April 2025

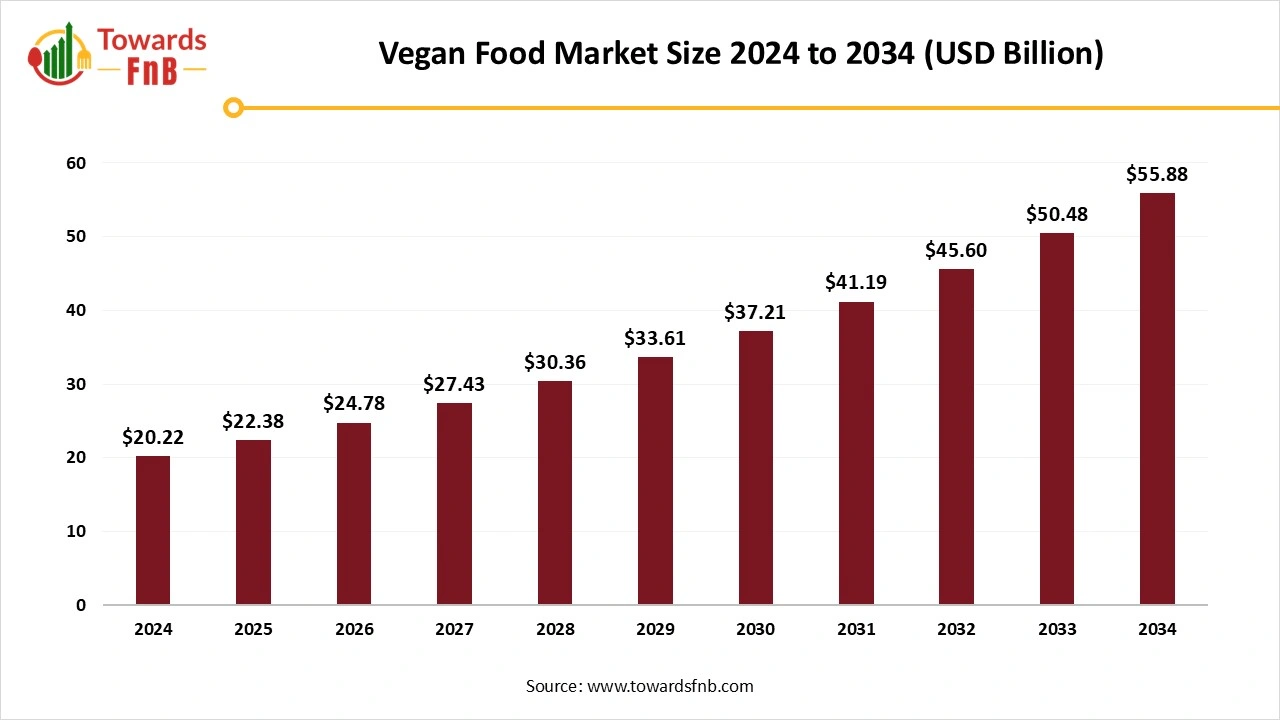

The global vegan food market size was accounted for USD 20.22 billion in 2024 and is projected to be worth USD 55.88 billion by 2034, growing at a CAGR of 10.7% from 2024 to 2034. The growing health concern and awareness regarding the animal cruelty is driving the growth of the market.

Vegan food includes all plant- based food only like vegetables, legumes, fruits, grains. Major driving factor is increasing awareness about benefits of vegan food. The increasing consumer demand for meat alternatives and non-dairy products is anticipated to enhance the adoption of these items. A vegan diet requires removing animal products and embracing a plant-focused eating plan. These factors upsurging the market of vegan food. People are increasingly conscious of animal suffering. Choosing a vegan diet also aids in preventing the abuse of animals for producing food items.

The vegan diet is considered the most ethical option, owing to its advantages for animal welfare and its lower environmental impact. As a result, many consumers are gradually adopting a vegan diet. Registrations for the yearly international 'Veganuary' initiative, which promotes a temporary dietary change, rose from 3,300 in 2013 to more than 629,000 in 2022.

Restaurant chains, upscale dining establishments, and food producers are introducing new items and plant-based recipes, considering the increasing demand in the market. Vegan recipes featuring pumpkin, avocado, and various nutritious components are introduced in the market to draw health-focused consumers looking to try new flavourful and healthy dishes.

Enhanced taste, equal pricing, health benefits, and sustainability are crucial factors in boosting demand. Major factors contributing to growth comprise improved R&D capabilities, wider distribution channels, increased production capacity, and availability of raw materials. The need for eco-friendly food packaging materials for meatless products is growing swiftly.

Although vegan food products are healthy in nature, but there are some deficiencies of nutrients like the vitamin B12, vitamin D, zinc, iron, and iodine are absent in the vegan food which limits the adoption of the vegan food products that restraints the growth of the market.

North America dominated the vegan food market in 2024.

The understanding of the food sector and its effects on the environment is resulting in an expansion of this market. The rising awareness regarding the health benefits accelerates the growth of the market. The rising population of lactose intolerant individuals in the US is driving the demand for alternative dairy products in the country.

Asia pacific expects a significant growth in the vegan food market during the projection period.

Given that the younger generation in the Asia Pacific region is increasingly conscious of climate issues and their link to meat consumption, the demand for vegan products in this area will grow. The population of vegetarians in India is high, yet the uptake of a meat-free diet remains low in the nation. The existence of cruelty-free products and the knowledge surrounding them will significantly contribute to the expansion of the vegan market in this area.

By product, dairy alternatives dominated the vegan food market in 2024.

With an increasing number of people embracing vegan, lactose-free, or flexitarian diets, there is a notable movement towards plant-derived substitutes for conventional dairy items. This change is motivated by health issues like lactose intolerance and cholesterol control, along with environmental factors. Whereas meat substitute expects significant growth in the market during the forecast period. Growth of segment is attributed to increasing concerns among consumers regarding the spread of pandemic in meat production facilities and concern regarding animal’s cruelty.

The offline channels segment led the vegan food market in 2024.

This growth is due to easy availability of vegan food at supermarkets, hypermarkets and convenience stores. Communication among consumer and seller further rising attention towards newly launched vegan products. Furthermore, the online channels segment anticipates significant growth in the market during the forecast period. E-commerce platforms have likewise emerged as a significant avenue used by consumers to buy their goods. Since these portals allow the purchase of products from the home, the sales of food items via these channels are steadily rising.

By Product

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025