April 2025

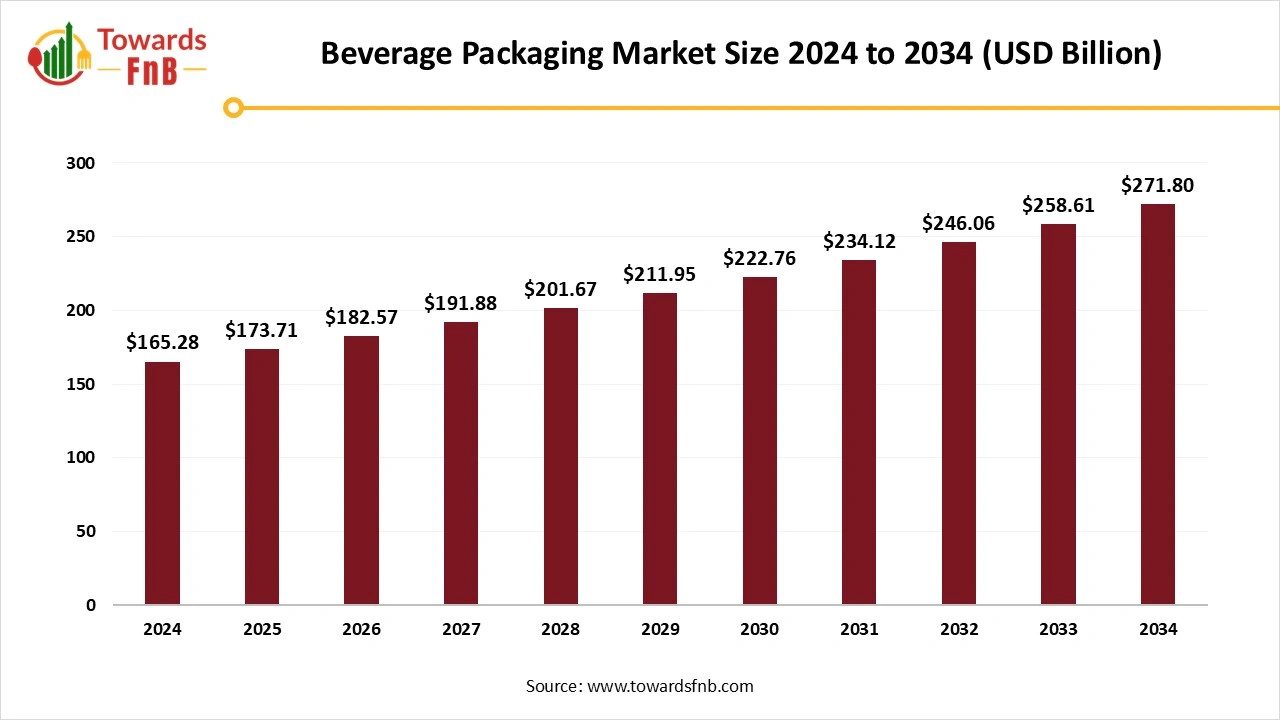

The global beverage packaging market size was valued at USD 165.28 billion in 2024 and is expected to surpass USD 271.80 billion by 2034, with an expected CAGR of 5.1% from 2025 to 2034. The growing demand for eco-friendly products and environmental awareness, along with the rising need for convenient packaging expanding the market.

The rise in hectic routines, the need for grab-and-go drinks is increasing. Ready-to-drink beverages also need easy and transportable packaging options. City residents are progressively seeking beverages that are convenient to drink while commuting, exercising, or engaging in other activities on the move. This has led to the creation of smaller, resealable, and lighter packaging designs. The growing population and higher net income in emerging markets are opening new opportunities for packaged drinks.

The worldwide market is experiencing significant demand from both alcoholic and non-alcoholic beverage sectors in developing economies. The entire market is experiencing growth due to an increase in the demand for functional beverages. Worldwide consumption of alcoholic beverages is primarily fueled by rising alcohol intake alongside a growing desire for premium products. These factors are majorly contributing for beverage packaging market.

Shelf appeal and aesthetics are the key elements in the worldwide beverage packaging industry, as they significantly influence purchasing choice of consumers. The most favored packaging types are those that convey brand identity or imply quality and freshness, with buying behavior often taking center stage. With significant attraction in aesthetically pleasing items, beverage brands have embraced creativity to set their products apart from others. This aspect raises the need for personalized packaging options to improve product visibility, enhance brand awareness and subsequently drive sales in a competitive marketplace.

The growing consciousness regarding environmental safety among consumers and the heightened acceptance of eco-friendly items create significant opportunities for manufacturers of beverage packaging products. A study by the National Retail Federation found that 69% of North American participants are willing to pay more for recycled products, and 80% want to understand the source of the products they purchase.

The primary challenge in the beverage packaging market is the availability and price variability of raw materials. Producers may struggle to maintain competitive pricing while managing quality and sustainability objectives. These variations compel companies to swiftly adjust, investing in substitute materials potentially hindering market growth and innovation.

Asia Pacific Area Led the Beverage Packaging Market in 2024.

The Asia Pacific region boasts a large and swiftly expanding population in nations such as India and China. This extensive consumer market creates a strong need for drinks and, as a result, packaging for those drinks. Economic expansion in the Asia Pacific has resulted in higher disposable incomes, allowing consumers to invest more in packaged drinks. The Japan is chiefly influenced by the rising awareness of environmental issues and sustainability challenges that are affecting manufacturers in the country. Japanese beverage companies are utilizing packaging options derived from renewable resources.

North America is Expected to Grow at the Fastest Rate in the Market During the Forecast Period.

The region has sophisticated manufacturing plants and technological advancements in packaging, resulting in the production of high-quality and sustainable beverage packaging. The stable economic climate in North America encourages ongoing consumer expenditures on various beverages, guaranteeing steady demand for beverage packaging.

The Plastic Segment Dominated the Beverage Packaging Market in 2024.

The plastic is lighter than materials like glass and metal. Plastic bottles and containers are simpler to transport and handle. These factors contribute to the rise in the market. Whereas the metal segment expects significant growth in the market during the forecast period. Metals are durable and highly resistant to strain and are also easy to transport. Aluminum cans have special appearance and contribute for brand recognition. These factors boost the market and raise the demand for metal cans.

The Alcoholic Beverages Segment Led the Beverage Packaging Market in 2024.

The packaging significantly influences the perceived quality and branding of alcoholic beverages like beer, wine, and spirits. Further, non-alcoholic beverages are expected to grow at the fastest rate in the market during the forecast period. shoppers are progressively choosing functional beverages like energy drinks, sports drinks, and fortified waters that provide extra advantages driving the market.

The Bottle and Jar Segment Dominated the Market in 2024.

Ready-to-drink beverages in bottles and jars provide convenience for consumption while traveling, attracting busy shoppers. Numerous bottled and jarred drinks are promoted as healthier choices, including natural juices, smoothies, and functional beverages, catering to consumer demand for healthier items. The carton product segment is expected to experience significant growth during the forecast period. Cartons are mainly produced from renewable resources like paperboard, which comes from wood pulp. This renders them more sustainable than plastic bottles or aluminum cans, attracting environmentally aware consumers and brands.

By Material

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025