April 2025

The global beef market size was valued at USD 555.28 billion in 2024 and is forecast to rise from USD 579.16 billion in 2025 to approximately USD 845.97 billion by 2034, with a CAGR of 4.30% during the forecast period from 2025 to 2034. Increasing demand for the high-quality protein for health management majorly contributing for the market growth.

Beef is obtained from the completely grown and developed cattle; beef market encompasses of supply and production of beef. Customers from Generation X and Millennials are contributing the market by demanding for easy and instant protein. Hectic schedules and health consciousness and fitness of consumers look for the instant and protein-loaded option. Suitable beef-derived products such as beef jerky or protein bars, ready to eat meals completing the need of protein conveniently. This demand for easy and suited protein sources is the significant driving factor for the market expansion. Rapid urbanization and development in developing countries, increased net income, rising population rising the demand of protein for complete nutrition. Expansion food sector, increasing number of restaurants and café, rising demand for quick foods, collectively, all these factors are contributing to the growth of beef production and market.

Beef producers employ targeted production methods to address environmental and weather-related issues. These methods encompass a range of management approaches, distinct production systems, and technologies aimed at improving beef production. Lately, the livestock sector has started incorporating advanced technological tools into production workflows to enhance resource management. This technology, referred to as precision livestock farming, encompasses sensors, big data analytics, blockchain technology, and robotics. Precision agriculture instruments like GPS-guided machinery and data analytics enhance cattle farming methods. Blockchain technology enhances traceability, guaranteeing food safety, benefiting the beef market expansion.

Consumers preference for the plant based vegan food due to environmental concern and animal welfare hindering the demand for beef. Because of the shrinkage of beef heard, ongoing drought, increased producer input costs, supply chain problems, declining the supply of the beef from manufacturers and leads to the increased product cost. Recently, fertilizer, vaccines, and cattle identification products, also affected by the disruption of supply chain.

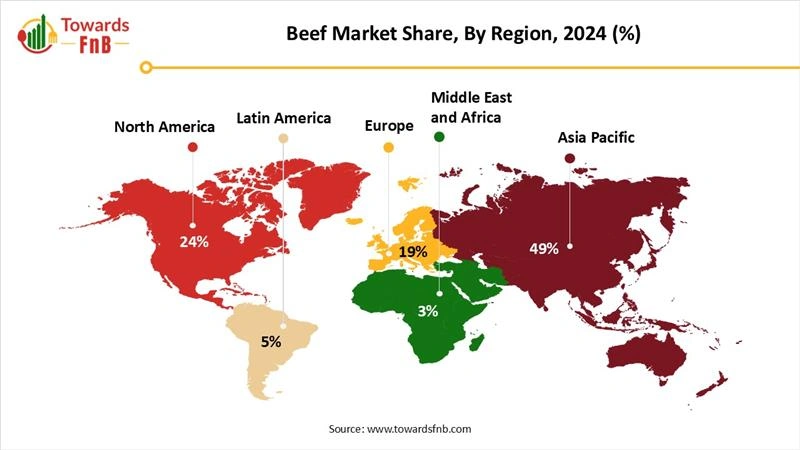

Asia Pacific Segment Held the Dominating Share of the Beef Market in 2024.

In recent years, the region went through swift industrialization and urbanization, because of that net income of the population increased substantially. This resulted in augmented need for protein-loaded, high-standard, and nutritious meat products. Advancements in beef supply chain networks contributing to the expansion of the market Asia Pacific region. The producers have saw significant influx of funding in novel agriculture methods, with producers choosing advanced breeding methods and automated feeding systems. These technological developments in beef industries boosting the market.

Emerging Beef Market of China

Third largest beef producer globally is China and is the biggest producer in Asia. Beef cattle production is the conventional activity of the China and is the vital component for the economical development. China’s market growth is attributed to the rapid urbanization and development, consumers preference for western foods and import of beef. The recent data from 2023 found that about of 1.8 million tonnes of fresh and frozen beef was imported from China. There was 6% rise in comparison with the year 2022.

North America Beef Market is Observed to Grow at the Fastest Rate During the Forecast Period.

Beef production in North America, especially in the Canada and United, is distinguished by three main constituents including cow-calf, stocker, and feedlot operations. There is increasing attentiveness among beef producers, customers, and other beef supply chain shareholder in attaining considerable sustainability within the industry fostering the market. Additionally, development in technology for beef production, distribution and supply leveraging the market.

Leveraging Beef Market of United States

Beef market of the United States is expanding, which is attributed to the increased demand of protein, convenient and ready to eat food, increased working population, and expanding food sector. Furthermore, various initiative and subsidies provided by the welfare of the livestock commodities boosting the market. From 2018 to 2023, the U.S. Department of Agriculture distributed $12.1 billion in total assistance to the leading 10,000 agricultural producers, recognized as those receiving the most federal financial aid, managing livestock feeding operations across the U.S. During this period, dairy, hogs, and beef cattle were the three main categories receiving livestock feeding assistance. The USDA projected an increase in beef production to 4.64 million metric tons (MMT) in 2024, up from 4.57 MMT, and forecasts exports to rise to 1.64 MMT, an increase from 1.56 MMT in 2023.

Loin Cut Segment Dominated the Beef Market With the Largest Share in 2024.

Loin beef portions are derived from the region below the spine. The Loin begins at the hip and consists of the Sirloin, Short Loin, and Tenderloin. Loin beef sections are some of the most flavorful, tender, and juicy. The way consumers perceive beef products is strongly tied to their preferences for certain palatability traits, with tenderness, juiciness, and flavor collectively impacting overall enjoyment.

The Brisket Segment is Seen to Grow at a Notable Rate During the Predicted Timeframe.

Brisket is a piece of meat taken from the breast or lower chest of beef or veal. Brisket is not a costly cut. It is, nevertheless, a nutritious one. As brisket has a high amount of connective tissue, it indicates that it is rich in collagen, the body's most prevalent protein. Collagen is essential for maintaining healthy joints and maintaining skin elasticity. Brisket meat contains high amounts of oleic acid. This aids in reducing harmful cholesterol while increasing the levels of the beneficial type. Brisket is loaded with protein. These benefits of brisket boosting the market.

Halal Beef Segment Held the Largest Share of the Beef Market in 2024.

With the growth of the Muslim community, the need for halal food items, particularly beef, also rises. The focus on humane and ethical treatment of animals is on the rise, and the halal slaughter method, designed to reduce animal suffering, is becoming more acknowledged and accepted. The food market is progressively seeking higher quality, natural, and eco-friendly meat products, which are viewed as healthier than traditional options. Alongside various other alternatives to traditional meat, halal meat is appealing to consumers globally, regardless of their faith. Hence, halal meat and meat products are becoming more accessible in supermarkets and fast-food chains. Like organic meat, halal meat is derived from grass-fed livestock that are not given antibiotics or growth hormones; furthermore, the slaughtering process is more compassionate towards the animals. In general, halal meat production is anticipated to offer superior nutritional value compared to traditional meat, thus delivering considerable health advantages.

Kosher Beef Segment Expected to Grow at the Fastest Rate in the Market During the Forecast Period.

For religious reasons, Orthodox Jews exclusively buy meat that has kosher certification. Therefore, the kosher beef market, is important as it caters specifically to this portion of the population. The quality of Kosher products is celebrated globally for being healthy and sustainable, closely linked to the production methods, particularly the slaughtering process, as well as the sanitary and strict conditions in which animals are raised. Ideas like health and sustainability have a significant impact on consumers food selections; in fact, many individuals are attracted to authentic, healthy items like Kosher meat, even if they don't practice Judaism.

Performance Food Group

McDonald’s, and Syngenta North America

Impossible Foods

By Cut

By Slaughter Method

By Region

April 2025

April 2025

April 2025

April 2025