April 2025

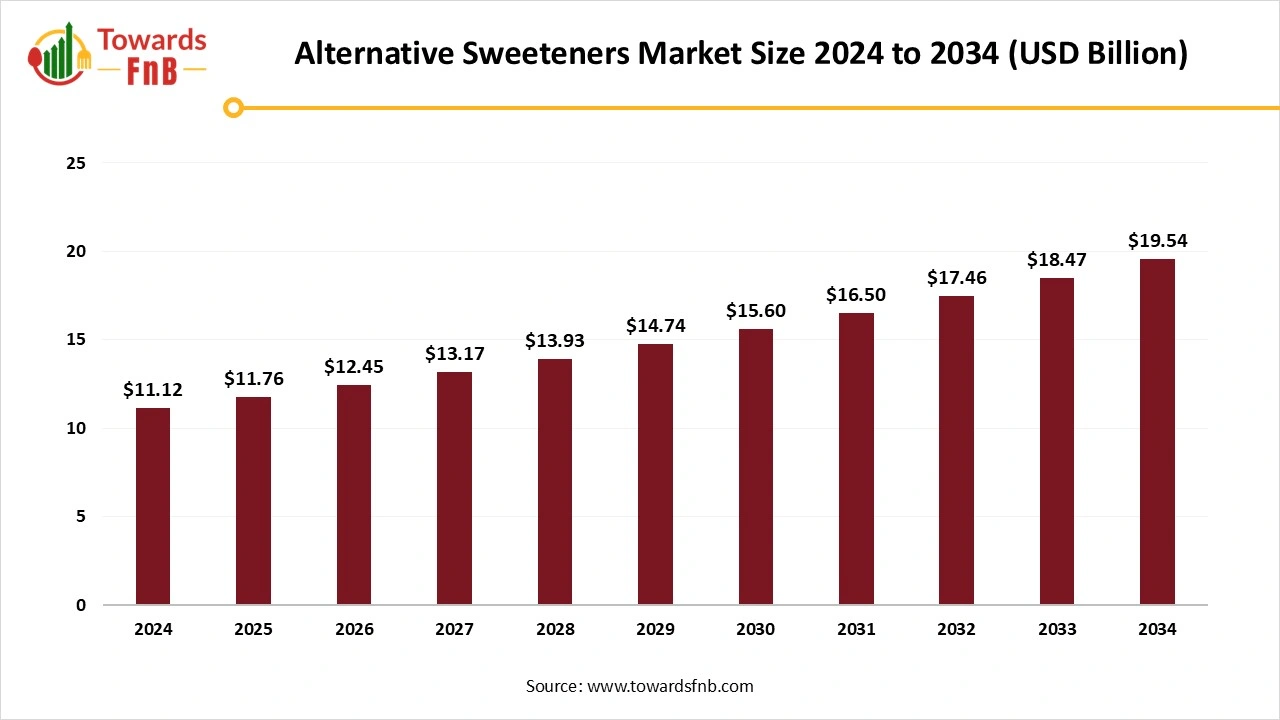

The global alternative sweeteners market size was valued at USD 11.12 billion in 2024 and is forecast to rise from USD 11.76 billion in 2025 to approximately USD 19.54 billion by 2034, with a CAGR of 5.8% from 2025 to 2034. The market growth is attributed to the increasing no-sugar carbonated juices or drinks.

The alternative sweeteners market deals with an alternative to sugar to sweeten and enhance several foods and beverages. As compared to regular sugar, alternative sweetener’s sweetness is very high and is used in reduced concentration. Due to the low-calorie and taste, alternative sweeteners are utilized as replacements for sugar. Alternative sweeteners do not add more calories to individuals' diets because they are the most widely used substitute for sucrose. This can be used directly in processed food such as soft drinks, jams, baked goods, candy, puddings, dairy products, and several other foods and beverages. In addition, the increasing prevalence of chronic diseases such as obesity and diabetes further enhance consumer dietary preferences, which is expected to drive the growth of the market during the forecast period.

One of the significant factors driving market growth is the growing availability of plant-based alternative sweeteners. These plant-based alternative sweeteners are supported by enhanced extraction methods and technological advancements, which further raise product innovation. These plant-based sweeteners have been grown for their medical uses and sweetness in various regions. These sweeteners may help reduce high blood pressure in people with hypertension and maintain healthy blood sugar levels. In addition, increased regulatory support for sugar reduction, coupled with rising implementation in nutraceuticals and functional foods, is further increasing the alternative sweeteners market. Various manufacturers are concentrating on increasing product portfolios, as customers prioritize natural ingredients and wellness, which further enhances market growth.

The rising technological advancements will continue to enhance alternative sugar-free innovations in the coming future. Researchers are seeking novel initiatives to enhance taste, consistency, and flavor, alternative sweeteners. Due to consumers shifting towards a healthy lifestyle with improved dental health and lower calorie consumption, the demand for alternative sweeteners is growing rapidly. By enabling traceability levels of alternative sweeteners in food, food companies can enhance consumer confidence. Companies are securing strategic patents and harnessing innovative sugar reduction technologies that are further revolutionizing the market. Addressing health problems such as metabolic diseases, diabetes, and obesity are connected to excessive sugar intake which needs innovative sugar reduction initiatives. By reducing the prevalence of these chronic diseases, strategies can help enhance public health outcomes, which are further expected to enhance the alternative sweeteners market in the coming years.

The increasing stringent approvals may create major challenges in the market. Before approving sweeteners for commercial use, regulatory bodies impose testing processes and stringent safety evaluations. To determine the impact on long-term safety, metabolic effects, and human health, each alternative sweetener must undergo extensive research, which may increase compliance costs and delay product launches. These strict processes may hinder formulation and innovation flexibility and reduce the number of sweeteners in the food and beverage market. These restraining factors are expected to hamper the alternative sweeteners market.

Asia Pacific dominated the alternative sweeteners market in 2024.

The market growth in the region is attributed to factors such as increasing purchasing power, high country growth rate, increasing presence of a wide range of manufacturers and suppliers, and rising development in new food habits, like consumption of low-calorie sodas and drinks. China, India, Japan, and South Korea are the dominating countries driving the market growth. India is the first leading country in the food and beverage industry. India’s rich culinary heritage offers natural alternatives to sugar that bring health benefits and taste. There are various Indian alternative sweeteners such as Jaggery, Dates, Gulkand, Raisins, and many more. They are rich in minerals, such as phosphorus, magnesium, and iron, which maintain blood sugar levels, further increasing the market in India.

North America Alternative Sweeteners Market Trends

North America is expected to grow fastest during the forecast period. The market growth in the region is driven by increasing consumer preference towards healthier alternatives and increasing prevalence of lifestyle diseases, like diabetes and heart diseases. In addition, increasing demand for low-calorie sugar-free products and sugar substitutes and increasing health awareness among customers are further expected to propel the alternative sweeteners market in the region. 69% of shoppers are shifting over pancake syrup bottles to review sugar ingredients and content on labels in North America.

The U.S. and Canada are the fastest growing countries in the region. The U.S. is the fastest growing country in the region. By the law of the Federal Food, Drug, and Cosmetic Act, sweeteners must be safe for consumption, like all other ingredients added to food in the U.S. The U.S. Food and Drug Administration approved six NNS such as stevia, acesulfame-K, neotame, sucralose, aspartame, and saccharine for use in humans and divided them as a safe category.

For instance, In July 2024, a leading supplier of natural sweeteners, NutraEx Food, Inc. Launched a ground-breaking new plug & play sweetener solution, BI-Sugar that inhibits the digestion of sugar.

The natural sweetener segment dominated the alternative sweeteners market in 2024.

The segment growth in the market is attributed to the increasing prevalence of health issues, such as metabolic syndrome, diabetes, and obesity, increasing concern about the negative effects of artificial sweeteners and refined sugar, and increasing health awareness. Natural sweeteners are found in the environment, like stevia herb. This sweetener is sugar-free and has no calories. It comes from various fruits and plants and offers a sweet taste. People who want to lose weight can adopt this sweetener. Natural sweeteners can help people to maintain a healthy weight and improve health significantly. Natural sweeteners ensure that an individual’s blood sugar level is not affected. In addition, natural sweeteners offer various benefits such as reduced calorie content, reduced impact on blood sugar, and lower glycemic, which are further expected to drive the segment growth.

The synthetic sweetener segment is expected the significant growth in the market during the forecast period. Synthetic sweeteners are chemicals used to be added to various foods and beverages to make food sweet. Synthetic sweeteners help to promote weight gain and increase appetite. People who want to decrease their sugar consumption and regularly consume soft drinks, synthetic sweetened drinks can be an easy alternative for them.

The high fructose syrup dominated the alternative sweeteners market in 2024.

The growth in the segment in the market is driven by rising investment by the manufacturers, increasing demand for packaged food, and the expanding growth of the food and beverage industry. High fructose syrup has several features such as high solubility and ability to remain in solution, which further increases the segment demand. High fructose syrup enhances many spices, citrus, and fruit flavors and provides a sweetness intensity equivalent to sugar. Consumers can find high fructose syrup in various products, such as jams, candies, canned and packaged foods, baked goods, yogurts, and many beverages. It has functional properties that enhance foods and beverages and provide product stability, which further drives the segment growth.

The high-intensity segment is expected to grow substantially during the forecast period. High-intensity sweeteners are widely used as a sugar alternative as they are sweeter than sugar. They are ingredients used to enhance and sweeten the flavor of foods. High-intensity sweeteners are helping to not increase blood sugar levels. There are various high-intensity sweeteners such as advantame, neotame, sucralose, acesulfame potassium (Ace-K), aspartame and saccharin are FDA-approved as food additives in the U.S., which further drives the segment growth.

The food and beverage segment dominated the alternative sweeteners market in 2024.

The segment growth in the market is driven by the increasing use of artificial and natural sugar substitutes and increasing demand for ingredients that minimize sugar content across various categories, such as sauces, soups, confectionery, bakery, dairy, and beverages. The food and beverages have undergone various testing to determine efficacy and safety, which is further expected to enhance segment growth.

The pharmaceutical and nutraceutical segment is expected to grow fastest during the forecast period. The adoption of sweeteners plays an important role in enhancing the palatability of several medical products, in the pharmaceutical industry. Enhancing the stability of formulations and improving patient compliance are the major benefits of pharmaceuticals in the alternative sweeteners market. The segment growth in the market is attributed to the rising advancements in sweetener technology and increasing demand for natural sweeteners, Furthermore, sweeteners also play an important role in the nutraceuticals industry and offer pleasant sweetness without sacrificing health, which revolutionized the sweeteners also play an important role in the nutraceuticals industry and offer pleasant sweetness without sacrificing health, which revolutionized the experience of consuming nutraceutical products. Alternative sweeteners emerge as fundamental elements in creating beneficial and attractive nutraceutical products, with their healthy versatility and sweetness.

Shiru

Fooditive Group

By Source

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025