April 2025

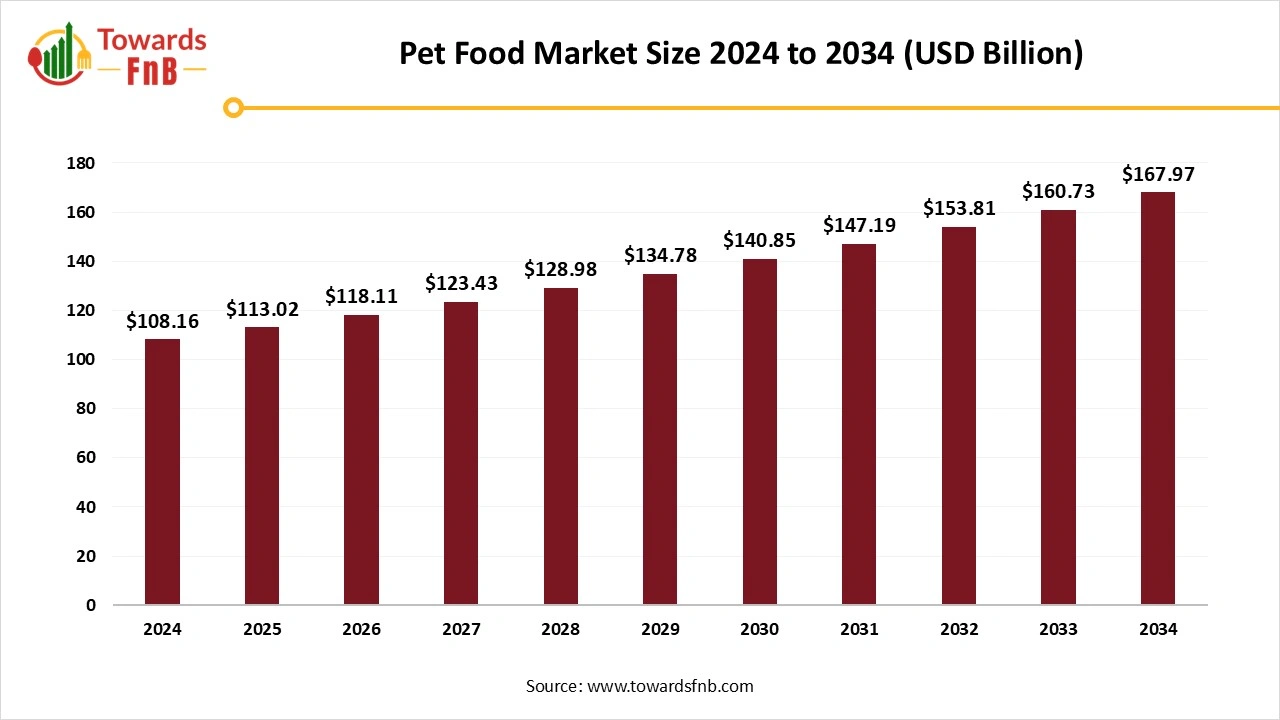

The pet food market size valued at USD 108.16 billion in 2024, is forecast to grow from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, with a CAGR of 4.50% during the period from 2025 to 2034. Factors like increasing pet ownership, the inclination to treat pets like humans, an emphasis on pet health, and the expanding pet food industry are the concepts that propel the pet food market.

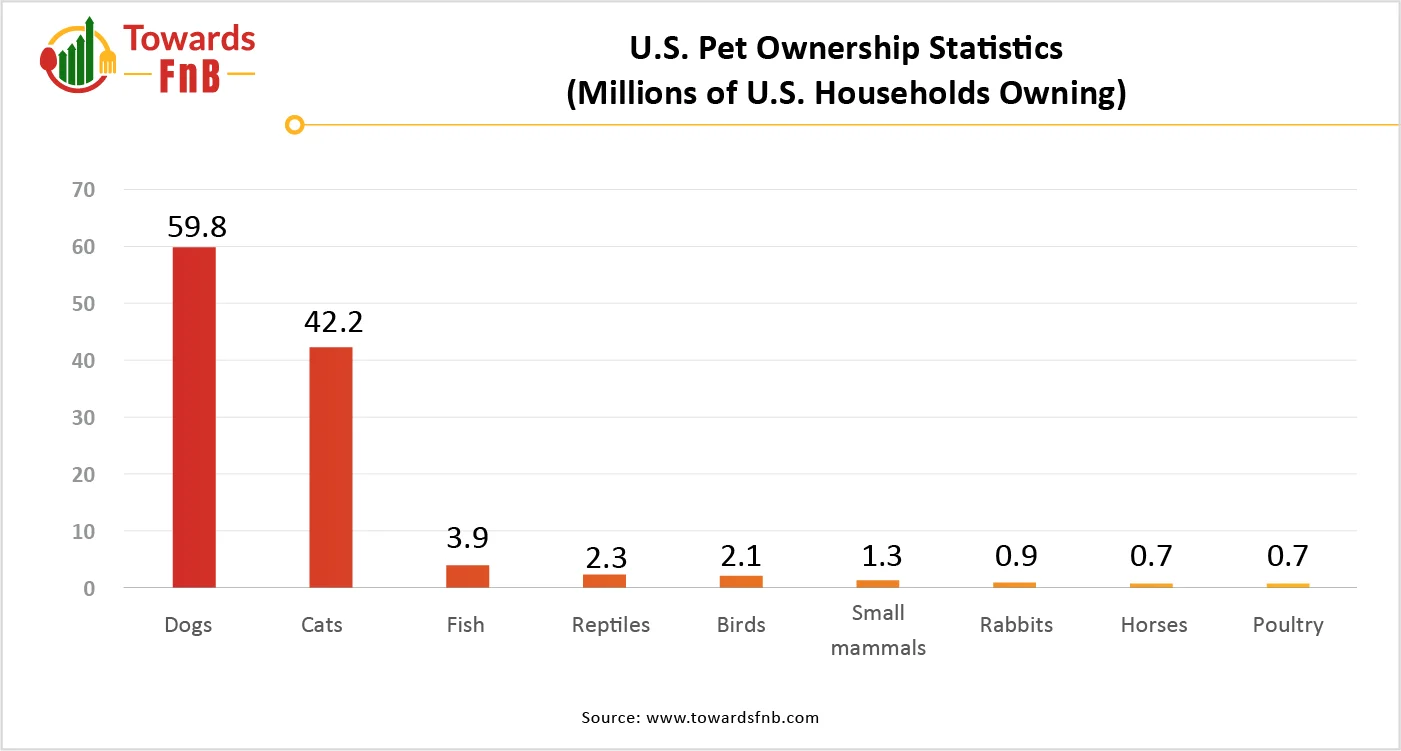

The pet industry is thriving as an increasing number of families recognize the companionship and emotional rewards that pets offer. As per a 2023 report by the American Pet Products Association, around 70% of households in the U.S, which equates to about 90.5 million families, currently have a pet, up from 67% in 2019. This change emphasizes an increasing trend in which pets are regarded not merely as animals but as cherished family members. Consequently, expenditures on pet care items and services have surged. Families are focusing on the health of pets, spending on high-quality food, excellent healthcare, and even pet-friendly trips and experiences. The strengthening connection between pets and their owners is fueling considerable expansion in the pet food market.

Animals can also experience high blood pressure and diabetes. Pet owners are now progressively moving towards selecting healthy foods produced by different companies due to growing awareness about maintaining their pets' health. As obesity among pets becomes more common, weight management has emerged as a major issue for pet owners. Pet food producers are creating tailored recipes that assist pets in managing a healthy weight or aiding in weight reduction.

This change in consumer preferences is anticipated to positively affect the pet food sector throughout the forecast period. The USDA has indicated a notable increase in the premium pet food segment and therefore, numerous consumers have adopted and financed it. Additionally, the role of FDA in overseeing food safety and quality standards has fostered consumer trust and spending. The swift expansion of E-commerce has greatly boosted the growth of the pet food market.

The pet food market has seen considerable expansion and innovation in recent years, propelled by evolving consumer tastes and technological advancements. Alongside sourcing sustainable ingredients, pet food producers are prioritizing eco-friendly packaging options. This involves the use of recyclable or compostable materials for packaging. A major use of AI in pet nutrition is developing customized dietary plans. Further the research and development on the constant enhancement in recipes and methods to improve the science and effectiveness of dog and cat food items accelerate the market expansion.

Pet food items are strictly regulated feed products, particularly in developed nations like the U.S. and various European countries. In these advanced markets, the tests performed on animal feeds are extremely rigorous across the supply chains, beginning with the components used in manufacturing through to their promotion and sales. Consequently, the stringent regulations linked to commercialization can serve as a considerable limiting factor in the pet food market expansion.

North America dominated the pet food market in 2024.

Pet cat adoption is rising in North America due to a strong demand for companionship and lower costs for cat food compared to dog food. The sector has experienced significant product innovation and premium offerings, highlighting changing consumer preferences and a greater emphasis on pet health and well-being.

In the United States, the pet food market is vibrant, driven by an increasing number of households with pets. Pet owners are now investing more in high-quality, specialized pet food that caters to their pet's specific health requirements, including weight control, allergies, or age-related needs. The trend of pet humanization, where pet owners treat their pets like family, has also fueled the demand for premium, gourmet, and specialty pet food items, leading to overall market expansion. The swift expansion of e-commerce has changed the pet food industry in the U.S. Digital platforms provide convenience, subscription options, and a variety of products. A lot of pet owners today choose online shopping due to its convenience, home delivery, and savings.

Europe expects a significant growth in the pet food market during the forecast period. In Europe, 150 pet food companies were founded, providing jobs for around 118,000 individuals in 2022, resulting in fierce competition to nourish the estimated 340 million pets across the continent. Cats and dogs are popular pets, with populations of 127 and 104 million, respectively, in Europe for the year 2022.

The UK pet food industry has observed several significant trends lately, indicating shifts in consumer tastes and lifestyle choices. A significant market factor has been the growing humanization of pets, as owners look for high-quality and nutritious food that aligns with the health standards, they have for themselves. This trend has increased the demand for natural and organic components in pet food as customers emphasize transparency and sustainability.

Dog pet segment held the largest share of the pet food market in 2024.

Demand for the dog food product is expected to increase as the trend of bringing dogs into homes as pets becomes more common. The concept of humanizing pets is becoming increasingly popular, especially among dogs. As a result, there has been a rise in dog ownership, and more people are providing their pets with nutritious food. The most favoured type of dog food is dry, representing around 30% of total dog food consumption, exceeding wet dog food, which held a 20% share.

Wet Pet food made from animals had greater environmental effects than dry dog food, primarily because of greater packaging demands and heavier transportation needs ascribed to its elevated water content. The maintenance and enhancement of dog weight have garnered more focus due to heightened consumer awareness regarding pet health. Shoppers choose from a variety of foods and prioritize product brands highly. Producers aim to enter the market for premium dog food and increase their overall profit margin.

Cat segment is expected to grow at the fastest rate in the pet food market during the forecast period. The worldwide cat food industry is significantly shaped by the trend of cat humanization, where felines are regarded as part of the family. A recent Cargill survey revealed that 59% of pet owners currently have a cat, with over one-third having multiple cats, a rise attributed to cats' compatibility with contemporary, hectic urban living.

Even with the increase in cat ownership, survey findings indicate that numerous cat owners are unhappy with the available choices for fresh cat food. A recent survey by Cargill revealed that although 90% of cat owners buy dry food, two-thirds also buy canned food while half purchase wet food in pouches. Cat owners are progressively looking for functional foods that offer vital nutrients and cater to health requirements, which is contributing to a rising trend.

By Pet Type

By Region

April 2025

April 2025

April 2025

April 2025