The global malted wheat flour market size was estimated at USD 46.68 billion in 2024 and is expected to rise from USD 49.39 billion in 2025 to nearly reaching USD 82.03 billion by 2034, growing at a CAGR of 5.80% from 2025 to 2034. The demand for malted wheat flour is due to its rich in vitamins, minerals, and enzymes that make it a common ingredient in health-focused food products due to health awareness among consumers of naturally processed foods.

Malted wheat flour is a kind of flour made from the inner endosperm of barley kernels, and on the other hand, malted flour also contains the outer bran and germ. It is low in gluten as compared to regular flour, while malted flour has a higher gluten content and a stronger color than regular flour. The growth factor of malted wheat flour concerns nutritional and enzymatic compounds, which are either produced or enhanced during the malting process (which is the sprouting or dying of wheat process). Consumers also choose recognizable, minimal ingredients, so malted wheat flour fits well as it improves flavor, taste, texture, and fermentation, especially in artisanal breads available in the market.

Malted wheat flour represents a strong market potential, fueled by changing consumer preferences and growing food and beverage industry trends. As people become more health conscious and interested in clean-label products, malted wheat flour stands out due to its natural enzymatic activity, increased flavor profile, and functional benefits. It is especially useful in artisan baking, where it improves dough fermentation, texture, and shelf life, making it more appealing to both amateur bakers and professional bakeries looking to differentiate their offerings.

One of the most pressing challenges is the regulation of enzyme activity, notably amylase. While enzyme activity is desirable in tiny levels, it can result in extremely sticky dough, poor gluten structures, and gummy breadcrumbs, lowering product quality. This makes it critical to control the amount utilized or to pick between diastatic (active enzymes) and non-diastatic (inactive enzymes) versions based on the intended outcome.

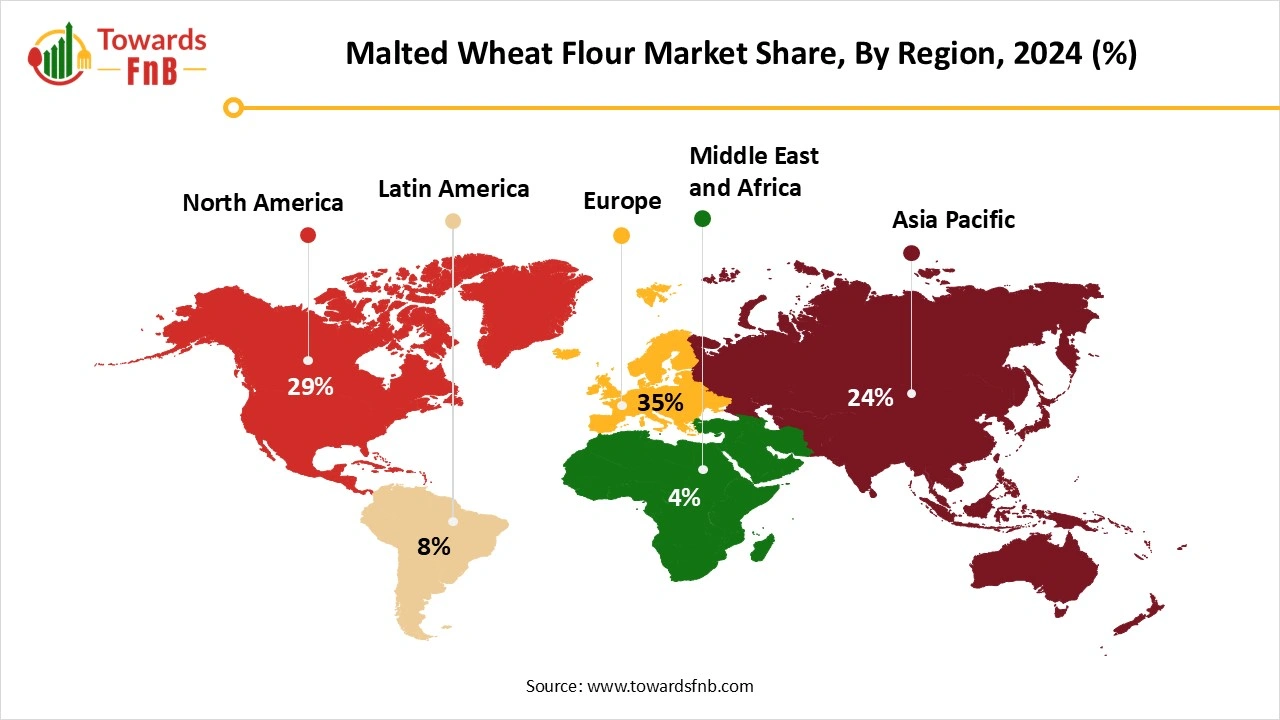

Europe Dominated the Malted Wheat Flour Market in 2024.

One of the key factors behind Europe’s dominance is the popularity of traditional breads such as German rye loaves, French pain de campagne, and Italian ciabatta all of which often benefit from the flavor, color, and texture enhancements provided by malted wheat flour. European bakers are known for their precise formulations and attention to ingredient quality, making malted wheat flour a staple in both artisanal and commercial applications.

The widespread use of malted wheat flour in German baking, particularly in sourdough and wholegrain breads, where the non-diastatic version is used to deepen flavor and create a rich, caramelized crust without affecting the dough’s enzymatic balance.

Asia Pacific Expects Significant Growth in the Malted Wheat Flour Market During the Forecast Period.

This growth is due to several reasons, such as changing dietary preferences, growing disposable incomes, and expanding populations. Wheat flour is hugely consumed in nations like China and India, where it is a compulsory ingredient in many regional cuisines like bread and noodles. Additionally, the rising popularity of baked goods and confectioneries in the region, alongside the functional benefits of malted wheat flour, such as improved dough handling and flavor enhancement.

North America Expects the Significant Growth in the Malted Wheat Flour Market During the Forecast Period.

It is used to produce whole-grain bread, cereals, and other baked goods, which are marketed as healthier alternatives. The rising awareness of the nutritional advantages of whole grains drives the demand for malted wheat flour as a compulsory ingredient in health-focused food products. The secondary reason is the rising demand for malt extract and food preparations of flour, meal, and starches in the United States, the market is projected to continue an upward consumption trend over the next decade.

The Bakery and Confectionary Segment Held the Dominating Share of the Malted Wheat Flour Market in 2024.

Malt extract acts as a natural enhancer of flavors by consolidating sweet and toasted flavor in baked products. This is specifically valuable in whole-grain or rye bread in which the grains can impart a more bitter or earthy flavor. Due to this, malt extract makes goods more flavourful and enhances their perceived quality. It is occasionally used in rustic and artisanal bread in which consumers want rich and complex flavor.

The food and beverage segment are expected to grow at the fastest rate during the forecast period. Beyond baking, malted wheat flour is used in breakfast cereals, health bars, and snack foods to give nutritional value, moderate sweetness, and enhanced texture. Its high vitamin, mineral, and amino acid content makes it ideal for use in health-related products. Malted wheat flour is used in the beverage industry, particularly in brewing, to provide fermentable sugars and enzymes, which are important for taste development and fermentation efficiency. It is also becoming more popular in non-alcoholic malt beverages, where it improves taste while providing a natural, wholesome profile.

The Diastatic Segment Held the Dominating Share of the Malted Wheat Flour Market in 2024.

Utilizing diastatic malted wheat flour in yeasted baked goods can make a huge difference in the rise, color, and texture. The enzymatically active ingredient is extremely crucial for those who work with fermented sourdough-based dough and organic, home-millet and whole wheat flours. It is made from specifically barley, sprouted grain, and diastatic malt powder leans towards flavor, color, and texture in terms of yeasted doughs.

The non-diastatic segment expects the significant growth in the malted wheat flour market during the forecast period. the non-diastatic malted wheat flour plays a specialized role in baking, particularly where flavor and appearance are key, rather than fermentation support. During the malting process, wheat grains are sprouted to activate natural enzymes, but in the case of non-diastatic flour, these enzymes are deliberately neutralized through controlled drying or roasting. This results in a product rich in complex sugars and aromatic compounds, but without enzymatic power. Its flavor profile is more developed than that of regular wheat flour, often described as nutty, toasty, or slightly caramel-like, making it a valuable ingredient in premium and craft baking.

Nestle

Woolworths

By Application

By Product

By Region