April 2025

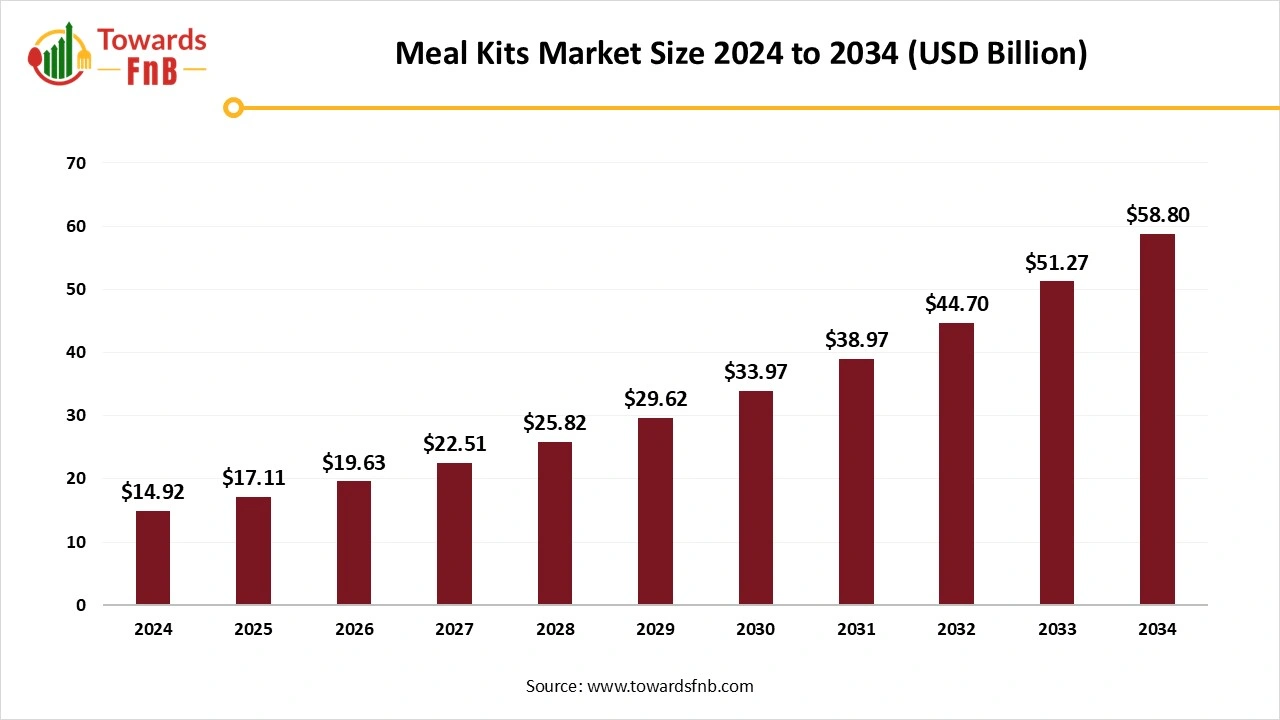

The meal kits market size was valued at USD 14.92 billion in 2024 is anticipated to reach USD 58.8 billion by 2034, growing at a CAGR of 14.70% from 2025 to 2034. The increasing demand for the convenience of proportioned ingredients, easy recipes, and reduced food wastage patterns drives the growth of the market.

A meal kit is a subscription service food service business model through which the company sends customers pre-portioned or partially prepared food ingredients and recipes to cook home-cooked meals, and it's kind of a personal meal box of groceries too, in which high-quality meal kit services are offered in terms of fresh ingredients, exact portions of every meal, and a specific number of meals. While choosing the right meal, one should consider dietary restrictions, budget, portion sizes, and meal variety too. The cost of a meal kit is totally based on the service itself, the number of meals, and the exact portion we choose.

One of the fundamental drivers for meal kits is that meal kit adoption is convenient and easy to use, as busy buyers value time-saving elements more for the meals and ingredients that are delivered at their doorsteps, and as the tendency is shifting towards convenience, the services offering quick and easy meal options drives the growth of the market. Whereas another market driver is having diverse dietary preferences because consumers are finding meals that fulfill dietary needs and preferences such as vegan, keto, and gluten-free options, as businesses that stick to customized meal plans will attract a huge customer range.

The growth factors associated with the meal kit market are several, right from convenience to nutrition options, as meal kits are very convenient, and one doesn’t need to plan meals and have grocery shopping too, as they offer a variety of dishes from different cuisines, and our taste buds are on a continuous different culinary adventure.

For health-conscious people, food proportion matters a lot, so pre-portioned meal options in meal kits play a crucial role in balancing the diet. Lastly, the two most important growth factors with respect to health and the environment are that due to meal options, there is no wastage of food as meal kits come with limited ingredients, and meal kits mostly contain fresh ingredients of high quality as they offer balanced meals, which support healthier lifestyles. With respect to this,

Inclination towards the weight loss programs to offer calorie-counted or portion-controlled meals to serve people who are seeking weight loss recipes and plans drives the demand for the personalization in meals kits. Additionally, the expansion in the subscription model as it provides businesses with a constant revenue flow and serves consumers convenience and predictability. With respect to the subscription option, one can opt for the tiered subscription option in which it offers customizable services with premium plans offering exclusive benefits and discounts for long-term duration.

The increasing numbers of mergers and acquisitions as companies are expanding and hence sharing market share and growing their service offerings, which can move towards greater efficiencies and broader customer reach. The rising number of collaborations between the companies which helps in expansion in the service offerings for better and broader customer reach collectively enhance the meal kits market expansion.

The cost of the product is higher than the other alternative which limits the adaptation rate of the meals kits. Additionally, the packaging wastes, transportation challenges, and control over the quality of ingredients collectively hampering the growth of the market.

North America dominated the meal kits market in 2024.

The growth of the market is attributed to the rising availability of the developed countries in the region with the increased per capital income which tends to spend on the lifestyle maintenance. The busy and hectic lifestyle and lesser time to cook fresh food in home accelerate the demand for the meal kits in the regional countries like the United States, and Canada. The growing inclination towards the personalization in meals kits for having the food as per the diet, taste, and requirements of people that collectively boosts the growth of the meal’s kits market in the region.

Asia Pacific expects a significant growth in the market during the forecast period.

The growth of the market is attributed to the rising population and the economic stability in the people of the regional countries. The rising urbanization and the awareness regarding the health and diet routine is contribute in the expansion of the market. Additionally, the number of companies are focusing on the meal kits subscription model for the better reach and delivery to the consumer that boosts the growth of the meal kits market across the region.

The non-vegetarian segment has dominated the meal kits market in 2024.

The reason is that the time required for non-vegetarian food requires more time as compared to vegetarian food, so consumers prefer more non-vegetarian meal kits, which include chicken, fish, and beef. The vegetarian segment is the fastest-growth in the meal kits market during the forecast period. This growth is due to ready meals or meal kits, which provide a convenient option for time-consuming consumers. Additionally, the consumers who are health conscious and environmentally concerned have leaned towards vegetarian meal kit options.

The cook and eat segment dominated the meal kits market in 2024.

The demand for this segment is due to the reason that consumers prefer more freshly cooked food rather than that which is cooked and then served, as it lets them develop their cooking skills. The heat and eat segment expect a significant growth in the market during the forecast period. The meals that are prepared by chefs to consumers, and they can choose the ingredients required for the recipe on the website. These dishes are basically prepared, cooked, and packaged for easy consumption.

The online segment dominated the meal kits market in 2024.

The growth of the segment is owing to the consumers are continuously using the food apps, so they explore opportunities in online platforms, which is very convenient for consumers to order ready meal kits via different online sources, and it's very convenient for busy lifestyle consumers.

The supermarkets or hypermarkets expects a significant growth in the market during the forecast period. due to the reason that in-store meal kits are easily available for consumers and have more benefits as the cost of subscription-based services is higher, and there is more flexibility for both retailers and suppliers in hypermarkets and supermarkets.

By Meal Type

By Offering Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025