant possibilities for creating starch-based nanomaterials, leading to innovative opportunities in fields like medicine, electronics, and more.

Natural sources like rice, wheat, tapioca, and corn are utilized as raw materials in the production of modified starch and its derivatives. These raw materials are commonly employed in the manufacturing of modified starch utilized in bio-ethanol products. The growing use of modified starch in areas like food and beverages, animal feed, pharmaceuticals, cosmetics, and paper drive up the demand for this starch, which ultimately causes an increase in raw material prices. The elevated expense of raw materials primarily results from the significant transport costs associated with moving raw materials to various industrial sites across the globe that collectively hampers the industrial starch market growth.

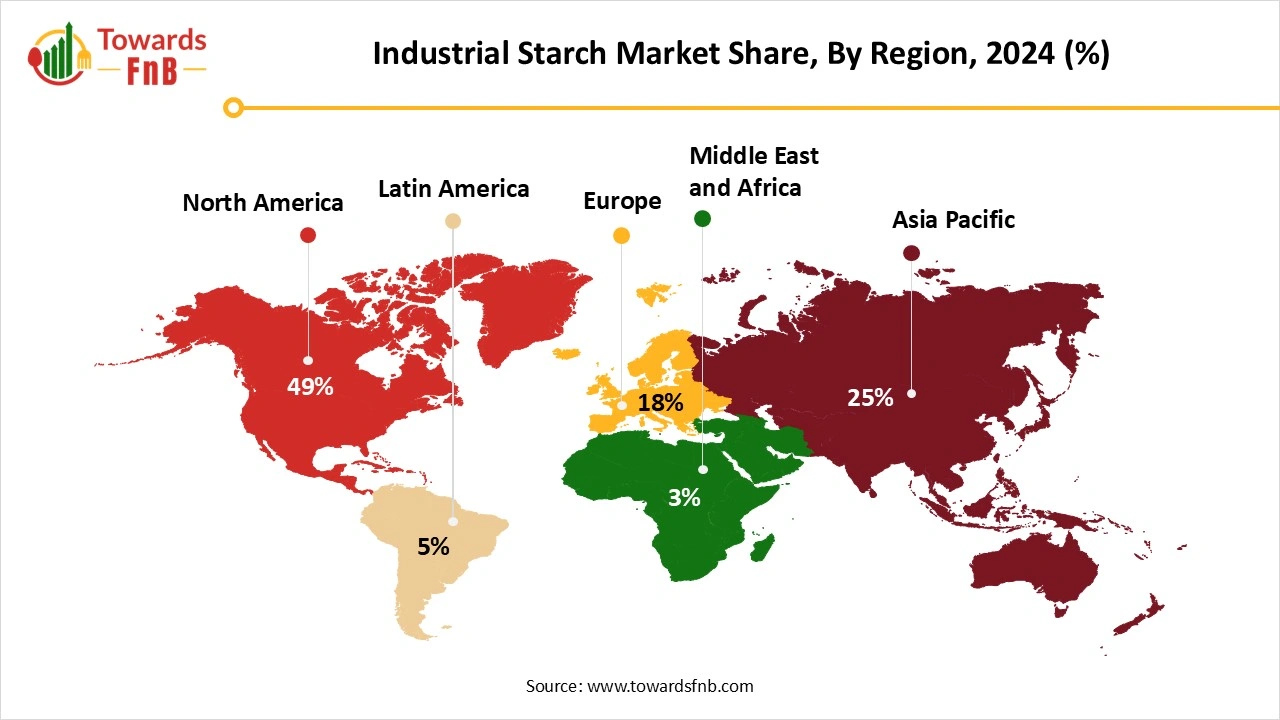

North America Held the Dominating Share of the Industrial Starch Market in 2024.

The growth of the market is increased by the purchase of processed meals. For improving the texture, moisture management, and as stabilizer for various products, such as yoghurt, bakery products, and convenient foods industrial starch is critical factor. Increased demand for clean label products consumers is opting for organic and sustainable products rising the demand for the organic industrial starch, benefiting the market.

The United States industrial starch market is mainly propelled by the transformative digital platforms within the food and beverages company, development of e-commerce, and food traceability by blockchain. Furthermore, the robust agricultural infrastructure and government initiatives for organic agricultural practices, innovative product development by leading companies expanding the market of United States.

Asia Pacific Observed to Grow at the Fastest Rate in the Industrial Starch Market During the Forecast Period.

With the growing need for food and industrial goods, the demand for starch has risen, as it is an essential component in numerous food products and industrial uses. In numerous Asia Pacific nations, urbanization has resulted in alterations to dietary habits and ways of life. City dwellers frequently favor convenience and processed foods with starch-based components, increasing demand. Starches obtained from gluten-free origins like corn, tapioca, and rice were highly sought after for formulating gluten-free products. Health-aware consumers sought starches with particular nutritional qualities. This resulted in heightened interest in resistant starches, which may offer health advantages like better digestion and blood sugar control.

Emerging Industrial Starch Market of India

The continuous industrialization and modernization are expected to drive the need for industrial starch market of India. The food and beverage sector continues to be the biggest user of industrial starch in India. Investment prospects are increasing in the creation of starch-derived adhesives and bioplastics, addressing the need for environmentally friendly options in multiple sectors. India's solid agricultural base allows the nation to generate top-quality raw materials such as corn, wheat, and tapioca. Improvements in farming techniques, enhanced crop outputs, and supportive government measures for farmers are anticipated to continue guaranteeing a consistent supply of starch-producing crops.

The Food and Beverage Segment Led the Industrial Starch Market in 2024.

Starch is used in a different type of foods and purposes such as adding stability, thickening, and replacing costly ingredients. Starches gaining popularity due to their comparatively low cost, availability, and specialized properties.

The pharmaceuticals segment is seen to grow at a notable rate during the predicted timeframe. Starch is nontoxic, biocompatible and affordable because of these properties are starch is significantly used by pharmaceutical companies as the excipients for the formulation of tablets, capsules and syrups. It is also used as drug carrier in pharmaceuticals. The escalating pharmaceutical industry and investment in the research and development fostering the market of industrial starch. As per the survey conducted by the Indian Economy in 2021, the domestic market is projected to expand 3x in the further ten years. Domestic pharmaceutical market of India held at US$ 42 billion in 2021 and is expected to hit US$ 65 billion by 2024 and increase to attain US$ 120-130 billion by 2030, thus increasing the industrial starch market.

The Corn Segment held the Dominating Share of the Industrial Starch Market in 2024.

Corns are profusely available because of increased crop yield and increasing international trade globally. Availability of the corn and its products in the market at the cheaper rates propelling the demand for corn starch. Rising industrialization in food and beverages, pharmaceuticals, biofuel, cosmetics and increasing demand for the plant based natural product propelling the market’s growth. Corn starch is vital component in Mexico for paper and brewing industries and the rising investments on the brewing industries further expanding the market.

The Wheat Segment is Expected to Grow at the Fastest Rate in the Industrial Starch Market During the Forecast Period.

The increasing awareness of the health related with gluten-free products has risen the demand for the wheat starch as the gluten free alternative. Naturally gluten-free wheat starch provides similar functional aspects to wheat flour, prioritizing it as and best option for consumers with celiac disease or gluten intolerance. Increasing food and beverage, pharmaceuticals, paper and textiles industries, technological development and innovations boosting the market.

The Native Starch and Starch Derivatives & Sweeteners Segment Held the Largest Share of the Industrial Starch Market in 2024.

In retort to growing demand, food manufacturers are utilizing natural starch sources like cassava, rice, corn, potatoes, wheat and tapioca, referred to as native starches. Natural starches improve the texture, volume, and overall quality of baked goods like breads, cakes, and pastries. Carbohydrate includes more than just starch. They may have various characteristics and distinct properties. Food and drinks require either carbohydrate types or sweetener types. The alternative sweetener derived from starch offers a variety of products. The various types of products demonstrate the broader market segments they can target and expand the market.

The Cationic Starch Segment is Observed to Grow at the Fastest Rate During the Forecast Period.

Cationic starch helps to improve tear strength, binding and holding capacity along with increasing filler and fiber retentions. As the demand for paper products with high quality rises and companies promote towards revolutionary manufacturing technologies, the demand for structured service-driven products like cationic starch will expand consistently. Technological advancements emerge as a significant trend in the cationic starch market. Businesses are concentrating on delivering innovative solutions to satisfy end-user needs and improve their competitive standings. Innovations encompass cross-linked starch products, high-charge cationic starches, among others.

CSIR-Indian Institute of Chemical Technology

Roquette

Agrana Stärke and Ingredion

By Application

By Source

By Product

By Region

April 2025

April 2025

April 2025

April 2025