April 2025

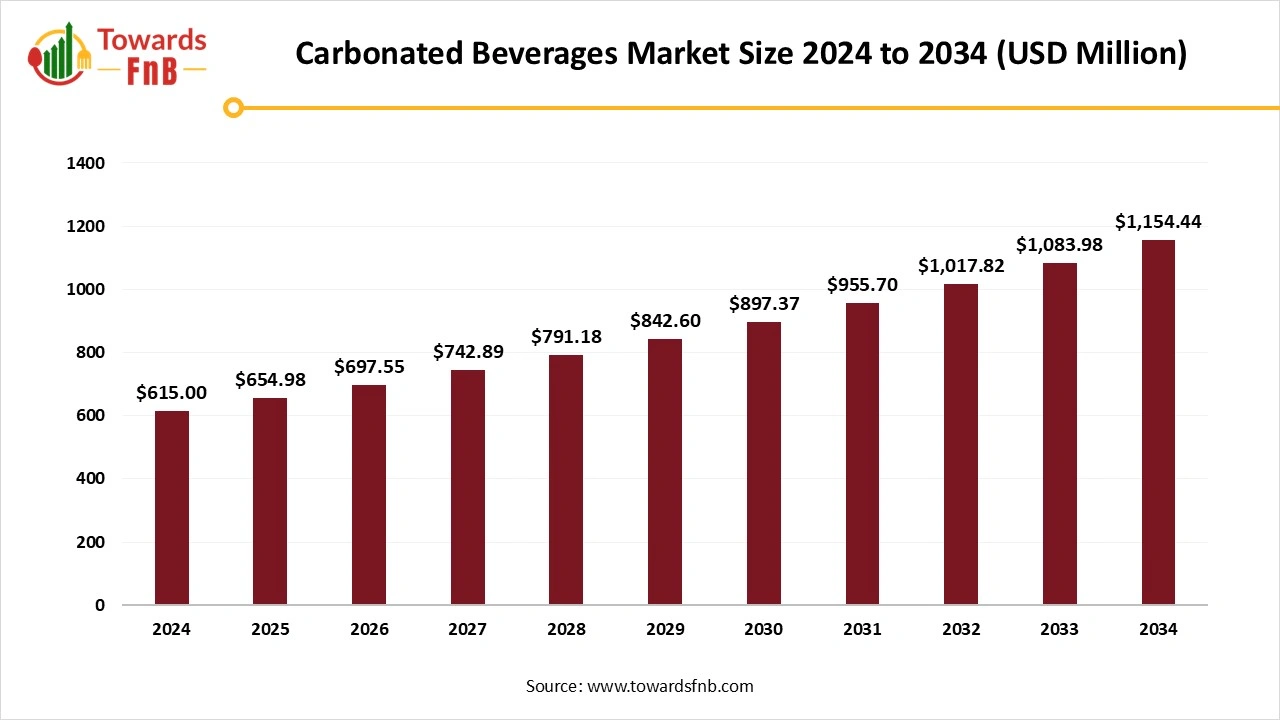

The carbonated beverages market size was valued at USD 615 million in 2024 and is forecast to rise from USD 654.98 million in 2025 to approximately USD 1,154.44 million by 2034, with a CAGR of 6.50% from 2025 to 2034. The market remains an important part of the beverage sector, propelled by elements like evolving consumer tastes, lifestyle trends, and promotional tactics employed by leading companies.

Carbonated drinks are beverages that have dissolved CO2 for a variety of purposes including soft drink, energy drink, juices, coffee etc. From the viewpoint of consumers, many enjoy the bubbly feeling and appreciate the subtly different flavor that carbon dioxide adds. The carbonation method creates distinct fizziness and bubbles in these beverages, stemming from CO2 that is dissolved in a liquid under pressure. Owing to the diverse preferences of individuals, several kinds of beverages based on fruit, vegetables, water, and milk might be carbonated.

The increase in consumer interest in carbonated soft drinks, known for their various flavors and enjoyable character, fuels the expansion of this market segment. The ability of sector to innovate by offering new flavors and product variations meets consumer preferences, which propels market expansion. Carbonated drinks can extend feelings of fullness to post-meals more effectively than regular water. They might assist in keeping food in your stomach for extended times, making you feel more satisfied.

Over the years, it has become common for fast food chains, particularly major brands such as McDonald's, KFC, Subway, and Dominos, to include carbonated drinks in their menus. This is because it produces substantial earnings for the restaurants further boosting the market. As greater numbers of individuals relocate to cities, there is a change in living habits and buying behaviors due to urbanization. City dwellers generally possess greater purchasing power and are more willing to invest in high-end and luxury items, such as carbonated drinks. The extensive range of carbonated drinks, from well-known brands to specialty and artisanal options, meets the varied tastes of city dwellers.

Producers are consistently launching novel and enticing flavors to meet evolving consumer tastes and to set their offerings apart from rivals. The market for carbonated beverages is swiftly changing, as new products and trends regularly arise to cater to shifting consumer tastes. As the market keeps changing, it’s evident that the future of carbonated beverages depends on their capacity to merge flavor, function, and creativity.

Brands that adeptly manage these trends and provide products aligning with consumer demands are strategically poised for achievement in this vibrant and evolving industry. By employing cutting-edge flavor technologies, producers can craft drinks that not only have excellent taste but also deliver a delightful and unforgettable drinking experience. The beverage packaging industry is vital within the broader packaging sector as it ensures beverage freshness and safety while enhancing visual attractiveness to extend shelf life.

Rising prevalence of various diseases like diabetes and obesity increases health awareness among consumers and hampers the carbonated beverages market. Obesity and being overweight are significant health issues confronting all of humanity today. Soft drinks emerge as a significant source of the issue being discussed. There is compelling evidence indicating that the intake of sugar sweetened beverages, characterized by high energy and low nutrients, correlates with a heightened risk of obesity, dental curries, early puberty and aggressive behaviors in children and adolescents, as well as obesity, diabetes, and other chronic diseases in adults.

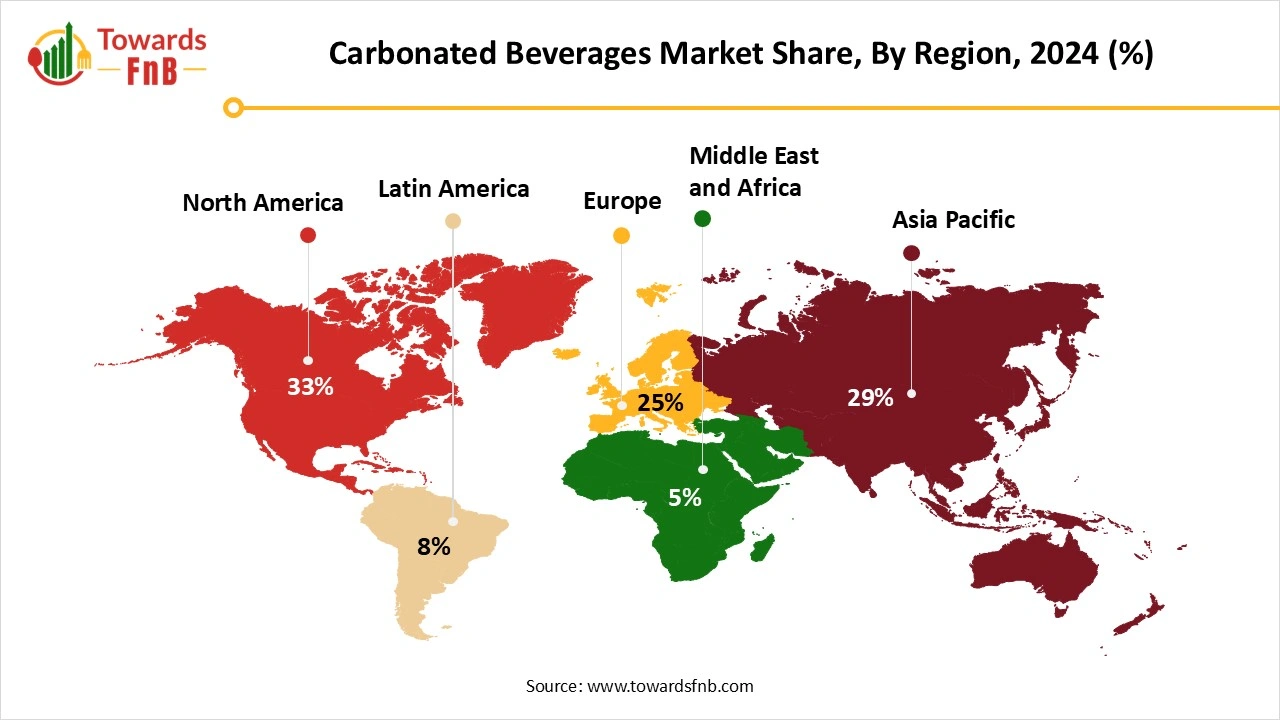

North America Dominated the Carbonated Beverages Market in 2024.

Approximately one-third of the total American population tends to eat fast food every day. Almost every meal paired with a fizzy carbonated drink at fast food restaurants has boosted the North American carbonated soft drinks market, which has experienced remarkable growth in recent years. Fast food restaurants such as McDonald's or Domino’s Pizza have turned soft drink ordering into a regular practice by including these fizzy drinks in their budget-friendly meal deals. This subtly pressures consumers to choose meals rather than individual dishes, which aids in increasing carbonated drink sales.

To combat obesity, various nations are moving towards implementing a sugar tax on beverages that contain over 5 grams of sugar per 100 ml. Renowned brands such as Coca-Cola and PepsiCo have launched either sugar-free beverages or soft drinks containing reduced sugar levels to avoid the tax and enhance consumer sales with healthier options. This has provided a lift to the North America carbonated soft drinks market and will shape its expansion in the years ahead.

Asia Pacific Expected the Fastest Growth in the Carbonated Beverages Market During the Forecast Period.

Easy-to-access and revitalizing drinks are increasingly sought after because of swift urban growth and busy lifestyles. Carbonated beverages fulfill this demand because of their convenient formats and claimed capacity to boost energy. Because of the hectic lifestyles of consumers, fizzy drinks have become popular. The market for low-calorie fizzy drinks has grown because of increasing consumer interest in clean-label, gluten-free, low-calorie, and low-care products in the food industry is further contributing in the market expansion. The overall market for functional drinks is growing, and consumers are becoming more aware of their health, which has increased the demand for low-calorie drinks that collectively drives the growth of the carbonated beverages market in the region.

Emerging Beverages Market in India

Carbonated beverages market of India is a vibrant and swiftly changing industry, marked by substantial growth propelled by urbanization, rising disposable incomes, and a youthful, adventurous consumer demographic. Key companies such as Coca-Cola, PepsiCo, and Parle Agro lead the market, providing an extensive selection of flavored soft drinks, sparkling water, and energy beverages. Present trends emphasize health and wellness, resulting in the launch of low-sugar and functional drinks. The marketplace is experiencing a rise in online sales and digital marketing initiatives. Eco-friendly packaging and corporate social responsibility efforts are growing more significant in influencing the future of the industry.

The Carbonated Soft Drinks Segment Dominated the Carbonated Beverages Market with the Largest Share in 2024.

Product innovation has emerged as a vital differentiator in the carbonated soft drink industry, with producers launching distinctive flavors and formulations to attract consumer attention. Leading producers are adapting to these changes by altering their products to contain less sugar and more natural ingredients. Today's consumers tend to emphasize convenience, leading to a significant portion of their daily purchases consisting of single grab-and-go items instead of traditional bulk products.This has resulted in long-lasting innovations and sustainable packaging, created from clean, renewable resources, with reduced preservatives and chemicals.

The carbonated sports & energy drinks segment is expected to grow at the fastest rate in the carbonated beverages market during the forecast period. People who aware about their health and fitness often seek simple methods to sustain their active routines. Energy and sports beverages provide a fast and convenient method to rehydrate, replenish lost electrolytes, and increase energy levels without needing extensive preparation. They can also be consumed while on the move, which aligns perfectly with the busy routines of individuals focused on reaching their health and fitness goals.

The Cola Flavor Segment is Held the Largest Share of the Carbonated Beverages Market in 2024.

Cola flavored fizzy drinks are effervescent drinks that have a flavor like traditional colas. The main contemporary flavourings in a cola beverage consist of citrus oils, cinnamon, vanilla, and an acidic taste. Cola drink producers incorporate subtle flavourings to establish unique flavors for every brand. Trace flavourings can comprise a diverse range of components, including spices such as nutmeg or coriander. Cola flavor complements cocktails, wine, burgers, meat, barbecue, savory dishes, pastries, bread, steak, pasta, rice, vegetables, chicken, sweet corn, butternut squash, popcorn, and seafood and thus boosting the market.

The fruit-based flavors segment is observed to grow at the fastest rate in the carbonated beverages market during the forecast period. Public knowledge regarding the nutritional value of drinks has peaked, particularly as governments globally impose higher taxes on sugary soft drinks. Numerous individuals link fruit with both nature and wellness, and the market's acceptance of fruit aligns with a broader movement toward healthier drink choices.

The Hypermarkets & Supermarkets Segment Held the Dominating Share of the Carbonated Beverages Market in 2024.

The segment of supermarkets and hypermarkets leads the market due to increasing soft drink sales in different areas. The growth of this channel has been driven by their bulk buying deals, price reductions, and ease of use. Supermarkets are prevalent and readily available to shoppers, situated in both city and countryside regions. This availability guarantees that customers can effortlessly buy soft drinks whenever they require them. Additionally, supermarkets frequently operate for longer hours, allowing customers to purchase carbonated beverages at any hour of the day.

The online stores & D2C segment is seen to grow at a notable rate during in the carbonated beverages market during the predicted timeframe. Shoppers are progressively relying on online platforms for convenient access to a diverse range of drinks, encompassing niche and high-end choices. Online grocery delivery apps have been increasing their inventory of drinks to meet demand. Zepto now displays a banner on its homepage to showcase ‘hydration heroes’ featuring pictures of tender coconut, watermelon, and muskmelon. Likewise, Swiggy has experienced a 28% increase in the demand for cold beverages and juices.

Spindrift Beverage Co. Inc.

Bloom Nutrition

By Product

By Flavor

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025