April 2025

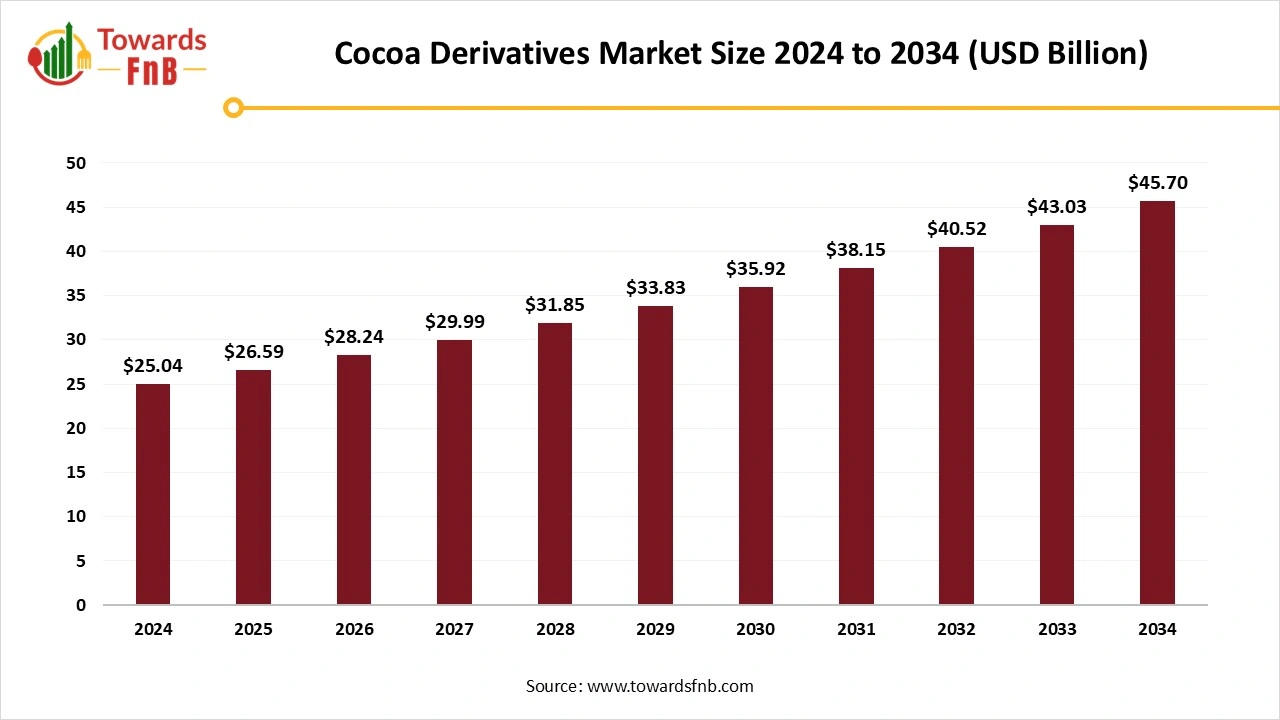

The cocoa derivative market size was estimated at USD 25.04 billion in 2024 and is predicted to increase from USD 26.59 billion in 2025 to approximately USD 45.7 billion by 2034, expanding at a CAGR of 6.20% during the forecast from 2025 to 2034. The sector is experiencing strong demand because of rising chocolate consumption, trends in functional foods, and growing usage in the cosmetics and pharmaceutical industries.

Cocoa derivatives are fundamental products that are made up of cocoa processing, which includes cocoa beans, cocoa powder, and cocoa butter, which are available in organic and conventional categories. However, cocoa is the main ingredient in all of them, utilized in the production of baked goods, chocolates, and hot beverages. On the other hand, cocoa butter has been used by the cosmetics and confectionery industries for its moisturizing properties. There is also ‘sustainable chocolate ‘existence as sustainability is one of the trending topics. So ‘sustainable chocolate’ means chocolate that is manufactured using only sustainable cocoa products, which are made using a sustainable cocoa economy. It is only practicable when farmers are paid a fair price for cocoa farming using environmentally sound practices.

The rising demand for the cocoa derivative market is owing to the growing demand for premium and high-end artisanal chocolate along with the growing trend for chocolate-embedded baked goods. Also, seasons like the holiday period and festivals drive the claim for cocoa products. On the other hand, cocoa beans are high in antioxidants, which makes them popular in different food and beverage use.

Cocoa trees follow complicated growth cycles, which results in a high pod mortality rate, which makes yield production difficult. So, merging AI-powered image analysis with real-time data is revealing data in pod development with 90% accuracy. Overseeing cocoa farms in remote regions results in specific challenges, so to avoid these complications, hyperspectral satellite imagery and Normalized Difference Vegetation Index ( NDVI) are utilized to track tree health, productivity trends, and soil conditions. The future of cocoa farming is also crafted by sustainability, innovation, and data-driven decision-making. As climate change grows, supply chain expectations and farming population decline, which stick to traditional methods, which is no longer enough. The only way to constant and continuous growth is through innovative technology, continuous research, and commitment to sustainability.

Chocolate production is one of the main drivers for the overall demand for cocoa, but unfortunately, the cultivation of cocoa is weighted with sustainability issues. To produce just half a kilogram of chocolate, it takes appropriate with every cocoa tree rendering to assist 20 to 30 pods every year. With more than 1,400 trees is a must to produce a single metric ton of cocoa, and only one tree can produce 1.02 kilograms of chocolate yearly. So, basically, it takes almost 5 years for a cocoa tree to mature and start producing beans.

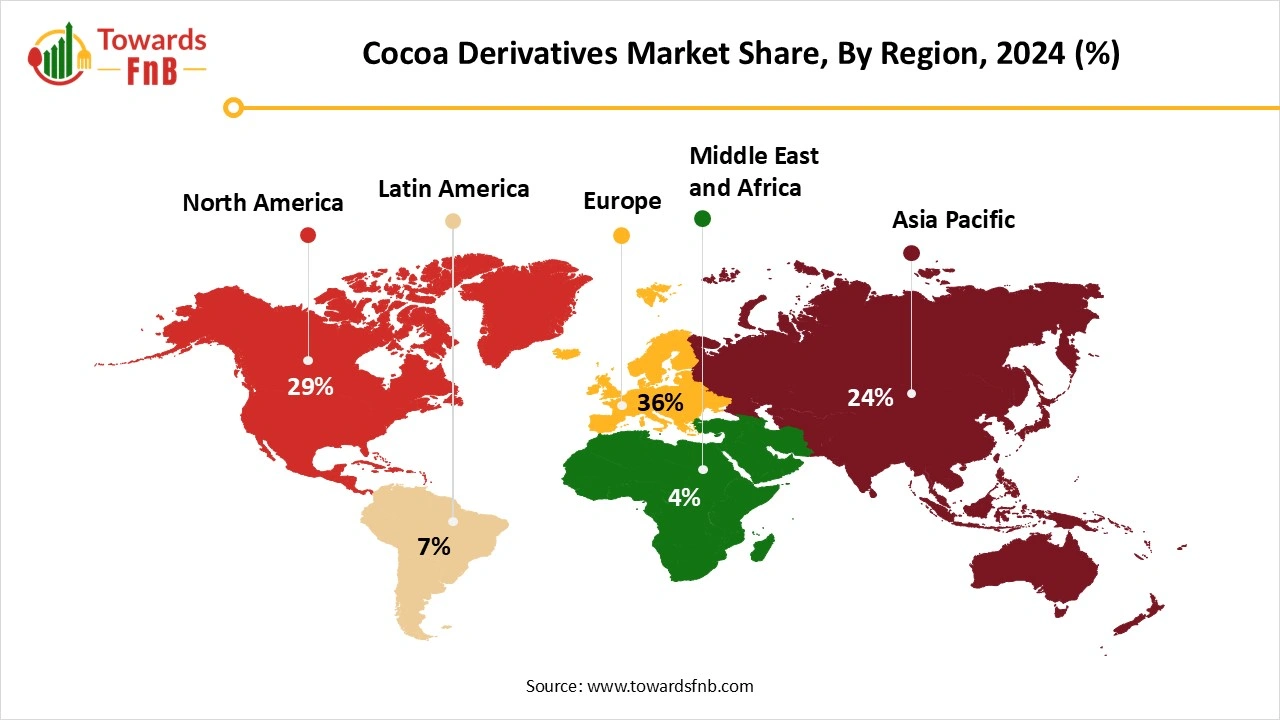

Europe Dominated the Cocoa Derivative Market in 2024.

Europe is the world’s largest importer of cocoa beans, cocoa paste, cocoa butter, and cocoa powder worldwide. It is a crucial trade hub for cocoa and chocolate products. The crucial supplying countries are the Nigeria, Ivory Coast, Cameroon, and Ghana. European importers working on bulk cocoa beans and products imports. It is usually produced as Forestaro, whereas Fine Flavour cocoa is usually Trinitrio, Nacional, or Criollo.

Once the cocoa is concluded in Europe, it is either shipped or locally processed other European countries. About 23% of all imported cocoa beans are re-exported within Europe in 2023.

The United Kingdom and Germany are the biggest markets for fair-trade cocoa. Whereas, the Netherlands is the largest European importer of organic beans, approximately 26,000 tonnes in the year 2023. They are navigated with Belgium ( 17,000 tonnes), Germany ( 4,000 tonnes), Italy ( 7,000 tonnes), and Spain (2,000 tonnes). The overall demand for organic and fair trade-certified cocoa beans is rising in the European region. The Port of Hamburg is the place from where most cocoa beans enter Germany to align with the production industry for chocolates and other cocoa products. Germany is home to Europe’s second-largest cocoa processing sector, which includes companies like Cargill and Stollwerck.

Asia Pacific Expects Significant Growth in the Cocoa Derivative Market During the Forecast Period.

It is the largest manufacturer of sweet biscuits, baked goods (pastries and cookies), chocolate confectionery, and ice cream categories altogether. All these departments use cocoa and chocolate according to their formulation, which makes Asia Pacific the fastest-growing region for cocoa & chocolate ingredients. So, the overall Asia Pacific cocoa market is gaining attention because of the rising demand for constant product innovation, premium products, and communicative branding, along with the rising awareness of the health benefits linked with chocolate consumption.

Emerging Cocoa Demand in India

India has produced 29,792 metric tons of cocoa in the year 2023-2024, according to the Directorate of Cashew nut and Cocoa Development (DCCD). The flavor of coffee beans totally depends on climatic conditions, cultivation method, and soil. So, there are several varieties of Indian cocoa that differ from region to region. The coffee beans from Karnataka have a little bit of nutty taste and even a spicy taste while those from Kerala have more complicated flavors with a mix of fruitiness.

The Cocoa Powder Segment Led the Cocoa Derivative Market in 2024.

They are primarily derived from the beans of the Theobroma cacao tree, which is a complicated ingredient in the global food industry. Cocoa powder is not only venerable for its culinary use but also for its capable health benefits. It is loaded with antioxidants, flavonoids, and a range of other bioactive compounds that contribute to overall well-being. The story of cocoa powder is linked long back to ancient civilizations such as the Mayans and Aztecs who used to cultivate cocoa beans and utilized them to create a bitter, frothy drink called “chocolate”. Cocoa powder has a milder flavour, which makes it perfect for adding to baking and traditional chocolate recipes. Dutch-processed cocoa is even softer textured and less bitter which makes it perfect for cakes, hot chocolate, and brownies.

The Cocoa Butter Segment is Expected to Grow at the Fastest Rate During the Forecast Period.

These are original fats extracted from cocoa through Hydraulic machinery. After the careful selection of cocoa beans, they are then dried and roasted before being cold pressed to evoke cocoa butter. It is hugely used in the cooking and cosmetics industries. According to research data, phytochemicals assist in anti-aging and standardly moisturizing the skin. It has a very low melting point at 35 degrees Celsius same as the human body temperature, and it has melt-in-mouth characteristics. It is rich in antioxidants, fatty acids, and vitamin E, which makes it the perfect choice to keep skin moisturized as it gives many skin benefits like deep hydration, anti-inflammatory properties, enhances skin tone, and improves skin elasticity.

The B2B Segment Dominated the Cocoa Derivative Market in 2024.

Digitalization can assist in improving the cocoa business in the overall area, which includes information on quality, origin, and sustainability. The B2B segment generally focuses on cocoa beans and cocoa products with high-quality or specialty cocoa. This type of platform will assist in understanding the main information about buyer is looking for. Digital platforms are not only utilized in the cocoa trade but also as a traditional cocoa market and not as a substitute. Whereas many cocoa buyers continue to trade in a regular way.

The B2C Segment is Expected the Significant Growth in the Cocoa Derivative Market During the Predicted Period.

B2C (Business-to-Consumer) plays an important role in the cocoa derivative market since it connects manufacturers and brands directly with end users. Cocoa derivatives, such as cocoa powder, cocoa butter, and chocolate, are widely consumed as snacks, beverages, and confections. Companies can market and sell cocoa-based products directly to customers via B2C channels such as supermarkets, online stores, and specialty shops, giving them more brand control, user input, and personalization.

The Food & Beverage Segment Dominated the Cocoa Derivative Market in 2024.

In this industry, cocoa is used as a basic raw material for chocolate making like white chocolate, dark chocolate, or even milk chocolate. For this utilization, cocoa mass is extensively used with the addition of sugar, cocoa butter, and milk powder. Chocolate is a form of chocolate drops or buttons which is an excellent ingredient for the preparation of baked goods and desserts too. Cocoa mass or cocoa butter derived from cocoa is used as raw material for the manufacturing of other confectionery products, desserts, baked goods, and ice cream too which is into the production of dietary and nutritionally grown products such as energy bars and muesli.

The Personal Care and Cosmetics Segment is Expected to Grow at the Fastest Rate During the Forecast Period.

Theobroma cocoa extract is hugely beneficial and is rich in polyphenols, which are responsible for its antioxidative and anti-inflammatory properties. Its antioxidant confirms two purposes formulation stability and advantages to skin and hair, which increase blood flow and have an anti-ageing effect too. These antioxidants assist in improving and reducing wrinkles and skin elasticity and give a youthful appearance. On the other hand, it is also used in the cosmetic industry to incorporate scrubs, face masks, and anti-aging creams to harness these advantages. Cocoa powder is also utilized as a natural coloring agent in the cosmetics industry. Its rich brown color is exclusively used in products like eyeshadows, bronzers, and tinted moisturizers to make a warm and earthy tone.

Orea and Coca-Cola

Koa and Altinmarka

Haco Industries

By Type

By Distribution

By Application

By Region

April 2025

April 2025

April 2025

April 2025