April 2025

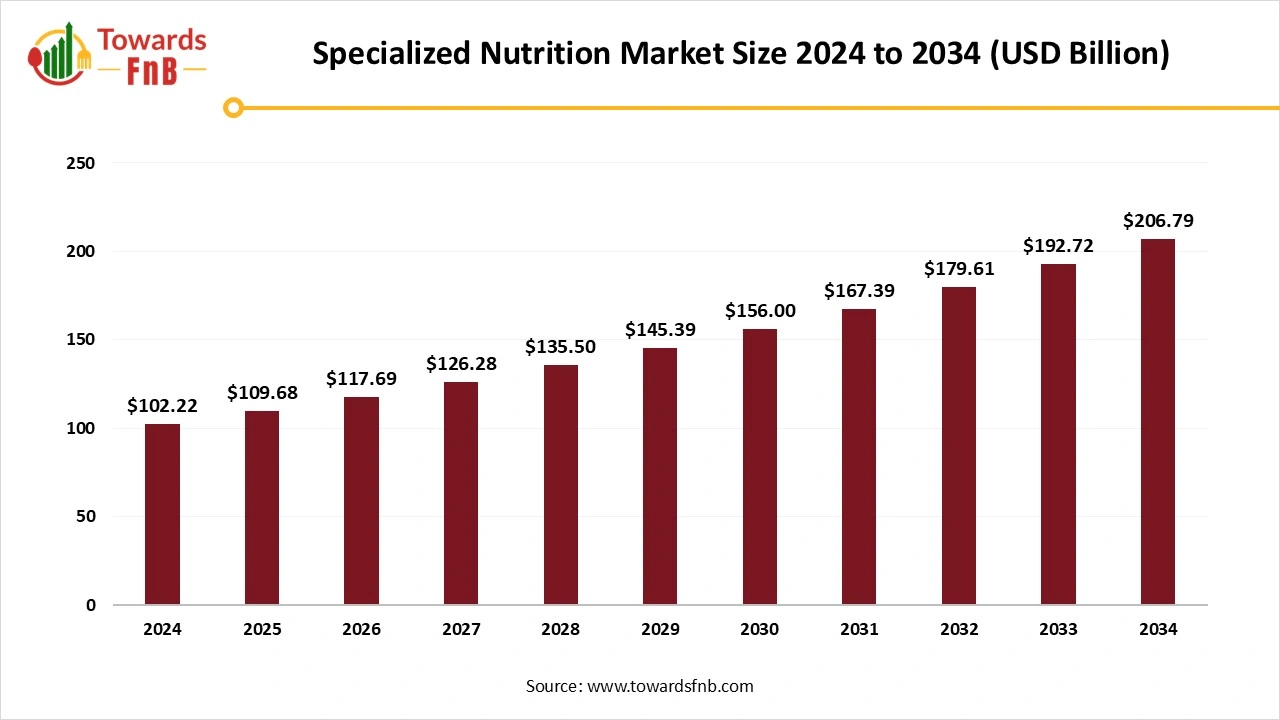

The specialized nutrition market size was estimated at USD 102.22 billion in 2024 and is expected to rise from USD 109.68 billion in 2025 to nearly reaching USD 206.79 billion by 2034, growing at a CAGR of 7.30% from 2025 to 2034. The need of having nourishment that is customized to meet their individual health demands is becoming increasingly apparent to consumers. The market for specialized nutrition is being driven by this increased awareness.

Specialised nutrition products aid consumers to take diet properly while completing their demand of required nutrition and are needed for babies and young children, patients with various disease like the obesity, diabetes, cancer for management of the disease, athletes require specialized nutrition for energy and muscle management. All these nutritional requirements from consumers expanding the specialized nutrition market. The World Food Programme utilizes specialized nutritional food to enhance the nutritional diet people all around the world. This specialized nutrition includes Fortified Blended Foods and Ready-to-Use Foods and High-Energy Biscuit to micronutrient powders.

Rising health awareness among consumers including millennials and gen Z developing the importance of specialized nutrition as the people with allergies, health problems and food tolerance looking for specialized food, this increasing awareness expanding the specialized nutrition market. Rising prevalence of diseases like diabetes, obesity, cancer and heart problems increasing the demand for specialized nutrition like medical foods and supplements. Older demographic is constantly looking for nutrition to improve their day to days activities and demand for ready to eat meal fostering the market.

Increasing prevalence of chronic disease, rising older demographic, increasing infant population spurring the demand for medical nutrition. Various industries in health care sector are focusing on development of the medical nutrition and creating the opportunities for further development. By focusing on safe and effective nutritional development companies are formulating innovative product range. Further technological advancement and digitalization increasing the demand for specialized nutrition products and therefore manufacturers are creating digital platform for ease of consumers.

Production cost of premium specialized nutrition and personalized products, stringent regulatory compliances add to the higher cost of the products. Further, scalability of the technology like DNA testing microbiome analysis is not affordable. It becomes hard for middle class and low-income consumers to buy specialized nutrition products. Because of higher prices of the products consumers are buying general nutritional products with cheaper prices, which can lower the growth of the specialized nutrition market.

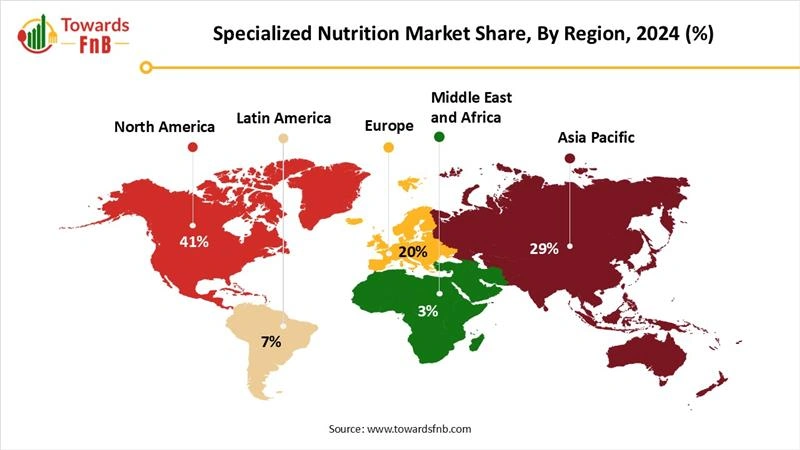

North America Dominated the Specialized Nutrition Market with the Largest Share in 2024.

Increasing health awareness is the significant driving factor for the expansion of the specialized nutrition market. Specialized nutrition products are in high demand due to the growing prevalence of lifestyle related disorders, rising healthcare expenses, and increased global awareness of the importance of nutrition. Due to evolving developments in nutritional research and technology, producers are creating unique, tailored goods to meet a range of customer needs.

Upsurging Specialized Nutrition Market of United States

Specialized nutrition market of United States is growing significantly as the demand for the tailored nutrition for health management is upsurging. Prevalence of chronic disorders like obesity, diabetes and cancer is more and thus, increasing the demand for the specialized nutrition. According to Centers for Disease Control and Prevention, 6 in 10 Americans suffer from at least one chronic disorder, and 4 in 10 suffer from two or more chronic disorders. Increasing elderly population, demand for specialized infant nutrition and increasing popularity of sports and fitness propelling the market.

Europe Observed to Grow at the Fastest Rate in the Specialized Nutrition Market During the Forecast Period.

Increasing malnutrition in Europe is important driving factor for the boosting of specialized nutrition market. Malnutrition is widespread in the Europe and almost 33 million are at risk. The demand for different specialized nutritional supplements is expanding due to the growing trend of adopting healthy lifestyles, which is being driven by growing awareness of lifestyle diseases and the associated healthcare expenses. Furthermore, the demand for plant-based protein supplements has increased because of the growing popularity of plant-based diets. The supply of personalized nutrition is changing because of the incorporation of digital health technologies like wearable technology and smartphone apps. These tools improve the effectiveness of nutrition solutions by allowing consumers to monitor health markers and track their nutritious intake.

The Proteins and Amino Acids Segment Held the Largest Share of the Specialized Nutrition Market in 2024.

Increasing number of health-conscious consumers and daily requirement of protein uptake fostering the market. Protein supplements are significantly consumed by athletes and people to enhance muscle mass and strength. Protein and amino acid specialized nutritional products serve as easy option for those with a hectic schedule and facing decreased appetite after workout.

The Prebiotics & Probiotics Ingredient Segment is Seen to Grow at a Notable Rate During the Predicted Timeframe.

In health-conscious world, there is an exponential increase in demand for items that promote total well-being. Because they provide a natural and comprehensive way to maintain gut health and strengthen the body's immune system, pre and probiotics have become important participants in the health and wellness revolution. The market for prebiotic and probiotic products is expanding significantly as consumer knowledge and interest in preventive healthcare continue to rise. Furthermore, individualized nutrition is becoming more and more important, and new technologies like microbiome analysis and genetic testing enable customized probiotic and prebiotic compositions to suit individual requirements. It is projected that this emphasis on product diversification and personalization would spur market expansion and draw in a larger customer.

The Elderly Nutrition Segment Held the Dominating Share of the Specialized Nutrition Market in 2024.

The elderly nutrition has grown significantly in recent years due to improvements in healthcare and longer life expectancies. Numerous important variables are the main drivers of this expansion. First of all, older people are becoming more conscious of the role that nutrition plays in preserving general health and wellbeing. Age-related problems demand specific dietary solutions because people's nutritional needs alter as they become older. The growing trend in the elderly nutrition market to meet the specific nutritional needs of this group is shown in the rising usage of dietary supplements and nutraceuticals among older persons. The desire for better health and quality of life among the aging population is fueling the market expansion.

The Sport Nutrition Segment is Expected to Grow at the Fastest Rate in the Specialized Nutrition Market During the Forecast Period.

Growing knowledge of the advantages of exercise and a healthy lifestyle is driving the sports nutrition. Demand for goods that promote performance improvement, recuperation, and general wellness is rising as more people participate in fitness activities. Innovations in product formulations that meet the varied needs of consumers, from athletes to fitness enthusiasts, are driving the expansion of the market. Growing health consciousness and the expansion of retail distribution channels are important factors driving market expansion. Increasing health consciousness and government programs encouraging fitness and well being have a big impact on the use of nutrition products in many major markets throughout the world.

Cargill

Danone

By Ingredients

By Application

By Region

April 2025

April 2025

April 2025

April 2025