April 2025

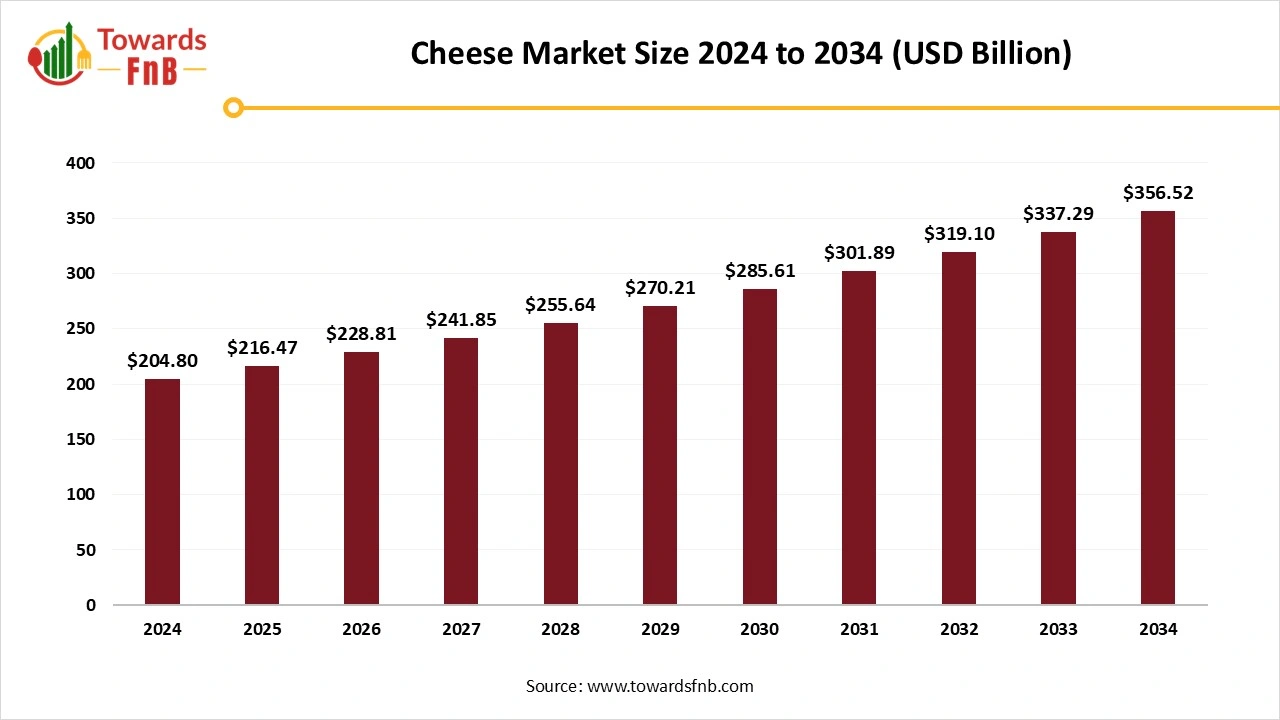

The global cheese market size was estimated at USD 204.80 billion in 2024 and is expected to rise from USD 216.47 billion in 2025 to nearly reaching USD 356.52 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034. Rapid urbanization, change in taste of consumers and demand for western cuisine are the major factors influencing the market growth.

Cheese is the fermented milk-based food products, made with the different flavors and types. It is estimated that more than 500 distinct cheese varieties are currently produced worldwide. Growing demand for the ready to eat and convenience food majorly driving the market. The rise food delivery industry through on-demand services like DoorDash, Grubhub, and Uber Eats increasing the demand for the convenience food and thus fostering the cheese market. Furthermore, increasing demand for western food menu like burger, pizzas and pastas loaded with cheese, growing outlets of fast-food chains like dominos McDonalds, pizza hut, Subway etc. fueling the demand for the cheese and increase the cheese production.

The use of functional ingredients derived from plant by-products in cheesemaking might serve as a method for enhancing the overall quality of the products. The implementation of automatic and semi-automatic machines has greatly enhanced efficiency in cheese manufacturing. These systems can manage substantial amounts quickly, boosting efficiency and allowing businesses to satisfy demand more adeptly. Automation has diminished the necessity for manual work, decreasing production costs and enhancing production capacity. The diversification of cheese flavors is also broadening the market. One instance is BOOSTRACTTM, a flavor modulation technology that increases or amplifies the sensation of kokumi. This distinct, all-natural method enhances the mouthfeel and richness of the taste experience, while simultaneously concealing undesirable flavor notes and intensifying the flavor traits that consumers most prefer.

Rising health awareness among consumers challenging the cheese demand as the cheese contain high fat and high sodium. Therefore, consumers are choosing alternative for the conventional cheese. Increasing allergies and lactose intolerance further impede the cheese market growth. Cheesemaking is majorly dependent on the milk and the price of milk is dependent on the feed cost, climate change and supply which can influence the price of the product.

Europe dominated the cheese market in 2024.

In 2024, cheese production in the EU was projected to increase by almost 1%, hitting around 10.5 million tons, as stated in a recent USDA World Markets and Trade report. This growth is fueled by strong internal consumption and steady demand for exports. The main producers are Germany, France, Italy, the Netherlands, and Poland, account for almost 75% of the EU's overall cheese production. Cheese manufacturing continues to be a major focus for the European dairy industry because of its consistent profits and strong market need. Besides being a cherished food, cheese holds an important place in European culture and customs. Cheese-making festivals and contests take place in various European nations, with numerous cities and regions boasting their own distinctive cheese-making customs.

Recent data showed that a significant change in dairy consumption habits in German consumers, with a rise in cheese consumption. As per the Federal Agency for Agriculture and Food, the mean per unit of population consumption of cheese increased by 1 Kg, attained 25.4 kg in 2024. Additionally, domestic cheese manufacturing rose from 2.66 million tons to 2.74 million tons. The growing awareness regarding health increasing the demand for organic and sustainable cheese. Along with this, localized diversity of Germany and strong appreciation for heritage cheese varieties contributing for the expansion of cheese market.

North America observed to grow at the fastest rate in the market during the forecast period.

Different varieties of cheese is the major driving factor growth of the North America cheese market. There is a cheese to please every taste including mozzarella, cheddar and artisanal cheese. Customers have different varieties to choose like hard cheeses, soft cheeses, blue cheeses, dairy-free alternatives, and fortified cheese to fulfil dietary preferences and culinary experiences and boosting the market. Various organizations are supporting the production of cheese in America.

U.S. cheese production in 2025 is projected to rise, about 1.6 percent, due to increased milk production and financing in processing technology. Cheese producers in important dairy states, comprising California, Wisconsin, Minnesota, Texas, and Idaho are enhancing capacity, concentrating on in-demand products like mozzarella, cheddar, and specialty cheeses to fulfil both local and international demand. Exports of U.S. cheese is also expected to rise in 2025, fostered by increased price competitiveness and continued demand from Mexico and prominent regions in Southeast Asia and the Middle East. Food service industries such as hotels, café, and restaurants are including cheese in their food to captivate the consumers and to expand the business.

The cheddar cheese segment dominated the cheese market with the largest share in 2024.

Creamy and premium taste of cheddar cheese attracting the consumers. Furthermore, the originality of cheddar cheese makes it a top pick for different dishes, including pizza, pasta, burger and sandwiches. Buyers are consistently opting for distinctive and customized cheese products that to combat with their taste preferences and dietary needs. Companies are offering customized cheddar cheese option in response to the consumer’s demand.

The mozzarella cheese segment is seen to grow at a notable rate during the predicted timeframe. Mozzarella cheese has important properties like melting and stretching and therefore widely used by the producers of Pizza in which it is vital component. Mozzarella is a cheese with lower sodium content, featuring roughly less than half the sodium found in other well-known cheeses, such as feta and Parmesan, containing 138 milligrams per serving. This represents approximately 6% of the American Heart Association's suggested daily limit of 2,300 mg of sodium or fewer. Mozzarella cheese contains beneficial probiotics for the gut, such as Lactobacillus casei and Lactobacillus fermentum. These benefits of mozzarella cheese are boosting the market.

The animal-based cheese segment led the market in 2024.

Rising demand for the dairy and dairy markets increasing the animal-based cheese market. Cow’s milk is the widely used for the cheese production, almost 7,921,662 tons of cheese manufactured in the EU in 2022, of which Italy contributed for 13%. Milk of Goat, sheep, and buffalo is also widely used in the cheesemaking.

The plant-based cheese segment is expected to grow at the fastest rate in the market during the forecast period. Approximately 75% of the world's population experiences lactose intolerance, with prevalence rates between 50% and 90% in areas such as Africa, South America, and Asia, and 15% to 5% in Europe and North America, indicating that they are refraining from consuming products with lactose and utilize milk-free alternatives. Plant-based cheese substitutes, specifically, present considerable opportunities for meeting consumer dietary requirements and tackling sustainability issues. The need for plant-based cheese substitutes is growing rapidly, with sales across six European nations hitting EUR 194 million in 2023, around 7% increase in merely one year.

The natural cheese type segment held the dominating share of the cheese market in 2024.

Rising consumer demand for healthy and natural food primarily driving the market. Natural cheese developers are consistently innovating to launch innovative flavors and varieties. Rising trend of veganism and plant-based alternatives also the demand for sustainability fostering the demand for natural cheese.

The processed cheese segment is seen to grow at a notable rate during the predicted timeframe. The processed cheese demand has increased significantly during recent days because of increasing customers interest in practical yet inexpensive food items. Processed cheese composed of natural cheese along with emulsifiers and other compounds which give its smooth texture combined with prolonged shelf life.

The B2C distribution channel segment dominated the cheese market with the largest share in 2024.

B2C marketing channels are important for industries to directly connect with their target consumers. These channels help industries to attract broader range of consumers, create brand awareness, and boost customer involvement. For example, social media platforms give potential platform for companies to involve and interact with their consumers, allowing for real-time feedback and personalized communication. Various supermarket, hypermarkets and convenience store provide easy access for the cheese and cheese products and increase the demand.

The B2B distribution channel segment is observed to grow at the fastest rate during the forecast period. Increasing market of food and beverage, food service sector rising the demand for the cheese. Cheese tastings is one of the excellent platforms for promotion of product, enhancing relationships, and creating business opportunities. For manufacturers, distributors, and importers, hosting such programs gives a platform to show the quality and value of their cheeses, introducing them thoughtfully to an audience of corporate buyers, including retailers, restaurateurs and wholesalers.

Paras Dairy

Sargento

Ever.Ag

By Product

By Source

By Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025