April 2025

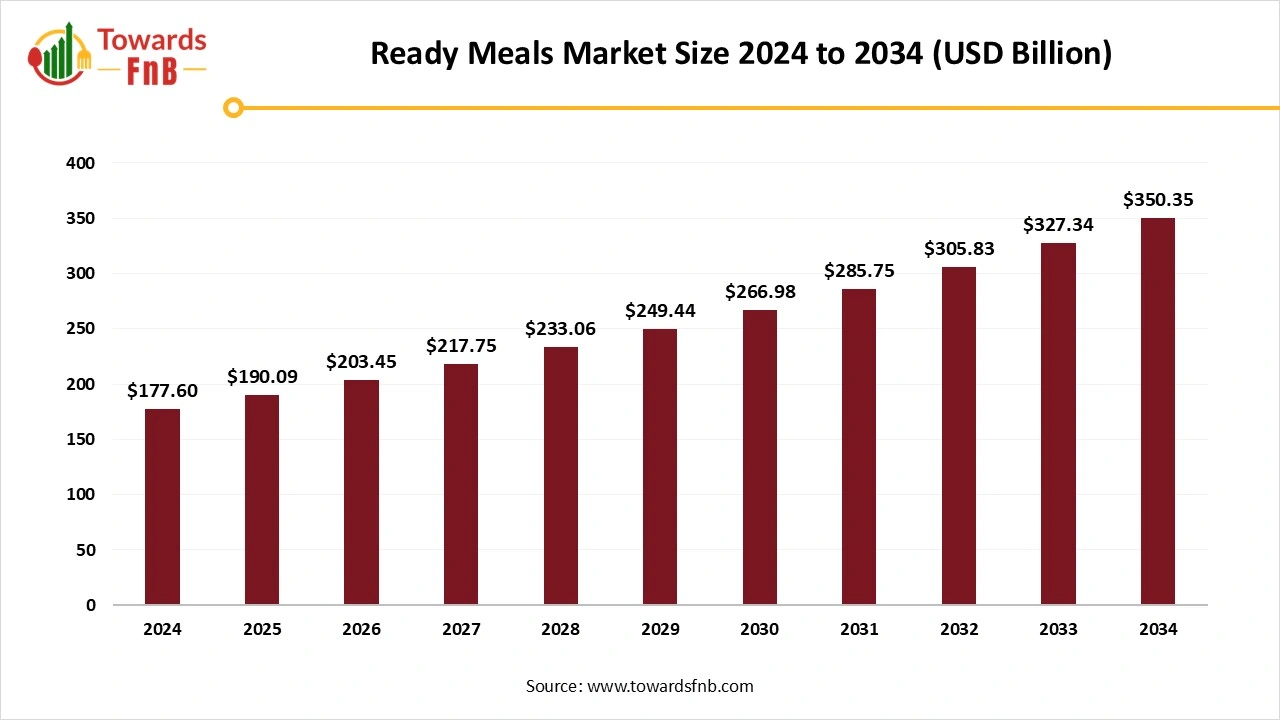

The global ready meals market size valued at USD 177.6 billion in 2024 and is forecast to grow from USD 190.09 billion in 2025 to USD 350.35 billion by 2034, with a CAGR of 7.03% during the period from 2025 to 2034. The growing demand for the processed food drives the growth of the market.

The ready meals market deals with cooked dishes that don't need extra processing or preparation before eating. Their ease of use is saving effort and time and makes them desirable and conveniently stored. Consumers have a growing preference for ready-to-eat food products due to the fast-paced schedules of working individuals and students. According to individual tastes and preferences, packaged meal options vary. In addition, factors such as speedy delivery options, more diverse choices available on offer online, and better food quality greatly impact customer satisfaction with this type of service are expected to drive the market growth.

The growing demand for convenience food further drives the growth of the market. The demand for convenience and ready-to-eat foods is continuously increasing since they save effort and time for working professionals with lifestyle changes. Through the growing interest in innovative packaged foods, GenZ, and millennials are enhancing the introduction of premium quality products. In addition, the increased demand for convenient food enables formulators to enhance trending consumer willingness and increasing demand for nutritious and premium ready-to-eat foods is further expected to drive the growth of the market.

Various food companies use technology to make ready meals more transparent and convenient for customers. While smart labels help keep food fresh for longer, self-heating packaging allows people to enjoy hot meals without needing a stove or microwave. These innovations make meals easier for busy consumers and reduce food waste. The self-heating ready meals packaging shows the increasing demand for on-the-go and easy meal options. In addition, QR codes also transforming the way the consumer is friendly with food packaging. Shoppers can instantly see preparation tips, ingredient sources, and nutrition facts, by scanning a QR code. This helps customers make informed choices and it is easier to check for the brand’s sustainability efforts, which further creates growth opportunities and enhances the growth of the ready meals market in the coming years.

Some consumers believe prepackaged foods to be of lower quality when compared to freshly cooked meals. Adopting these low-quality meals may be hampered by this concept, especially among consumers who value restaurant-made and freshly created meals. It can be difficult to challenge uniformity in texture and flavor across a variety of fully ready meals. It can be challenging to maintain the ideal textures and tastes during the packaging process and manufacturing, a variety of which may affect the entire eating experience of consumers, which is expected to restrain the growth of the ready meals market.

North America Dominated the Ready Meals Market in 2024.

The market growth in the region is attributed to the increasing popularity of ready-to-eat meals, increasing accessibility, convenience, and mobility, the value of packaged organic, vegan, and gluten-free foods, rising health consciousness, and worries about food safety. The region is the third most active market for product launches. The U.S. and Canada are dominating countries driving the market growth attributed to the increasing convenient meal delivery services.

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is driven by the increasing demand for saving effort and time in cooking meals for dinner and breakfast, the rising development of ready meals, the rapid adoption of Western food trends, and increasing preference towards changing lifestyles. In addition, evolving consumer preferences, burgeoning middle class, growing awareness of food safety and quality, and the rise of modern retail formats, such as hypermarkets and supermarkets. China, Japan, India, and South Korea are the fastest growing countries in the region. China is the second largest country in ready meals across the globe driven by caterers. The increasing availability of diverse cuisines and flavors and the widespread adoption of ready meals are further anticipated to drive the growth of the ready meals market in China. India is also a significant country driving the market growth.

The Frozen Meals Segment Dominated the Ready Meals Market in 2024.

The segment growth in the market is attributed to the increasing product launches and the increasing convenience of frozen food. Frozen meals are economical, offer explicit cooking directions, and leave no room for under-cooked and error food. As compared to fresh foods, frozen meals have a longer shelf life.

The Shelf-Stable Segment Expects Significant Growth the Market During the Forecast Period.

Shelf-stable meals can be consumed at room temperature and do not require refrigeration. They are often referred to as emergency meals when regular food cannot be offered, as these are affordable. The increasing product launches are the major driver fueling the segment growth.

The Non-Vegetarian Segment Dominated the Ready Meals Market in 2024.

The segment growth in the market is driven by increasing product launches by key players, rising hygiene issues with fresh products, increasing consumer preference towards frozen non-vegetarian packaged food, and increasing demand for protein-rich food items such as value-added salami, sausages, and chicken nuggets.

The Vegan Segment is Expected the Substantial Growth in the Market During the Forecast Period.

The segment growth in the market is driven by increasing trends towards vegan ingredients and products. Millennials are becoming more conscious about their welfare and health.

The Hypermarkets and Supermarkets Segment Dominated the Ready Meals Market in 2024.

The segment growth in the market is propelled by the increasing availability of a wide range of options for ease of accessibility and ready meals. The increasing variety of product offerings by these channels is also contributing segment growth. By offering a one-stop shopping experience, supermarkets provide the ultimate convenience. The segment attracts a diverse range of customers, which increases sales volume.

The Online Retail Segment Expects Fastest Growth in the Market During the Forecast Period.

Online retail brings small quantities of products to local delivery service players and consumers. The increasing sales of these meals are expected to drive the segment growth. In addition, the integration of environmental programs, online shopping trends, e-commerce and globalization in store formats are also contributing to segment growth. The segment is used for the delivery of ready meals to enhance customer experience, improve efficiency and streamline processes. The online meals allowing customer to invest in better consumer experience and marketing on their e-commerce site. In addition, the increasing shift in consumer patterns toward higher traction to online retail and increasing launch of online meal delivery services are expected to drive the segment growth.

Rebel Foods

Mumsnet

DDC Enterprise

By Product

By Meal Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025