April 2025

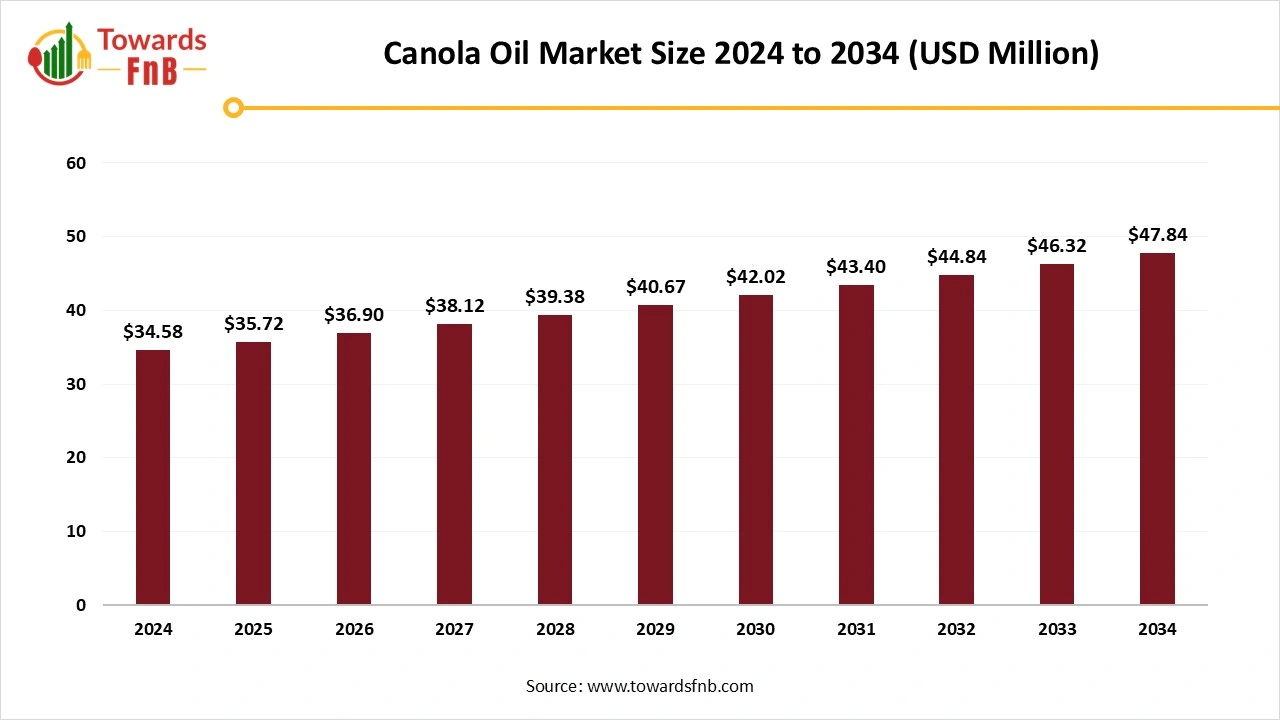

The global canola oil market size reached USD 34.58 million in 2024 and is anticipated to increase from USD 35.72 million in 2025 to an estimated USD 47.84 million by 2034, witnessing a CAGR of 3.30% during the forecast period from 2025 to 2034. With the increase in health conscious consumers, there has been a climb towards plant-based diets and healthier cooking oils. Canola oil is lower in saturated fats and higher in unsaturated fats, making itself for regular cooking oil like vegetable oil and sunflower oil.

Canola oil is one of the healthiest cooking oils, which has zero trans fat and the lowest amount of saturated fat among all cooking oils. It is evergreen and can be utilized affordably, it's perfect for making a huge range of healthy food both at home and for commercial use. Canola oil is derived from the canola plant, which produces beautiful, small yellow flowers. It develops pods, resembling pea pods. Each pod has small black seeds, which are made of 45% oil. If they are harvested once, canola seeds are crushed to release the oil that is contained within the seed. The oil is then refined and further filled in the bottled format. The facts linked with canola oil are that it contains half the trans-fat of soybean or olive oil, it belongs to the same plant family as broccoli, cabbage, Brussels sprouts, and mustard, and lastly, they are high in vitamin E and K, and plant sterols too.

Canola oil is a necessary feed ingredient that is extensively used in livestock and poultry production, which assists in producing high-quality meat products. The food industry’s rising usage of canola oil in processed foods has further boosted its demand for the canola oil market and as consumers are heavily giving importance to their health and actively finding foods that contribute to balanced diets. Technological advancements in the canola oil industry have also played an important role in its growth. It is one of the most widely utilized vegetable oils in the world, which is valued for its heart-healthy profile, neutral flavor, and versatility in production, industrial applications, and biofuels.

The future of canola oil carries significant potential driven by evolving health trends, rising global demand for sustainable products and technological advancements. As consumers become increasingly health-conscious , canola oil is likely to gain popularity because of its low saturated fat content and high levels of omega-3 fatty acids, which makes it heart-friendly cooking oil option. Inventions in food science lead to the growth of enhanced canola oil products fortified with additional nutrients such as plant sterols, antioxidants and vitamins too which changes it into a functional ingredient beyond just a cooking medium.

Canola oil is counted as one of the healthiest oils of all, but it also carries some negative effects on health, such as weight gain, because being calorie-conscious, huge utilization can cause weight gain, specifically if not balanced with physical activity which may limits the adoption of the and hampers the expansion of the canola oil market.

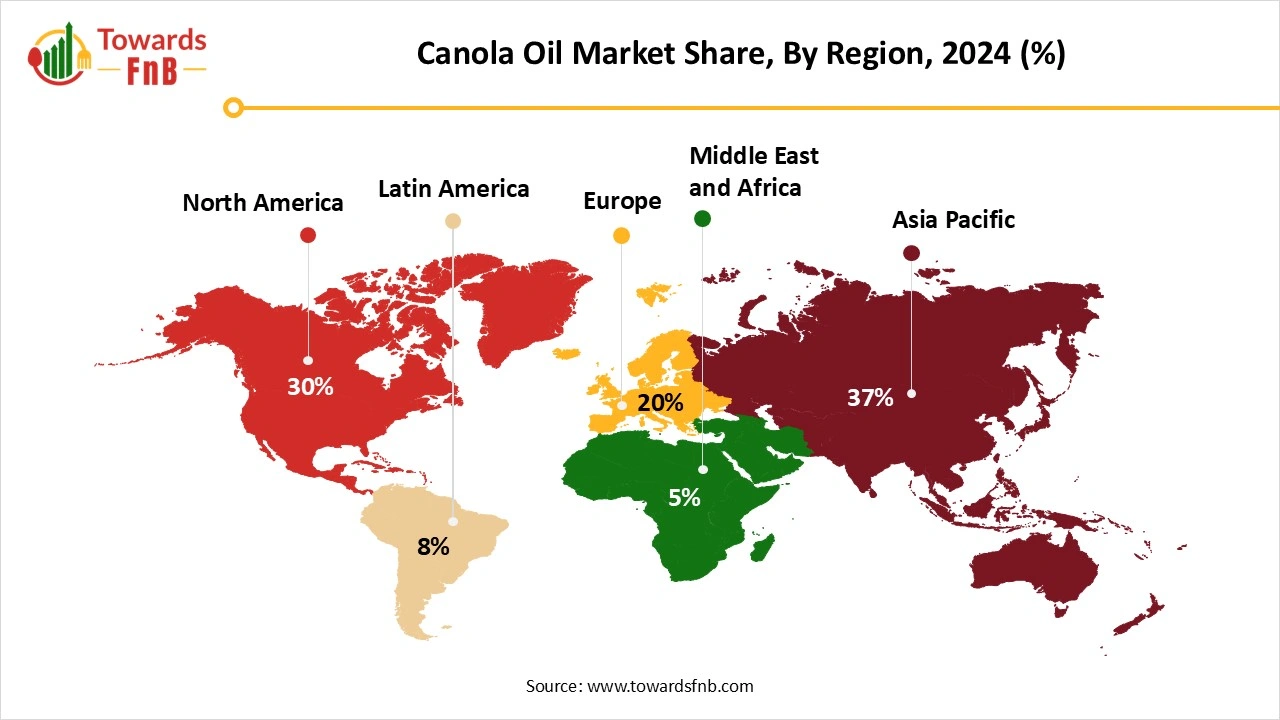

Asia Pacific Dominated the Canola Oil Market in 2024.

The overall demand for canola oil is rising over the years, which is due to changing consumer preferences towards healthier cooking oils. On the other hand, due to increasing health consciousness, rising urbanization, and a move towards healthier cooking oil. Countries like India, China, Japan, and South Korea are the main markets containing consumers who favor canola due to its low saturated fat and high omega-3 content. Furthermore, the food processing sector's growth and increasing disposable incomes are further boosting its consumption across the region.

China has regularly been a main importer of canola oil, with its rising middle class and growing awareness of health benefits due to demand. However, current regulatory changes in China, which include stricter import regulations and tariffs on agricultural products, influence the canola oil industry. The trade tensions between China and the main canola oil exporting countries, just as Canada, have also added to doubts in the market.

The demand for Canola Oil in India is growing is only due to health-conscious consumers but also due to the rising demand for cooking oil in emerging markets. Countries like India and China have experienced a growth in the utilization of canola oil due to its perceived health advantages and versatility in the cooking sector which contribute in the expansion of the canola oil market.

North America Expects Significant Growth in the Canola Oil Market During the Forecast Period.

This region is experiencing huge growth, which makes canola cultivation attention-grabbing for farmers in North America. According to the United States Department of Agriculture, the area reserved for canola exceeded 1 million hectares for the first time in the year 2024/2025. This shows a 13% rise from the previous year, and if the yield remains constant with the last session, the USDA expects a harvest of over 2.1 million tonnes.

Canada is the largest producer of canola oil in the world, accounting for the main portion of the global industry share. The country’s friendly climate conditions, effective supply of China and advanced agricultural practices have all contributed to its dominance in the sector. Canada is known for its strict quality standards with respect to canola oil production. The region’s producers stay rooted in rigorous regulations and undergo harsh testing processes to make sure that their products meet the highest quality standards.

The Processed Canola Oil Led the Canola Oil Market in 2024.

After harvesting of canola, they experience a series of processing steps for analysing and removing impurities. The processing of canola includes steps such as pressing, crushing, and refining to generate high-quality canola oil. The initial step in processing canola seeds for the oil. The overpowered seeds are then subjected to mechanical processing to extract the oil from the seeds. After interpreting the oil, it goes to the refining and filtering stage to remove impurities and improve the quality. The refining procedure includes degumming, filtering, neutralization, deodorization, and bleaching too to generate a clear refined canola oil suitable for intake.

The Virgin Canola Oil Segment is Expected to Grow at the Fastest Rate During the Forecast Period.

The demand for virgin oil has been steadily growing due to rising awareness of health and wellness among consumers. Virgin oils, such as virgin olive oil and cold-pressed coconut or sunflower oil, are taken out using mechanical methods without the use of chemicals or high heat. This procedure assists in retaining necessary nutrients, healthy fats, and antioxidants, which makes them a healthier alternative to refined oils. Furthermore, virgin oil is known for its natural flavor, richness, and aroma, which enhances the taste of food, especially in gourmet cooking and dressings. With the growing preference for organic, natural, and minimally processed foods, virgin oil has become famous among health-conscious individuals.

The Food Processing Segment Dominated the Canola Oil Market in the Year 2024.

It is utilized in huge amounts in baking, cooking, frying, and other applications because of its neutral taste and high smoke point. In recent years, there has been tremendous growth for healthier cooking oils, which is advantageous because canola oil is less saturated in fats and high in unsaturated fats, specifically in terms of omega-3, fatty acids. Canola oil is also utilized for frying due to its potential to maintain stability under high heat, which assists in preserving the texture and flavor of processed foods. Furthermore, its cost-effectiveness and long shelf life make it a preferred choice among food manufacturers for large-scale production.

The Food Service Segment is Expected to Grow at the Fastest Rate in the Canola Oil Market During the Forecast Period.

Canola oil is widely applied for its light flavor, versatility, and health advantages. It is prevalently used in commercial kitchens for deep frying, grilling, soldering, and baking because of its high smoke point and ability to maintain stability under high temperatures. Chefs and food service professionals choose canola oil for making a variety of food menus, from fried snacks to salad dressings. Additionally, its low saturated fat content and presence of omega-3 fatty acids make it a healthier option for customers, matching the rising demand for nutritious meals in cafes, restaurants, and catering services. Its affordability and long life further add to its appeal in large-scale food service operations.

The Supermarket and Hypermarket Segment Dominated the Canola Oil Market in the Year 2024.

Supermarkets sell canola oil in a variety of packaging formats to match different customer needs. It is presently utilized in plastic bottles, which are cost-effective and lightweight, making them perfect for everyday household usage. Premium brands serve canola oil in glass bottles to ensure quality and preserve freshness. For large families or food service buyers, canola oil is also sold in large containers, such as 3-3 litre or 5-litre jugs. Furthermore, spray cans are available for consumers who choose a more controlled way of applying oil during cooking.

The Online Segment is Expected to Grow at the Fastest Rate in the Canola Oil Market During the Forecast Period.

E-commerce platforms sell canola oil with the help of dedicated product listings on their site or mobile apps. Every listing typically includes good-quality images of the product, nutritional information, usage suggestions, and customer feedback too to help buyers make informed decisions. Online retailers can store canola oil in their fulfilment centers or warehouses under controlled conditions to maintain freshness and prevent damage, too. The oil is stored in dry storage areas, cool away from direct sunlight and heat. Inventory is managed effectively using digital tracking systems to ensure timely restocking and to follow the FIFO(First in First Out Method).

Challenge Butter

FairPrice Group

CME Group

Anchor

By Product

By Application

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025