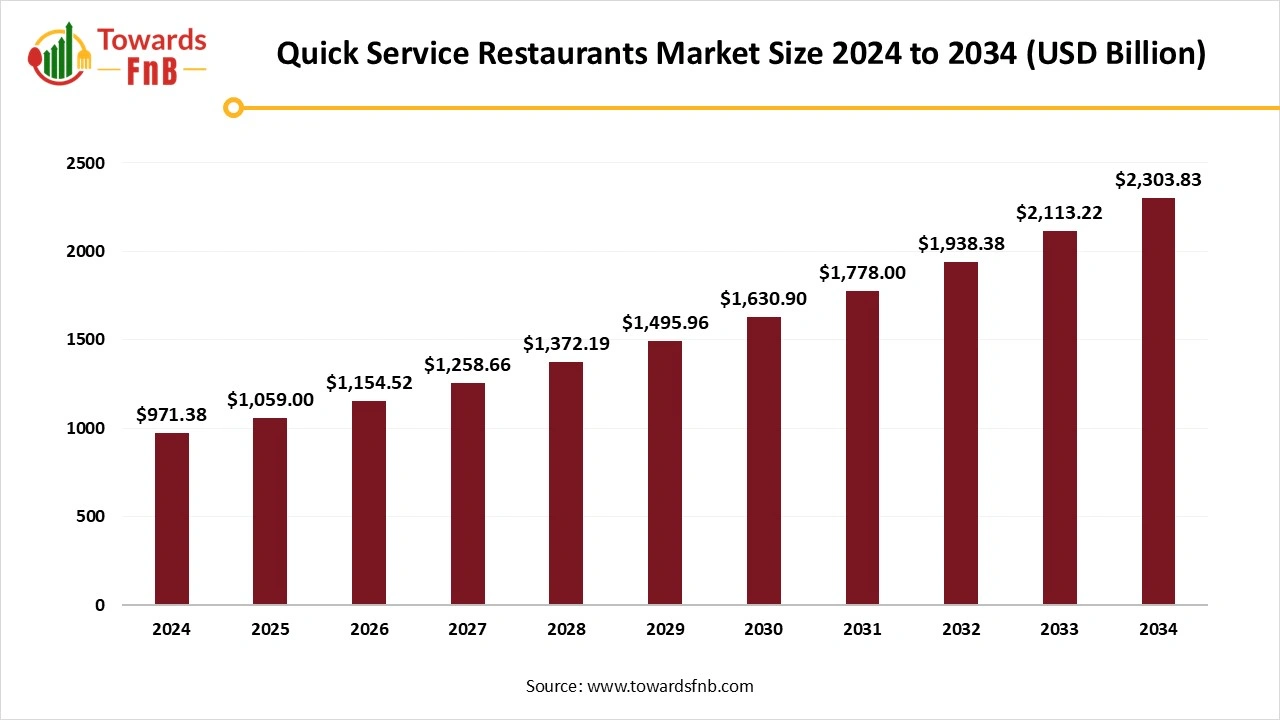

The global quick service restaurants market size stood at USD 971.38 billion in 2024, with projections indicating a rise from USD 1,059.00 billion in 2025 to approximately USD 2,303.83 billion by 2034, expanding at a CAGR of 9.02% throughout the forecast period from 205 to 2034. Changing consumer’s preferences in foods and food choices of gen Z and millennials significantly driving the market.

Changing consumer’s shift towards easy and convenient food, increased popularity of fast-food among young people expanding the quick service restaurants market. Rapid urbanization, adoption to western style foods, rising disposable income further boosting the market. Because of hectic life schedules consumers are constantly looking for the easy and convenient meals, this rapidly growing modern lifestyle consistently changing and boosting the market. With growing hospitality industries, consumers are constantly opting for the dine-in options thus, benefiting the quick service restaurants. Enhanced investments in the infrastructure of including airport, railway stations etc. for the advantage of customers have developed newer opportunities of quick-service restaurants to set up new outlet. Many quick-service restaurants have begun providing home delivery services because of customer’s increasing tendency to buy meals online, which has fostered the expansion of market.

With the onset of the 4th industrial revolution, emerging technologies have infiltrated the fast-food sector regarding operations management and customer engagement. Product innovation, which develops unique and original products, boosts brand efficiency, and may result in a lasting competitive edge. Moreover, product innovation is essential for building brand loyalty, as it indicates quality and dedication of the organization. This highlights the strategic significance of valuing product innovation more than process innovation for businesses aiming to improve performance and competitive stance. KFC has a substantial global footprint, featuring over 24,000 locations in more than 145 nations. Significant advancements involve the launch of the Double Down sandwich and the creation of healthier menu choices.

Quick service restaurants services are saturated with various brands and competition among these brands to sustain in the market is the major challenge. Opening of new outlets and restaurants, consumer’s shift towards natural products further create challenge for the companies to cope up with the market. Further, increased consumption of fast food and beverages loaded with sugar, high calories, fat and sodium, rising the diseases like diabetes and obesity among consumers. Thus, various countries mandated only healthy drinks for kids to prevent such conditions. Consumers health awareness and demand for healthy food further impeding the quick service restaurants market growth.

North America Held the Dominating Share of the Quick Service Restaurants Market in 2024.

The quick service restaurants market is advancing in North America because of individuals' busy lifestyles and preference for convenient meal choices. The Burger and Sandwiches market is notable due to its diverse consumer preferences and capability to offer satisfying, customizable meals for people on the move.

Upsurging Quick Service Restaurants Market of United States

The United States held the prominent position in the market. A key factor contributing to the growth of quick-service restaurants in urban areas is the rise of the fast-casual restaurant, a segment of quick-service dining that maintains the usual counter service and pricing but is seen as offering superior quality in menu items and ingredients, along with an atmosphere similar to casual full-service eateries. Consumers are progressively looking for healthier and more sustainable food options, prompting quick service restaurants to include additional plant-based and nutritious items in their menus. Quick service restaurants are utilizing technology to provide personalized experiences and address the unique preferences of each consumer. Increasing development in the food service sector in United States is fostering the quick service restaurants market.

Asia Pacific is Observed to Grow at the Fastest Rate in the Quick Service Restaurants Market During the Forecast Period.

Because of rising younger population, swift urbanization and increased net income consumers are inclining towards dining out options and fast food. Nowadays people are traveling more and trying various cuisine, propelling the market. The Asia-Pacific region has become a favored choice for travel, as locations like Hong Kong and Singapore have targeted this market for the past several years and also nations such as Japan, Korea, Taiwan, and Australia. Various marketing strategies and digital platform development enhancing the market. A strategy employed by restaurants in Macau to preserve their businesses has been to collaborate with online to offline (O2O) service giants like Aomi and mood.

O2O has emerged as a novel e-commerce model that links offline services and products with online sales, promotion, and assessment. To navigate the adverse effects of the pandemic on their operations, restaurants must integrate the O2O business model into their long-term plans. This platform provides several actionable recommendations for restaurants looking to enhance their customers' dining experience via O2O platforms.

Propelling Quick Service Restaurants Market in India

The food service sector plays a crucial role in India, fueling the q market. A household allocates around 38% of its dining expenses outside the home to quick service restaurants. The significant proportion of quick service restaurants in overall expenditures is fueled by their accessibility, attractive pricing, combo offers, and promotions, which makes them particularly popular among the youth. Today, city dwellers don't require a particular reason to dine out. The internet-based food delivery service has greatly aided the growth of QSR in India. Zomato's gross order value rose from Rs 13 billion in FY18 to Rs263 billion in FY23. The adoption of the Internet has surged rapidly, as data costs in India have decreased. India has emerged as a key focus for international QSR brands. Worldwide, the takeout and delivery sectors are expanding more rapidly than dine-in. Domino’s now considers India its second biggest market after the United States.

The Dine-in Segment Dominated the Quick Service Restaurants Market with the Largest Share in 2024.

Today, consumers have an unprecedented variety of dining options available, spanning from fast food establishments to upscale dining venues. Consequently, customer expectations regarding restaurant offerings are continually rising, and they are now more selective in making better dining choices based on the benefits they expect from their decisions. The demand for dining out can stem from a variety of reasons, including the need for fast meals, celebrating significant events, entertaining business partners, and more. Restaurant owners frequently invest heavily in marketing efforts to draw in patrons by employing numerous marketing strategies, from menu design to promotional sales.

The Delivery Segment is Seen to Grow at a Notable Rate in the Quick Service Restaurants Market During the Predicted Timeframe.

Rising demand for food delivery, prompted by people's hectic schedules, is fueling market growth. Moreover, food delivery services are time-saving and beneficial for working people who lack time to cook, enhancing the expansion of the target market. The rise of attractive, easy-to-use applications and technology-driven driver networks, along with evolving consumer demands, has opened ready-to-eat food delivery as a significant segment. Early in the pandemic, lockdowns and physical-distancing measures significantly enhanced the category, with delivery serving as a crucial support for the struggling restaurant industry. Going ahead, it is set to become a lasting presence in the dining scene. The food delivery industry through on-demand services like DoorDash, Grubhub, and Uber Eats is expected to expand into a $60 billion market by 2025. The rise of intuitive applications and technology-driven driver networks has made ready-to-eat food ordering and delivery a significant industry in India over the past ten years.

The American Cuisine Type Segment Held the Largest Share of the Quick Service Restaurants Market in 2024.

American food features milkshakes, barbecue, and a variety of fried dishes. Numerous classic American dishes offer unique interpretations of food that originated from various culinary traditions, such as pizza, hot dogs, and Tex-Mex. With a growing number of consumers pursuing unique experiences, foodservice providers need to consistently update their menu offerings, delivering exceptional flavor and quality alongside a wide variety of options.

The Italian Cuisine Type Segment Expected to Grow at the Fastest Rate in the Quick Service Restaurants Market During the Forecast Period.

The growth potential in this industry is appealing. Businesses offering premium Italian ingredients can leverage the global passion for Italian cuisine, highlighting authenticity and the ties between products and their origins. This growth indicates a rising trend in the desire for high-quality ingredients and traditional Italian products.

The Independent Restaurant Segment Led the Quick Service Restaurants Market in 2024.

In a self-sufficient or independent restaurant, owner have the freedom to do it all. Operators are expanding their income through catering, takeout, virtual brands, and even branded products like hot sauce or clothing. As reported by FSR Magazine, numerous independent businesses are introducing subscription meal kits such as Brooklyn’s Olmsted offering weekly chef boxes or operating ghost kitchens from their current facilities. Retail products, like Momofuku’s chili crunch, are also gaining popularity.

The Chained Restaurant Segment is Observed to Grow at the Fastest Rate During the Forecast Period.

The chain restaurant sector typically consists of expansive enterprises featuring thousands of locations, occasionally extending across multiple nations or even continents. Expanding a restaurant chain allows you to ensure uniform products and services for customers who rely on your brand. Having several locations allows for the standardization of food and recipes, ensuring a consistent menu.

McDonald’s France

Rebel Foods

By Service Type

By Cuisine Type

By Restaurant Type

By Region