April 2025

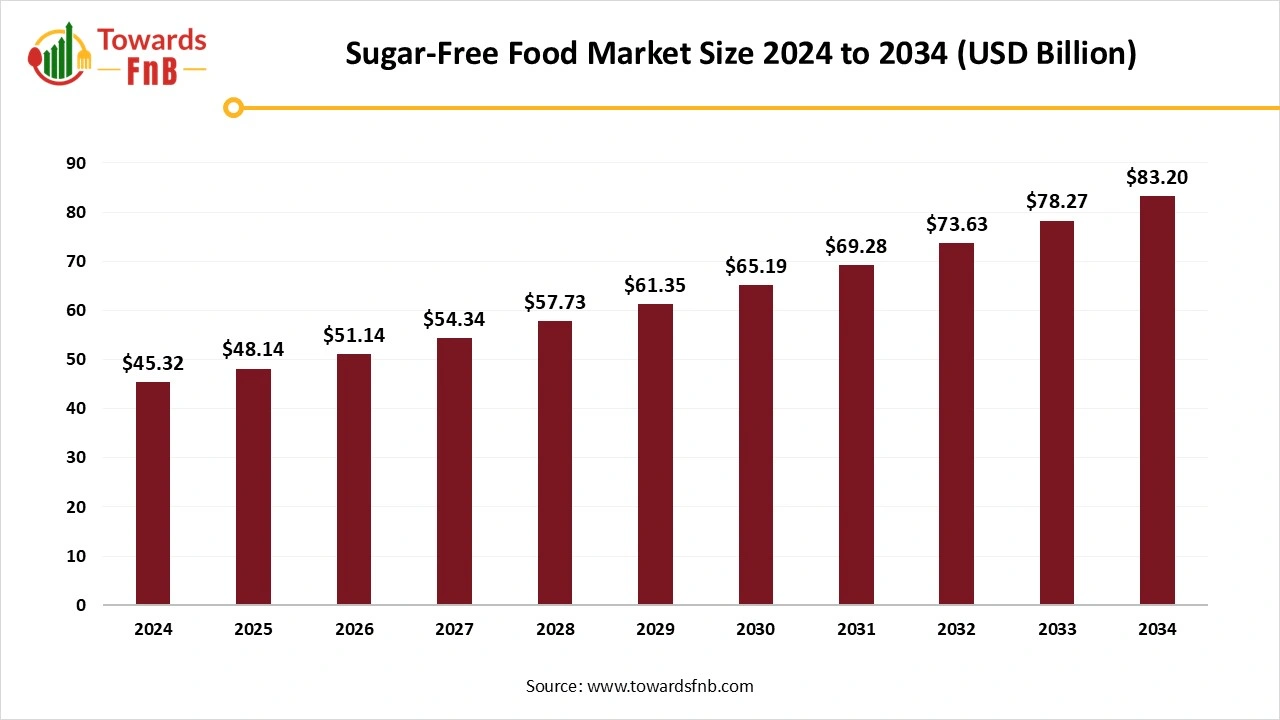

The global sugar-free food market size was valued at USD 45.32 billion in 2024 and is anticipated to reach USD 83.2 billion by 2034, growing at a CAGR of 6.27% from 2025 to 2034. The growing health awareness due to the increasing prevalence of the chronic illness such as diabetes is driving the growth of the market.

The sugar-free food business has grown significantly as a result of rising health concerns, increased prevalence of diabetes, and shifting customer preferences for healthier choices. These products include sugar-free snacks, beverages, bakery items, chocolates, dairy substitutes, and confectionary manufactured with natural or artificial sweeteners such as stevia, monk fruit, erythritol, and allulose.

They are popular among diabetics, weight-conscious people, and those following low-carb or ketogenic diets. Sugar-free foods can help with blood sugar management, reduce the risk of obesity and heart disease, and enhance oral health. With increasing government controls on sugar intake and rising demand for functional meals, the sugar-free food market is likely to develop even more, fueled by product innovation, increased availability, and enhanced flavor profiles.

One of the main drivers for the growth of the sugar-free food and beverage market is the growing consumption of health risks, which are linked with sugar consumption. The growing commonness of chronic diseases such as diabetes, obesity, and heart disease has led consumers to shift towards healthier and sugar-free alternatives. Apart from this, developed efforts and the expansion of low-calorie and sugar-free product lines too.

One of the major growth factors for the sugar-free food market is that consumers are choosing products that are free from artificial ingredients and excessive amounts of sugar too. They are also becoming more conscious about the environmental impact of different food choices, which leads them to find out more about organic products and sustainably sourced products. As the awareness of sugar-free products negative health impact, which are actively looking for sugar-free or low-sugar products, is expanding the market.

The sugar-free food market is expanding rapidly due to increasing health awareness, rising diabetes cases, and stricter regulations on sugar consumption.Key opportunities include catering to diabetics, health-conscious consumers, and followers of low-carb diets by offering innovative products such as natural sweetener-based snacks, beverages, bakery items, and dairy alternatives.

The growth of e-commerce, emerging markets, and food service adoption further drive demand, while regulatory pressures like sugar taxes encourage reformulation. Advances in sweetener technology and AI-driven personalization also create room for innovation, making the market highly lucrative for brands focusing on healthier alternatives.

There are many challenges and limitations in Sugar free food market i.e. Aspartame which consists of two amino acids like phenylalanine and aspartic acid which form a dipeptide, and it is chemically synthesized by around 200 times sweeter than sucrose. Second is saccharin which is previously used in tabletop sweeteners, soft drinks, canned fruits and numerous pharmaceutical products and side effect of saccharin is that it can make bladder cancer. Also, from the stevia rebaudina stevia plant, the sweetness is obtained which is a natural sweetener used in yogurt and drinks, baked goods or tabletop sweeteners too. The other side effects are increased appetite and weight gain too.

North America Dominated the Sugar-Free Food Market in 2024.

The growth of the market is attributed due increasing inclination towards a reduction in sugar consumption as they are heavily prioritizing health and wellness with a concentrated focus on sugar intake, which automatically deliberates in their decision-making skills. With respect to this, out of 100, nearly 46% of consumers are aware of sugar reduction in the US, whereas in Canada, 55% are conscious of the same, which is specifically due to older generations due to a lot of health issues and concerns.

The sugar-reduction trend is due to sugar-related claims, which are particularly due to rising pairs with energy, vegan, and plant-based claims, as global top companies are launching sugar-claim products such as Coca-Cola and PepsiCo, companies that are constantly launching the products that are sugar-claim ones. With respect to this,

Regulations Amending the Food and Drug Regulations (Canada):It will come into force on 1 January 2026, which will require food manufacturers and sugar producers in Canada to adjust product formulation and labelling too to meet the required amount of sugar in packaged food products. Compliance will lead to reformulation, especially in high-sugar category food to match with new serving sizes and nutritional labelling standards too.

Asia Pacific Expects the Fastest Growth in the Sugar-Free Food Market During the Forecast Period.

The growing awareness regarding the health and people focusing in the healthy diet boosts the demand for the sugar free food. As health awareness is growing, Asian consumers are seeking these foods while exploring new products that match nutrition and sustainability. According to this, 33% of parents in the Asian countries are planning each meal well in advance for their children, which shows how Asian consumers are aware of health consciousness and its trends. With respect to this,

The Sugar-Free Beverage Segment Dominated the Sugar-Free Food Market in 2024.

It is due to rising consumer awareness of health and fitness trends and growing demand for low-calorie and sugar-free beverages too. Another reason is functional beverage consumption, improved production techniques, growing research and development techniques, and lastly, the expansion of low-calorie and sugar-free product lines.

The sugar-free food products segment expects a significant growth in the market during the forecast period. This growth is due to the growing influence of beverages for the sugar-free food and beverages, and this segment is fundamentally driven by less sweetener-based carbonated drinks and energy drinks among the Gen Z and millennial population for their busy lifestyle demand.

The Substitute-Sweetened Sugar-Free Products Segment Dominated the Sugar-Free Food Market in 2024.

This segment is divided into three types: artificial sweeteners, natural sweeteners, and sugar alcohols too. Artificial sweeteners include aspartame, sucralose, and acesulfame potassium, which are prevalently used due to high sweetness intensity and stability in baking, among which polyols are alcohol sugars that are classified as a group of carbohydrates that have a sweet taste but are not counted under the sweet category.

Naturally sweetened sugar-free products segment expects a significant growth in the market during the forecast period. The natural sweetened sugar are agave nectar, cane sugar, coconut sugar and corn syrup which is linked with high fructose corn syrup content. Sweeteners like fruit juice, honey, molasses and maple syrup contains natural sugar and also contain natural ingredients too.

The Supermarkets/Hypermarkets Segment Dominated the Sugar-Free Food Market in 2024.

This surge is due to factors like the rising prevalence of lifestyle-related diseases like diabetes, which is a significant driver for the sugar-free candy market. Another reason is the rising consumer preference for healthy and low-calorie options, and lastly, technological advancements in sweeteners are making sugar-free options.

The online retail segment expects a significant growth in the market during the forecast period. The demand for online retail platforms is because of the availability of different e-commerce platforms such as Amazon, Flipkart, Big Basket, and so on, through which consumers can conveniently order sugar-free food and beverages at the comfort of their home system and make its payment too.

By Type

By Sweetening Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025