April 2025

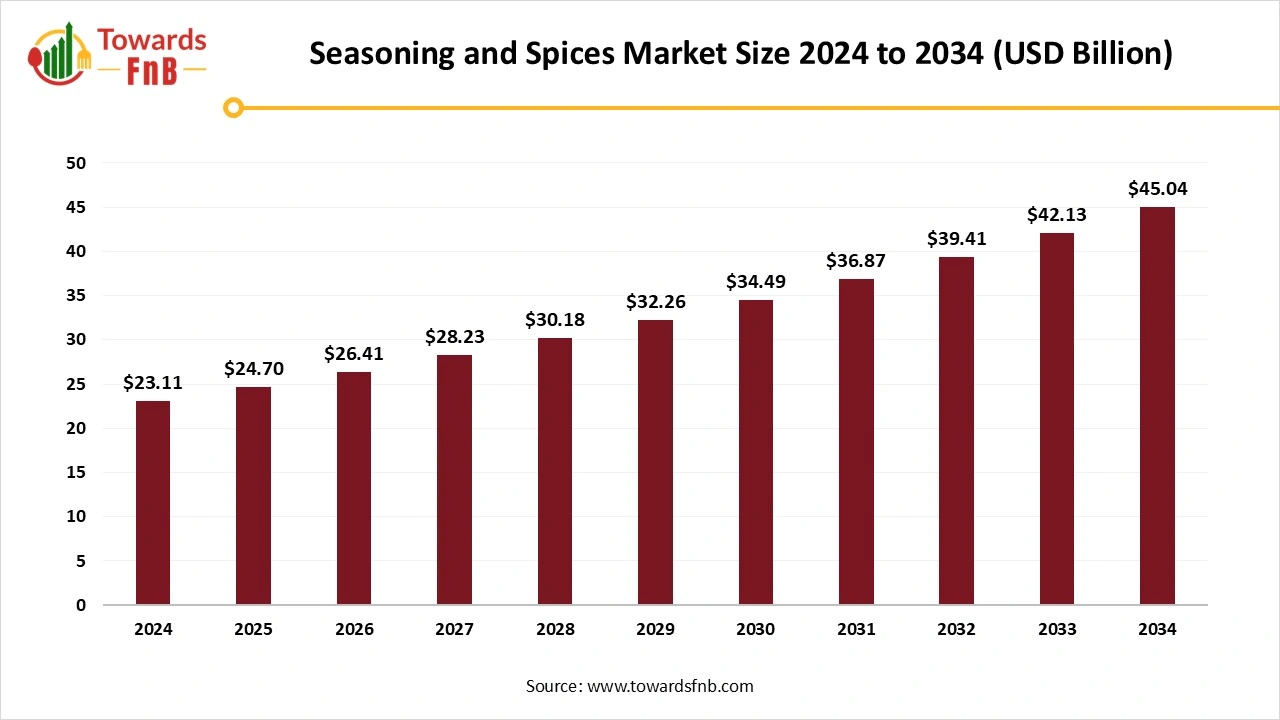

The spices and seasonings market size was estimated at USD 23.11 billion in 2024, is predicted to increase from USD 24.7 billion in 2025 to nearly USD 45.04 billion by 2034, growing at a CAGR of 6.90% over the forecast period from 2025 to 2034. The market for spices and seasonings is worth billions, driven by consumers seeking diverse flavor choices for their meals and prepared to invest in quality, top-tier spices and seasonings.

The market for spices and seasonings is undergoing a major change due to changing consumer tastes and increased awareness of functional foods. The popularity of immunity enhancing spices such as turmeric, ginger, and garlic has seen significant growth as consumers increasingly look for natural health-promoting ingredients. At present, it seems that consumers exhibit varied traits in terms of their food preferences and eating behaviours. The global integration of markets and migration trends have led to changes in consumer food preferences, as individuals slowly incorporate dishes and recipes characteristic of foreign cultures into their diets, increasing the market of spices and seasonings.

The Dietary Guidelines for Americans from 2020 to 2025 suggest a nutritious dietary pattern throughout all life stages. These healthy eating patterns fulfill energy requirements are rich in nutrient-dense foods and beverages, and restrict added sugars, saturated fats, and sodium. Nonetheless, the consumption of added sugars, saturated fats, and sodium continues to exceed recommended levels in the US population. Incorporating herbs and spices could be a successful method to boost flavor while lowering added sugars, saturated fat, and sodium and add taste, flavor and enjoyment in the meal, therefore there is rise in the demand of spices and seasoning.

The spices and seasonings market is mainly influenced by several factors, including the increasing appeal of ethnic foods. It is fueling the need for spice mixes and innovative spices. Additionally, the use of spices and seasonings is on the rise in cooking for salads and dressings in restaurants and cafes as well as home. Various spices are utilized in the preparation of a variety of beverages, including infused drinks, herbal drinks, and additional drinks.

These items are available in multiple forms, including whole spices, ground spices, blends, rubs, marinades, and sauces. Producers of convenience foods utilize these characteristics to improve the taste and quality of their items and extend the shelf life of their offerings. Furthermore, interest of consumers to trying new tastes and their growing fascination with ethnic flavours stem from an expansion in product choices and a boost in sales.

Spices are recognized for their beneficial bioactive properties that provide considerable health advantages. Additionally, these compounds are susceptible to breakdown and sensitive to elements like heat, light, oxygen, pH, temperature and moisture which restricts their practical use. Encapsulation appears as a very efficient way to safeguard these substances. It entails emulsifying them and encasing them in appropriate coatings, protecting them from external and internal stresses.

Microencapsulation and nanoencapsulation are the two most utilized techniques for enclosing bioactive compounds. For example, Encapsulated Oleoresin serves as Mane Kancor’s delivery platform, which encapsulates essential oils, oleoresins, and natural food colors in a highly stable form. Encapsulated Oleoresin maintains the essence of the spice(s) in their original state while offering the user the ease of active delivery. Encapsulated oleoresins can serve as a component for spice blends and seasonings.

Focus is given to risks such as high levels of sodium chloride and sodium in spice blends, the use of additives affecting the sensory experience, and inconsistencies in the labelling of spices and seasoning blends regarding the presence of additives and allergens. The dangers related to microbiological safety and the existence of heavy metals, pesticides, agricultural chemicals, along with synthetic fertilizers and undisclosed additives are highlighted, along with the problem of adulteration and the absence of authenticity in spices and spice blends. These problem regarding adulteration of spices and seasonings restraining the spices and seasonings market.

Asia Pacific Led the Spices and Seasonings Market in 2024.

Globalization has resulted in increased awareness and appreciation of global cuisines, especially in the Asia Pacific area, where the food culture is vibrant and varied. The growing enthusiasm for ethnic foods has boosted the need for genuine and varied spices, crucial for making traditional recipes at home. Additionally, the increasing diaspora from Asia Pacific nations to various regions globally has heightened the demand for ethnic spices and seasonings, as individuals strive to preserve a link to their cultural roots through cuisine. Nations such as India, China, and Vietnam in the Asia-Pacific area are encouraging organic spice farming, which is found to be more beneficial than traditional spices.

India is the biggest spice producer in the world. It is additionally the biggest buyer and seller of spices. The cultivation of various spices has seen significant growth in recent years. India generates approximately 75 of the 109 types that are recognized by the International Organization for Standardization. The spices that are produced and exported the most include chili, pepper, ginger, cardamom, coriander, cumin, turmeric, celery, fennel, garlic, fenugreek, nutmeg & mace, curry powder, spice oils, and oleoresins. In 2023-24, the nation exported spices valued at US$ 4.46 billion. In 2024-25, India shipped spices valued at US$ 1.09 billion.

Europe Expects the Fastest Growth in the Spices and Seasonings Market During the Forecast Period.

The spices and seasonings sector in European countries is undergoing substantial change due to shifting consumer tastes and altering dietary patterns. This industry is seeing a marked move towards high-quality and genuine flavors, as consumers are more frequently looking for distinctive and ethnic flavor experiences. This trend has resulted in the development of creative product options and tailored blending methods to appeal to refined tastes. Another notable trend in the European market for spices and seasonings is the growing consumer inclination towards natural and clean label products. As individuals grow increasingly conscious of the components in their meals, numerous consumers are seeking seasonings and spices devoid of artificial additives, preservatives, and synthetic flavors.

The Spices Segment Dominated the Spices and Seasonings Market With the Largest Share in 2024.

The spice market is growing because of the increasing appetite for unique tastes, authentic dishes, and cultural choices in snacks and foods. The demand for rapid meal choices is likewise driven by the rapid growth of the food processing sector and the hectic routines and sedentary lifestyles of consumers. Therefore, these are different market forces that contribute to the growth of the market.

The salt & salts substitutes segment is seen to grow at a notable rate during the predicted timeframe. The worldwide market for salt substitutes is experiencing an increase in demand driven by rising health awareness and the high occurrences of hypertension and cardiovascular ailments. Main market influencers comprise heightened government regulations on sodium consumption, growing public awareness of health dangers linked to high sodium intake, and the presence of novel salt substitute products.

National Brands Segment Held the Dominating Share of the Spices and Seasonings Market in 2024.

This growth can be linked to the innovative tactics used by spice brands. These brands have not only leveraged classic spices but also expanded their product lines to meet changing consumer demands. National spice brands are now acknowledged not only for their varied product ranges but also for their dedication to ethical sourcing and manufacturing. This has not only aided the expansion of the industry but has also strengthened its standing globally.

The private segment is observed to grow at the fastest rate in the spices and seasonings market during the forecast period. Private label brands provide a diverse range of high-quality spice items that can be tailored to your private label. From organic herbs to complete spice mixtures, offer a variety to satisfy unique needs. In the current competitive market for spices and seasonings, entrepreneurs and companies are always looking for methods to improve their product range and increase profitability. One of the most efficient methods to accomplish this is by using private-label spices.

The Retail Segment Dominated the Spices and Seasonings Market With the Largest Share in 2024.

The market features several key spice processing and marketing companies that grind spices and seasonings, whether sourced from imports or local production, package them in different containers, and sell them in retail outlets under their own brands or private labels. Various varieties of spices and seasonings are easily available at the retail stores thus, consumers mostly opt for shopping from retail stores.

The foodservice segment expects the significant growth in the spices and seasonings market during the forecast period. Changing lifestyles that prefer eating out or ordering food, especially within city populations, alongside the growth of online food delivery services, increasing the foodservice segment. Spice and seasoning manufacturers are progressively embracing growth to complete the demand from foodservice segment.

By Product

By Brand

By End Use

By Region

April 2025

April 2025

April 2025

April 2025