April 2025

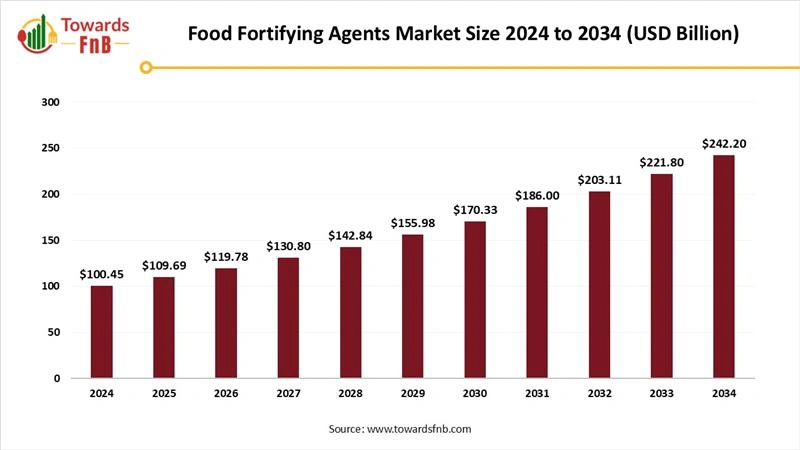

The global food fortifying agents market size was estimated at USD 100.45 billion in 2024 and is expected to rise from USD 109.69 billion in 2025 to nearly reaching USD 242.2 billion by 2034, growing at a CAGR of 9.20% during the forecast period from 2025 to 2034. The increasing consumer demand for functional foods and beverages is substantially fostering the market growth.

The fortification of food is the addition of the required nutrition to prevent or cure nutritional deficiencies. The growing awareness regarding health and nutritional deficiencies among consumers increasing the market. Additionally, the increasing emphasis on enhancing dietary standards, prioritizing wellness among people and rising prevalence of chronic health disorders is governing producers to add these agents in food items. Increasing elder demographics is opting for nutritional dietary supplements for overall health management demand for fortified foods, boosting the market of food fortifying agents. Lifestyle changes, growing demand for the nutritional food and beverages by the consumers and increased disposable income propelling the food fortifying agents market.

The use of digital tools and technologies to create and utilize information for decision making in public health and nutritional plans is increasing. Microencapsulation and nanotechnology development increase the stability and controlled release of fortifying agents. With the help of novel technology, BioAnalyt formulated the iCheck pipeline for a various vitamins and minerals. The iCheck devices are more portable, quicker, cost-effective, and easier to use than conventional lab equipment, and have been demonstrated in over 60 low- and middle-income nations. These developments allow to develop fortified products with enhanced taste, texture, and nutritional profile, in that way increasing consumer approval and food fortifying agents market expansion.

The market for fortifying agents encounters strict regulatory standards concerning health assertions, safety, and labeling. Adhering to regulations can require significant time and expenses, obstructing market access for new entrants. Food fortifying agents necessitate significant investment in product development and innovations, resulting in a rise in the product's cost. Furthermore, the absence of high-quality laboratories hinders the control and monitoring of products needed to assess the quality of fortified foods, which in turn restricts food fortifying agents market growth.

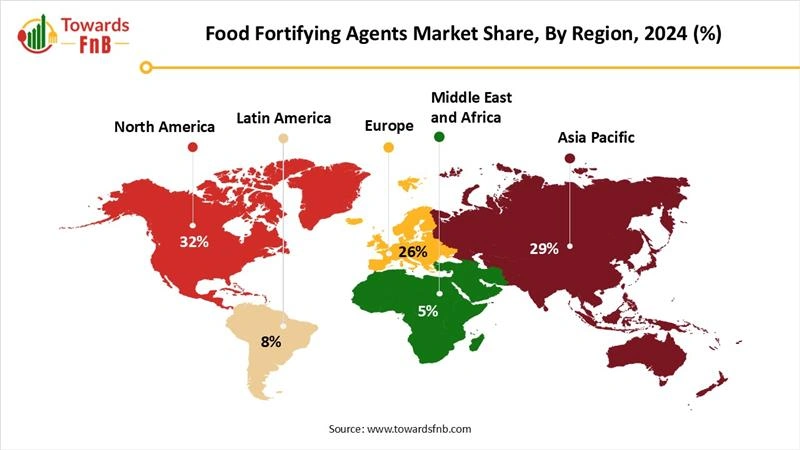

North America Dominated the Food Fortifying Agents Market with the Largest Share in 2024.

The market is significantly propelled by the rise in the health consciousness of people in the region. The initiatives of government firms have also fostered the market expansion. Rising demand for functional and healthy food and beverages, changing lifestyle, increasing prevalence of chronic disorders. Growing popularity of the organic and plant-based products among consumers as the natural alternatives, consumers are opting for natural fortifying agents.

The demand for food fortifying agents in the United States has increased due to rising awareness of the benefits of nutritional enhancement in the diet. In recent days, there is significant shift in the consumers food choices and opting for the healthier fortified food products increasing the demand for the food fortifying agents. Government supports and rules have also contributed for the market growth of food fortifying agents market.

Asia Pacific is Observed to Grow at the Fastest Rate During the Forecast Period.

Consumers in the Asia-Pacific area are increasingly aware of the importance of nutrition, leading to a rise in the demand for fortified foods. Fortified foods offer a convenient solution to combat hunger and deficiencies in crucial vitamins and minerals, which remain significant issues in numerous countries. The growth of aging populations, government initiatives to combat malnutrition, and the increasing demand for fortified foods in nations like China, India, and Japan are all factors driving the growth of the market. Innovation is a crucial attribute, as businesses allocate resources towards research and development to improve the effectiveness and performance of fortifying agents.

Leveraging Food Fortifying Agents Market of India

Deficiencies in micronutrients often result in malnutrition, a major public health concern, especially in developing countries like India. Adults and women of childbearing age are at a higher risk of micronutrient deficiencies. The inadequate nutritional status of mothers is a major factor in malnutrition in India; enhancing the nutritional quality of the food supply through food fortification is essential for promoting consumer health and minimizing potential health risks. Various government regulations and initiatives for food fortification further increase the demand for food fortifying agents.

Vitamins Segment Held the Dominating Share of the Food Fortifying Agents Market in 2024.

Increased vitamin deficiency is the main driving factor and increasing the demand of vitamins for food fortification. Majority of the people have insufficient levels of riboflavin, vitamin B, and vitamin C and B6. Producers are offering variety of fortified products, including beverages, snacks, and dairy items, to complete the demand of consumer preferences increasing the demand for the vitamin fortified foods. Regulatory authorities are promoting addition of vitamins to the food products and benefiting for fortifying agents market’s expansion.

Probiotics and Prebiotics Segment is Seen to Grow at a Notable Rate in the Food Fortifying Agents Market During the Predicted Timeframe.

The wellness and health sector are undergoing a notable change in consumer behaviours. Individuals are taking a proactive, preventive stance towards their health, resulting in a higher demand for pre and probiotic fortified products. These products are well-known for their possible advantages in supporting a healthy gut microbiome. Moreover, customers today look for items that meet their distinct health requirements, leading businesses to create customized formulations that tackle particular issues and provide individualized solutions. Novel probiotics including next generation and genetically modified probiotics for prevention of various diseases boosting the market.

The Dairy and Dairy-Based Products Held the Largest Share of the Food Fortifying Agents Market in 2024.

Dairy items, including milk, cheese, and yogurt, are fundamental in numerous diets globally, rendering them perfect vehicles for vital nutrients. Given that milk is consumed by every demographic group, enriching milk with specific micronutrients is an effective approach to tackle micronutrient malnutrition. India stands as the top milk producer globally, generating 146.3 million tonnes, with an average availability of 322 grams per person each day. The dairy sector has evolved from a state of shortage to one of abundance. In India, fortifying milk with Vitamin A and Vitamin D is necessary due to the prevalent deficiencies found in the population. Consumers demand for the fortified dairy products as the healthy choice fostering the market.

Fortified Beverages Segment is Expected to Grow at the Fastest Rate in the Food Fortifying Agents Market During the Forecast Period.

As more people grow aware of their eating habits, there has been a significant movement towards enhanced drinks that provide valuable nutrients and health benefits. Shoppers are progressively looking for items that offer extra vitamins and minerals to enhance their overall well-being. This pattern is backed by a wealth of data on the advantages of fortified beverages, commonly featuring enhancements in energy levels, immune aid, and overall nutritional benefits. The Fortified Beverages sector is undergoing extraordinary innovation and product variety, which greatly propels fortifying agents market expansion. Producers are consistently launching new tastes, compositions, and practical advantages to capture consumers' interest. This encompasses the launch of fortified plant-based beverages, functional teas, and smoothies enhanced with probiotics or superfoods.

Plenish

Global Alliance and Gates Foundation

ACI Pure Flour Limited

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025