April 2025

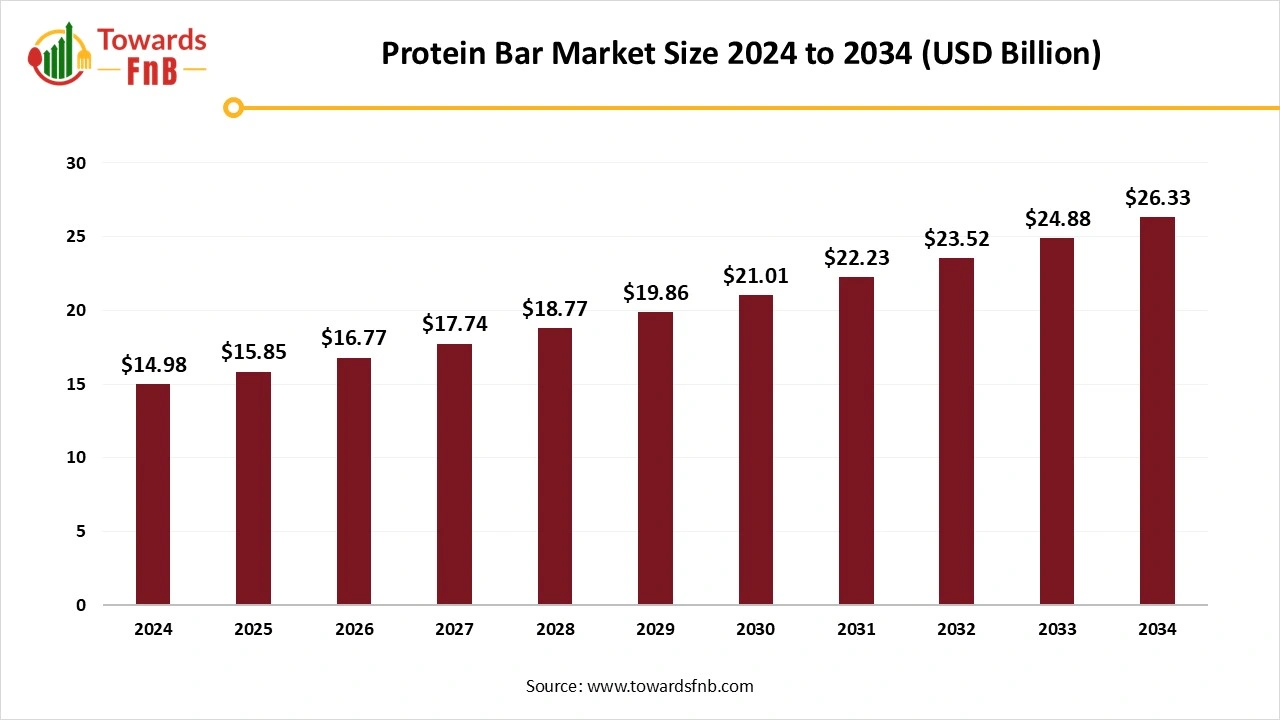

The global protein bar market size was projected to grow from USD 14.98 billion in 2024 to USD 26.33 billion by 2034, reflecting a CAGR of 5.80% during the forecast period from 2025 to 2034. The desire for easy and healthy snacking choices has greatly influenced the rise of protein bars, especially among athletes, fitness lovers, and those looking for snacks.

Protein bars are fantastic nutritional aid for athletes, assisting in the construction and repair of connective tissues. Recent sports research has concentrated on formulating various nutritional bars because of rising consumer demand, their high nutritional content, and the rapid energy they provide for the metabolic functions of body. It is important to note that protein-rich energy bars are recognized as a superior nutritional aid for athletes, supporting muscle development and boosting the market of protein bars.

Rising prevalence of diseases such as obesity and diabetes increasing the demand for protein to lose weight. From 1999 to 2017, the obesity rate in U.S. adults rose significantly from 31% to 42%, with survey data showing that 25–34% of adults attempting to lose weight used dietary supplements, viewed as affordable, safe, and effective. In 2015, protein was the leading weight management product consumed in the U.S., as reported by the Council for Responsible Nutrition.

The market for protein bars has been driven by consumer demand for nutritious foods and healthier snacking options. Additionally, due to the increasing demand for enriched food, energy bars fortified with high protein are sought after. Health consciousness has prompted consumers to incorporate ingredients from fruits and vegetables into their diets, thereby increasing the demand for nutritious snacks. Moreover, the hectic routines of today’s consumers fuel the need for convenient food choices that maintain nutritional quality. Consequently, protein bars are increasingly becoming essential in the diets of health-aware people, significantly boosting market expansion.

In addition to protein, protein bars are currently being designed with extra functional components like fiber, antioxidants, vitamins, and adaptogens to offer greater health advantages, including improved digestion, immune support, and stress relief. The latest purchase of Clif Bar by Mondelez International Inc. for almost $3 billion highlights the increasing interest from major corporations and consumers in discovering and investing in the next top protein bar.

Nowadays manufacturers are combining flavor and texture to craft thrilling sensory experiences. The outlook for protein bars appears bright, as ongoing innovation and product advancement fuel market expansion. As consumer tastes change, we can anticipate an increase in personalized and practical protein bars becoming available. Increasing trend of protein bars developing the opportunities for innovative protein bars like hybrid protein bars and fermented protein bars.

A range of alternative products is easily accessible in the market for protein supplementation, including protein cookies, protein powders, protein shakes, and beverages infused with protein. Additionally, other items like multivitamin bars and various snack bars that offer essential nutrition are on the market, likely posing a challenge to market growth.

North America Dominated the Protein Bar Market and Held the Largest Share in 2024.

The North American protein bar market is undergoing notable changes influenced by shifting consumer awareness of health and fitness trends. The rising focus on active living is reflected in the notable rise in gym memberships, as around 64.19 million Americans were health club members in 2023. Protein bars are gaining popularity as convenient nutritional options. Shoppers are looking for functional food choices that meet health-focused lifestyles and dietary requirements, driving the demand for organic, plant-derived, and keto-friendly protein bars. Moreover, sports nutrition companies are broadening their product lines with creative formulations to appeal to fitness lovers and athletes.

The protein bar market in the United States has experienced notable growth fueled by increased consumer awareness of health, a growing need for convenient nutritional snacks, and the rise of fitness and wellness trends. Protein bars are considered handy alternatives for meals or snacks, particularly for individuals with hectic lifestyles.

The Protein Bar Market in the Asia Pacific is Anticipated to Grow at the Fastest Rate in the Predictive Timeframe.

The rising health-awareness among consumers in the Asia Pacific region has greatly driven the demand for protein bars. As consumers move towards healthier diets and seek convenient products, protein bars have emerged as a popular snack choice. This increase is particularly evident in nations such as China and India, where protein consumption is becoming significant within the wellness community.

The protein bar market in China is very concentrated, featuring several key players that control the market share. These major entities possess a robust brand identity, broad distribution channels, and a variety of product offerings. Innovation is a key feature of this market, as producers are continually launching new flavors, formats, and ingredients to meet consumer needs. Rules are essential in influencing the protein bar industry. Strict safety and quality regulations guarantee the safety and quality of products accessible to consumers.

Sports Nutritional Bars Dominated the Market and Held the Largest Share in 2024.

The growing preference for a healthy and active lifestyle is a key factor impacting the industry. The growing appeal of yoga, meditation, and physical activity significantly affects individuals' motivation to pursue active lifestyles. The rising desire for the perfect physique, especially among the youth, is expected to drive market expansion. When it comes to illness or disease, consumers favor preventive measures rather than treatment options. Moreover, the market is growing due to the rising awareness of the importance of sports nutrition in maintaining health and promoting an active lifestyle.

The meal replacement bar is observed to grow at the fastest rate during the forecast period from 2025 to 2034. The contemporary lifestyle suggests extended working hours with alterations in dietary practices, resulting in a notable decrease in both the quantity and frequency of traditional meals consumed daily. As a result, requests for meal quality regarding its nutritional and functional attributes persist. Moreover, the modern way of living is progressively associated with physical activities and sports to promote health.

These products effectively replenish energy and nutrients consumed right after physical activity while also conserving meal prep time and thus, increase the demand for meal replacement bars. Individuals are increasingly choosing meal replacement bars; nevertheless, these bars offer rapid nutrition without sacrificing quality.

Animal-Based Protein Bars Segment Held the Dominating Share of the Protein Bar Market in 2024.

Animal protein is widely acknowledged to possess greater nutritional quality and this refers to its amino acid makeup, digestibility, and capacity to carry other essential nutrients like calcium and iron. Moreover, its technological capabilities like gelling, emulsifying, and foaming, contribute to the attractive texture and sensory qualities of food, increasing the demand for animal base protein bars.

Plant-based protein bars segment is expected to grow at the fastest rate in the market during the forecast period. Plant-based proteins bars have garnered growing attention. Consumers are progressively seeking plant-based food choices, whether for sustainability, health, or ethical motives, and food companies are addressing this demand with numerous new plant-based options.

The Supermarkets and Hypermarkets Segment Held the Largest Share of the Market in 2024.

These retail outlets like supermarket and hypermarkets provide a wide range of protein bars featuring various packaging sizes, brands, and price ranges to meet the diverse tastes of consumers. Prominent supermarket chains including Walmart, Kroger, and Target have robust distribution networks throughout the area, ensuring protein bars are readily available to shoppers. Having various choices boosts customer contentment and promotes repeat buying.

The online segment is seen to grow at a notable rate during the predicted timeframe. The trend in e-commerce, characterized by purchasing in multipacks instead of single items and the growth and solidification of direct-to-consumer partnerships, will keep positively influencing bar sales. Additionally, appealing online ads and promotions on high-quality protein bars entice customers to purchase those items.

By Type

By Protein Source

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025