April 2025

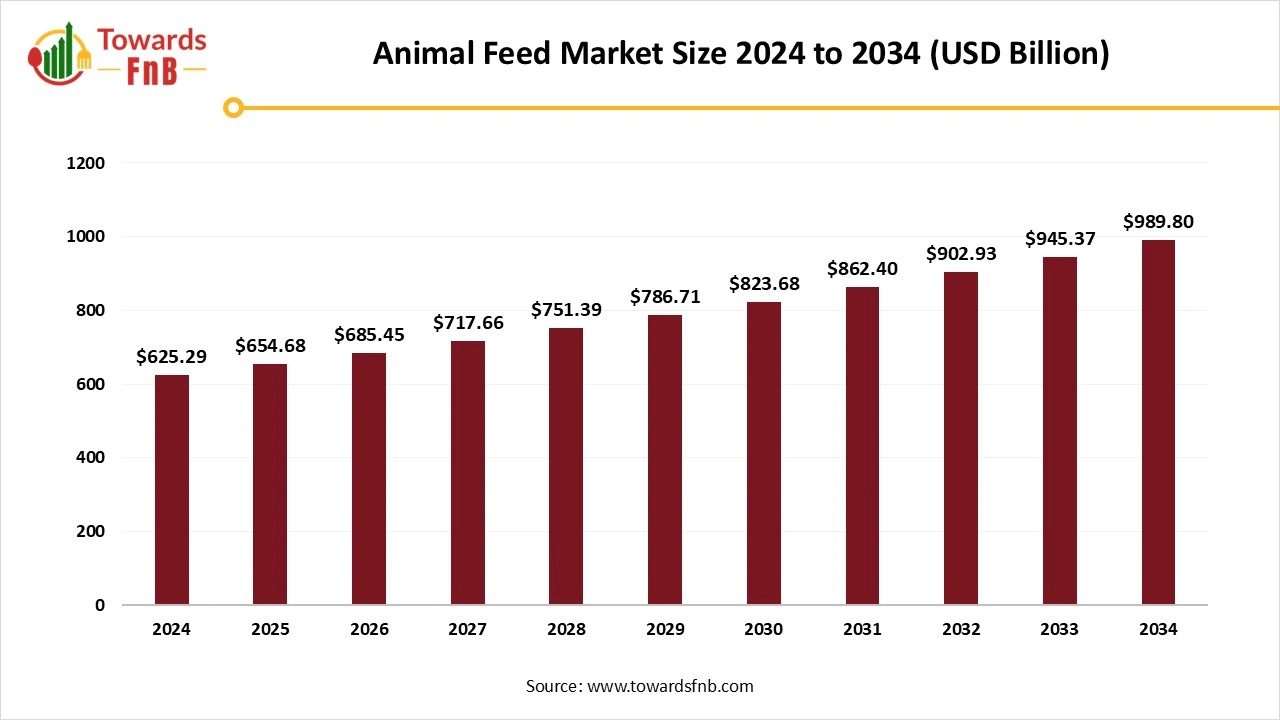

The animal feed market size was valued at USD 625.29 billion in 2024, is expected to expand from USD 654.68 billion in 2025 to USD 989.8 billion by 2034, with a CAGR of 4.70% during the forecast period from 2025 to 2034. Increasing worldwide population rising the demand for the livestock products substantially driving the animal feed market.

A growing population and changing eating habits have increased demand for premium animal products worldwide, putting the livestock sector under unprecedented scrutiny. In this ever changing environment, creating sustainable and nutritionally balanced animal feeds becomes essential to creating high-quality animal products that satisfy global demands and increasing the market of animal feed. For livestock production including breeding and reproduction along with animal well-being high quality animal feed is needed.

Increasing market of the aquaculture and increasing fish consumption further boosting the market. Escalating pet sector and pet humanization rising the demand for the high-quality pet nutrition and pet food, further fuels the market. Rising net income, evolving lifestyles, and increased awareness of health and nutrition have led to a greater demand for premium meat and meat-derived products. This has consequently increased the need for animal feed. The strong demand for food products from animals like meat, eggs, and dairy, along with a growing emphasis on animal health and nutrition, fuels the expansion of the market. Technological innovations in feed manufacturing, an increase in feed mills, and industry consolidation are additional elements driving the growth of the animal feed market.

A significant technological development influencing the field of animal feed formulation is the incorporation of computational models and artificial intelligence. This groundbreaking duo enables the examination of extensive datasets, considering aspects like animal genetics, physiology, and environmental elements. Utilizing machine learning algorithms enables researchers and nutritionists to uncover complex patterns in these datasets, resulting in an exceptional level of accuracy in feed formulation. This accuracy enhances animal performance and reduces resource use, aligning with overall sustainability objectives. In addition to artificial intelligence, the combination of molecular biology and genomics signifies a new age of customized nutrition for livestock.

A major challenge is the increasing expense of raw materials. Components like soybeans, corn and fishmeal, which constitute most of the animal feed, experience price fluctuations due to influences such as weather change, geopolitical conflicts, and rising competition for these resources from human food and biofuel sectors. Water shortages and land deterioration intensify the problem, restricting the resources needed for producing feed crops.

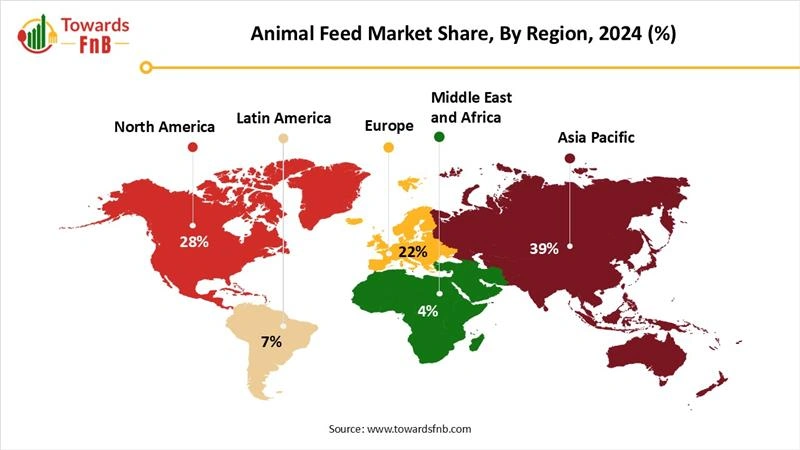

Asia Pacific Dominated the Animal Feed Market with the Largest Share in 2024.

The rise in cattle farming is expected to boost the need for animal feed because of the growing human appetite for products derived from animals. It is anticipated that natural growth proponents will remain engaged in the market as their momentum continues to increase. Consumer awareness of the advantages of feed additives in disease prevention has led to a transition from regular animal feed to specialized and higher quality options. These additives enhance immunity against enzootic diseases and simultaneously lower the likelihood of metabolic disorders. Moreover, positive actions and investments are being made by the governing bodies in multiple nations within the region to enhance animal agriculture, and the adoption of innovative animal-rearing methods is expected to stimulate demand for animal feed.

Escalating Animal Feed Market in China

China is a leading country in animal feed production. China's feed demand is increasing due to ongoing swine restocking and an expanding livestock industry. The rise in commercial feed tonnage is fueled by the recovery and evolution of China's pig industry, along with swine farms partnering with specialized feed mills. The increasing living standards of the Chinese people and the heightened demand for high-protein foods are driving the growth of the animal feed market in China.

North America Observed to Grow at the Fastest Rate in the Animal Feed Market During the Forecast Period.

The growth of the market is expanding because of rising demand for dairy and meat items, escalation of livestock production, advancements animal nutrition technologies, and increasing awareness regarding advantages of utilizing compound feed for livestock. Additionally, the North American market is upsurging due to the augmented use of feed enzymes and probiotics that are important in improving the productivity of livestock. There are around 5,650 animal feed producing facilities in the U.S. formulating more than 284 million tons of pet food and finished feed every year. The mill sizes differ drastically from a small on-farm mixer to advanced, computerized system with minimum workers developing more than 1 million tons of feed every year for swine or poultry activities.

The Poultry Segment Held the Dominating Share of the Animal Feed Market in 2024.

Indulging and developing markets have expanded poultry market and poultry becomes most consumed livestock globally specifically in developing nations. As the demand for the poultry increasing consumers are constantly developing innovative food products for the development and nutrition of poultry sector. Developments in poultry rearing methods are fostering the expansion of the market. Animal feed manufacturers are scaling up manufacturing to complete the demand from layers, broilers, and other poultry animals because of increasing poultry consumption in developing countries. Growing import and export of the poultry demanding the complete and healthy nutrition for overall development. The meat trade, which includes poultry imports, has grown considerably since 2001. Between 2001 and 2021, worldwide poultry imports increased by an average of 4 percent annually, reached 14.2 million metric tons in 2021. The USDA forecasts that poultry imports will increase to 17.5 million metric tons by the year 2031.

The Cattle Segment is Seen to Grow at a Notable Rate in the Animal Feed Market During the Predicted Timeframe.

The cattle feed market is constantly leveraging as milk producers start to change conventional cattle feed with nutritionally blended balanced cattle feed, considering the noticeable advantages of nutritional feed for yield enhancement. Additionally, population rise and growing living standards, the livestock market has been enforced to change and improve for completing demand from consumers by providing healthy compound animal feed to livestock animals. As a result, this factor helps to expand the cattle industry and feed market.

The Amino Acid Segment Dominated the Animal Feed Market with the Largest Share in 2024.

Since most livestock are unable to produce amino acids, the demand for animal feed amino acids has increased in recent years. Research and development efforts have shown that the primary and secondary limiting amino acids, lysine and methionine, are increasingly utilized in lactating dairy cows to enhance production efficiency and minimize metabolic disorders. Additionally, a rise in the demand for organic meat from consumers in developed countries, along with the adoption of new animal husbandry practices and the maintenance of high agricultural standards, has fostered a favorable outlook for the industry. The rising use of sustainable agricultural methods has also boosted the demand for high-quality animal feed that support animal wellness and improve production efficiency. The increasing collaborations among companies that drive innovations are beneficial to the market.

The Antibiotics Segment is Expected to Grow at the Fastest Rate in the Animal Feed Market During the Forecast Period.

Various research and studies provide evidence regarding the positive effects derived from the use of antibiotics as feed additives. Pigs receiving antibiotics in their diet need 10–15% less feed to reach the desired growth level. The expense of feed represents a significant part of the costs associated with raising animals. Therefore, the inclusion of antibiotics significantly reduces costs. Antibiotics included in the feed also guarantee better conversion of feed into animal products and enhancements. The daily growth rate of animals fed with antibiotic-enriched food is recognized to be enhanced by 1–10% in comparison to that of animals receiving feed without antibiotics. The meat sourced from animals given antibiotics is of superior quality, containing more protein and less fat than that from animals not treated with antibiotics and the benefiting to the market expansion.

Insectika Biotech

Kemin Industries

Evonik

By Species

By Additives

By Region

April 2025

April 2025

April 2025

April 2025