April 2025

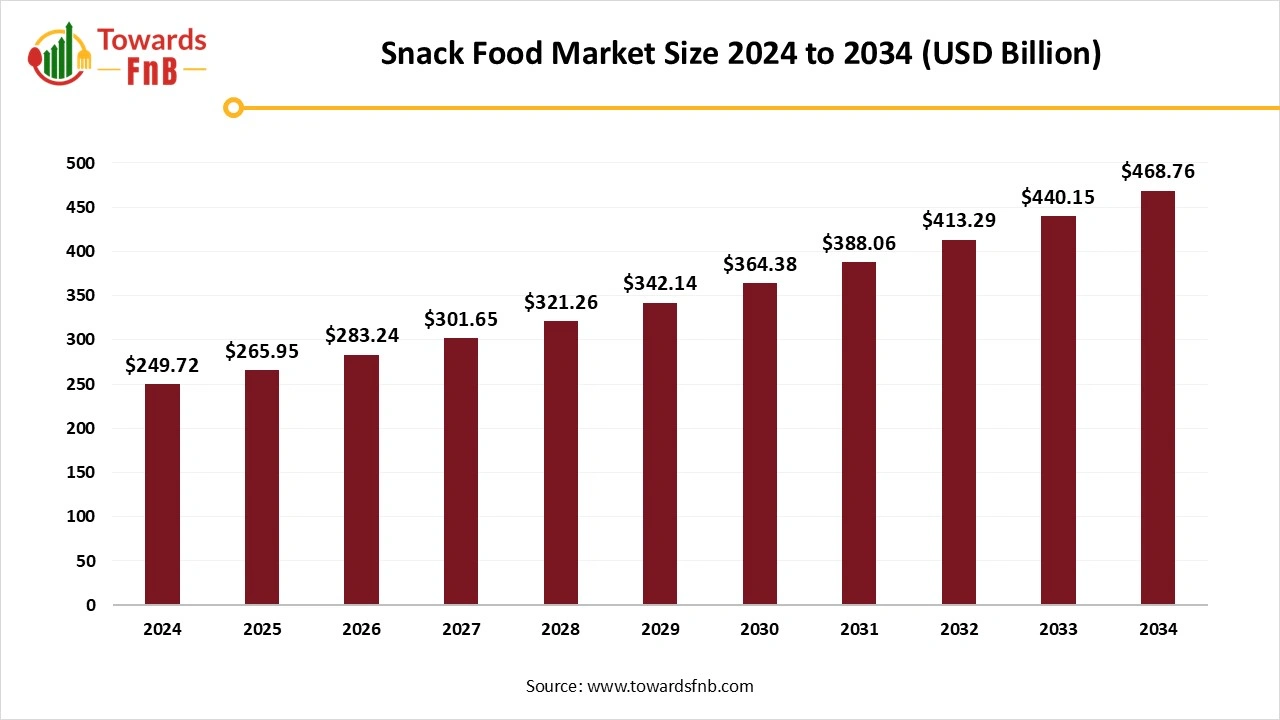

The global snack food market size was valued at USD 249.72 billion in 2024 and is expected to surpass USD 468.76 billion by 2034, growing at a CAGR of 6.50% from 2025 to 2034. The market share of snack food items is escalating as consumers seek luxurious treats and leading companies are promoting new product innovation.

Snack foods provide an easy and convenient option for eating while busy, catering to the demands of individuals with limited time seeking portable and practical food choices. Moreover, snacking is increasingly becoming a usual habit in relation to eating. Nowadays, consumers incorporate snacks into their daily habits not merely as a bridge between meals but also as an alternative meal or a way to satisfy cravings. The demand for various snack food items is driven by the rise in snacking occasions. According to Mondelez international report, 91% of worldwide consumers eat at least one snack throughout a day, 71% believe that sharing snacks is love language and 73% consumers can’t imagine their world without chocolate.

Moreover, the rising popularity of snacks among millennials and the growth of convenience stores are anticipated to enhance demand. Consequently, producers are introducing innovative and distinct flavors to their range of snack products. A key factor affecting the sector is the demand for diversity. As health issues like obesity, hypertension, and diabetes rise among consumers, the global trend toward healthy eating has significantly increased in the past few years. As a result, there is an increase in the desire for low-fat, low-calorie, and sugar-free snack options.

The growing flexible demographic and the rising popularity of plant-based diets are generating opportunities for plant-based snack products. Companies can produce snacks from ingredients such as legumes, fruits, vegetables, and other protein alternatives. Vegans, vegetarians and environmentally conscious individuals can all savory snacks made from plants. In March 2025, Schouten Europe launched two plant- based snacks named as Power Bites and Sea Bites.

The growing health concern in the population for excessive consumption of snack foods due to the availability of high sugar, oil, and additional preservative content which may hamper the consumer health that results into the severe health effects which limits the consumption of snacks and restricts the growth of the snack food market.

Europe dominated the snack food market in 2024.

A crucial element propelling the regional market expansion is the ongoing innovation and creation of new products by leading companies to address the evolving needs of consumers. This involves the incorporation of better ingredients, creative flavors and easy-to-use packaging choices that attract a diverse array of consumers.

Asia pacific is expects a significant growth in the snack food market during the forecast period. Consumer preferences significantly influence the growth of the regional market. There has been a significant rise in the demand for savory snacks, with potato-based snacks, nuts, seeds, and popcorn being some of the most favoured subcategories. Consumers are progressively looking for bold flavors and single-flavor options, reflecting a desire for diversity and flavor innovation.

India is expected to grow in the Asia pacific region. Rise in the retail stores, supermarkets and hypermarkets and easy availability rising the demand. Partnerships and collaboration within various brand increasing the sales of snacks.

The savory snacks segment led the snack food market in 2024.

Shoppers are increasingly exploring diverse snacking options, resulting in a desire for savory treats featuring bold and exotic tastes influenced by global cuisines. Producers are offering a range of ethnic tastes and components to meet this demand. Whereas frozen & refrigerated snacks segment is expecting a significant growth in the market during the forecast period. Manufacturers of frozen and refrigerated snacks are continually innovating to satisfy consumer preferences for novel flavors, constituents and formats contributing the market growth.

The bags and pouches segment dominated the snack food market in 2024.

Consumers appreciate snack bags and pouches that accommodate numerous servings and feature resealable technology, as they maintain freshness and are suitable for different events. Key elements in this category consist of zippers, hook-and-loop closures, and resealable labels. Whereas cans segment is expected a substantial growth in the market during the forecast period. The strength and safeguard provided by cans also reduce spoilage and harm while being transported, maintaining the product's quality when it arrives to consumers. Attractive presentations and aesthetics of cans further driving the segment.

The supermarkets and hypermarkets segment led the snack food market in 2024.

Customers show a tendency to choose supermarkets and hypermarkets for snack purchases, and this preference is linked to various reasons. Further, online segment expects a significant growth in the market during the forecast period. The growth is attributed to the factors like easy convenience and accessibility of snacks without visiting the stores.

By Product

By Packaging

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025